UK electric vehicle and battery production potential to 2040

In an update to its 2020 study, the Faraday Institution predicts that there will be demand for ten UK-based gigafactories (large, high volume battery manufacturing facilities) by 2040, each producing 20GWh per year of batteries.

The transition to electrified transport is essential to meet Net Zero commitments. The size of the economic opportunity provided by this change is significant. The combined electric vehicle automotive and battery ecosystem could be worth £22 billion by 2030 and £27 billion by 2040. Recent announcements in the UK by Britishvolt and Envision AESC have built excitement, particularly in the Northeast, about the potential to create a new, dynamic and highly skilled battery industry in the UK.

The UK Government has played its part by making bold policy commitments and increasing investor confidence in the UK as a location to do business.

But more needs to be done.

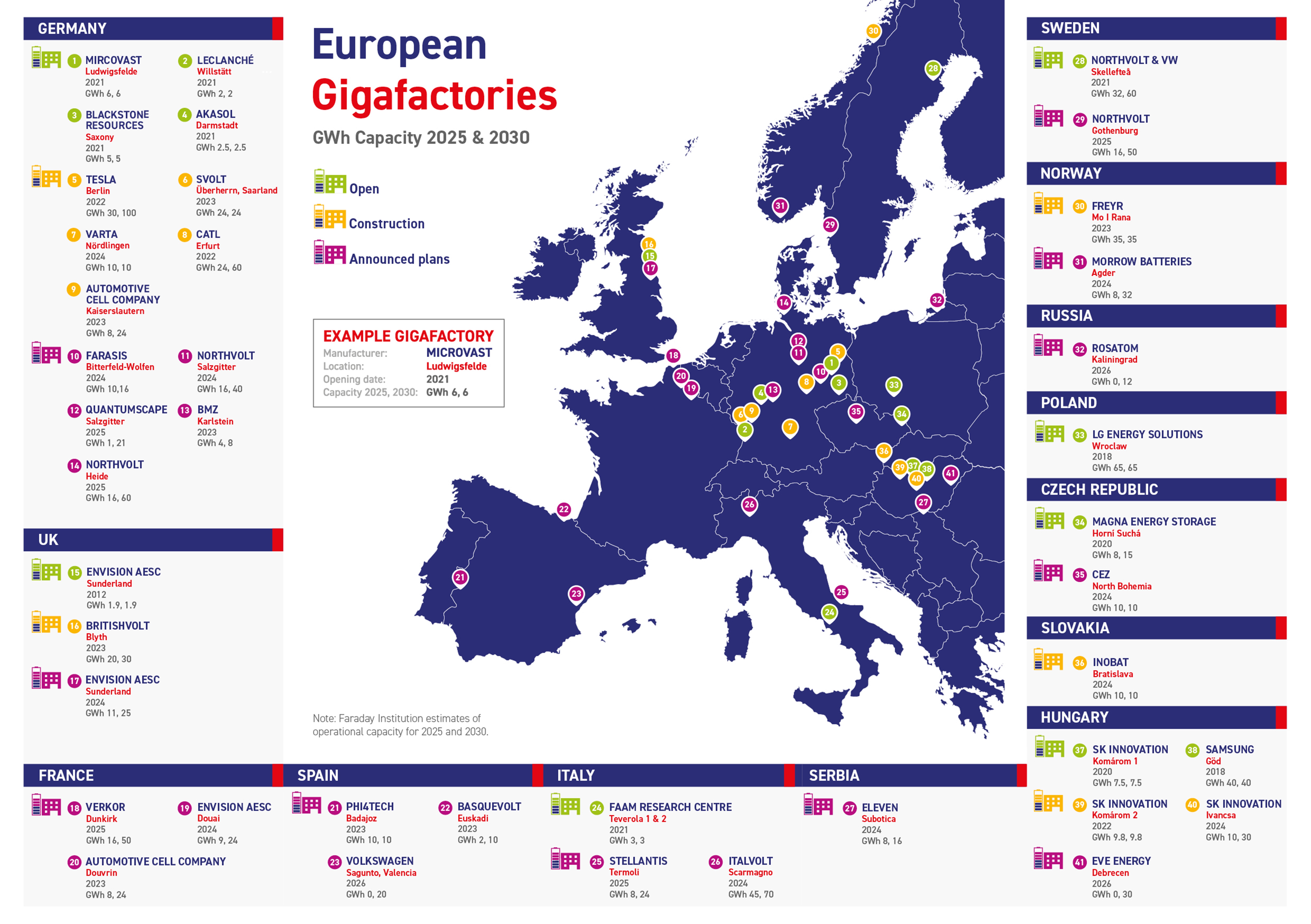

The UK is making progress but not moving fast enough compared to its European competitors. UK battery manufacturing plants could reach a combined capacity of 57GWh by 2030, equivalent to around 5% of total European GWh capacity, compared with 34% in Germany.

