The key for Electric Vehicle take-off

Global plug-in Electric Vehicle (EV) population reached 7.5 million units (including light commercial vehicles) by the end of 2019. Although plug-in EV is only around 2% of global sales today, they are positioned to take the lead of road transportation in the coming decade, as governments around the world announces bans on ICEs along with the mature of EV technologies and market.

EV manufacturers have been improving the range of their vehicles to help alleviate range anxiety for EV drivers. However, larger batteries and longer range alone is not going to address the range anxiety for customers.

The availability and convenience of charging is also one of the key factors to ensure good driving experience for EV owners. Therefore, the deployment of charging infrastructure is essential to facilitate the uptake of plug-in EVs and the sustainable development of the plug-in EV industry.

According to IDTechEx's research on electric vehicles, by 2030 there will be over 100 million plug-in EVs on road globally including passenger cars, buses, trucks and vans which are the most relevant sectors to consider for EV charging infrastructure.

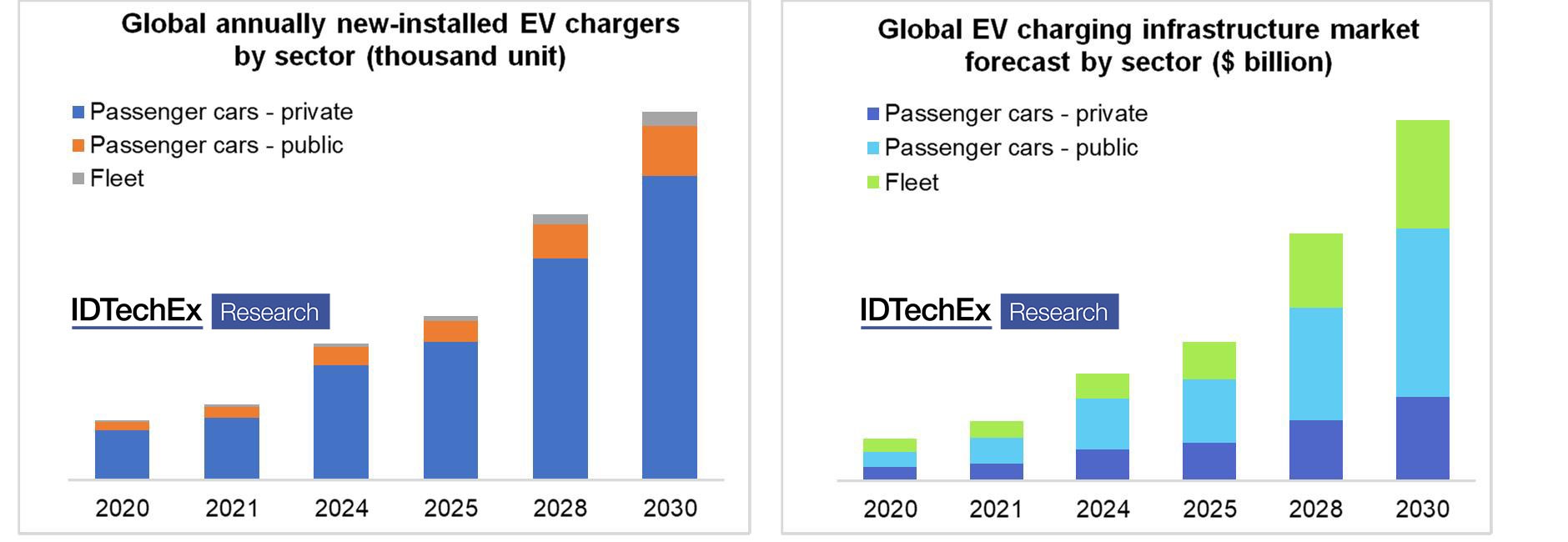

Among them electric passenger cars represent the largest plug-in EV sector in volume while electric fleets such as buses, trucks and vans are expected to grow rapidly in the coming decade which will drive up demand for charging infrastructure significantly. The global EV charging infrastructure market value will grow at 24% CAGR in the next decade and reach $40bn per year by 2030, according to IDTechEx's latest report 'Charging Infrastructure for Electric Vehicles 2020-2030'.

Market forecast of global EV charging infrastructure in unit numbers (left) and revenue (right). Source: IDTechEx

Electric vehicle fleets such as buses and trucks require very different charging infrastructure from the existing infrastructure built for passenger cars. The rising population of electric vehicle