It is important that UK Government continues to communicate the attractiveness of the UK as a battery manufacturing location to investors. Alongside cultivating new investors, it should also help to develop a resilient, sustainable, and efficient supply chain, build up skills capability and commit to the long-term funding of battery research, particularly next generation batteries.

The UK needs to move quickly to secure investment in new gigafactories. By 2030, around 100GWh of supply will be needed in the UK to satisfy the depend for batteries for private cars, commercial vehicles, heavy goods vehicles, buses, micromobility and grid storage. This demand is equivalent to five gigafactories, with each plant running at a capacity of 20GWh per annum. By 2040, demand rises to nearly 200GWh and the equivalent of ten gigafactories.

Pam Thomas, Chief Executive Officer, Faraday Institution said: “The UK is well placed to have a leading position in next generation batteries such as solid-state, lithium-sulphur and sodium-ion technologies. The UK is already home to global experts in battery research and to well-established companies. We must move quickly to exploit this competitive advantage by establishing large-scale domestic manufacturing in the UK while continuing to fund long-term battery research.”

Stephen Gifford, Chief Economist, Faraday Institution said: “There is a growing sense of optimism that a highly productive and sustainable battery manufacturing industry can be built in the UK. By 2040, a successful industry could employ 170,000 people in EV manufacturing, 35,000 people in gigafactories and 65,000 people in the battery supply chain.”

Matt Howard, Chief Strategy Officer, Faraday Institution said: “The move to electrify transport and toward large-scale battery production represents a massive shift in industrial skills. The UK's engineering and manufacturing workforce can gain a competitive edge over other countries through the provision of a national training curriculum that will ensure the right skills are delivered at the right time.”

Continued efforts needed

The UK Government, industry stakeholders and research organisations should celebrate the recent successes but keep up the pace and focus. The shake-up and unprecedented change in the global automotive industry will create winners and losers. The UK needs to grab the opportunity with concerted and coordinated effort by:

- Continuing to communicate the attractiveness of the UK as a global and regional battery manufacturing location to global investors

- Identifying prospective sites for gigafactories and the construction of associated physical, transport and energy infrastructure by the local, regional, and national government

- Developing the requisite electric vehicle (EV) battery skills and training infrastructure

- Providing long term commitment to mission-based research into next generation batteries that are cheaper, lighter weight, longer-lasting, safer, manufacturable, and fully recyclable

- Developing a strategy to localise and create an efficient, resilient, and sustainable UK supply chain to improve availability and affordability of key battery materials for battery production

- Developing a strategy to create the conditions for a new lithium-ion battery recycling industry in the UK to flourish

Summary of changes in key outputs of the report

Key changes in assumptions and modelling in the Faraday Institution’s 2022 report relative to the 2020 study are:

- Consideration of the UK announcement to end the sales of new petrol and diesel cars and vans by 2030 and for all cars sold to be zero emissions capability by 2035

- Inclusion of additional battery demand from commercial vehicles, HGVs, buses, micromobility and grid storage

- Faster uptake trajectories for battery EVs at the expense of plug-in hybrid EVs, with BEVs having larger battery capacity on average

- Using most up to date data on UK EV and ICE vehicle sales and a review of industry forecasts, as well as reflecting the downturn from the pandemic and the recent upturn as the global economy recovers

The result of these key changes for the 2022 report relative to the 2020 study are:

- Demand for UK EV battery manufacturing capacity of around 200GWh per annum in 2040 (2020 report: 140GWh per annum).

- The overall industry workforce of the automotive and EV battery ecosystem could grow by 100,000 jobs from 170,000 to 270,000 employees by 2040 (2020 report: growth of 50,000 jobs from 176,000 to 220,000 employees by 2040).

- Demand for ten UK gigafactories in the UK by 2040, with each factory having a manufacturing capacity of 20GWh p.a. on average (2020 report: seven gigafactories producing 20GWh p.a.).

- UK automotive industry is projected to manufacture around 1.8 million private cars and commercial vehicles in 2040 (2020 report 2.2 million in 2040)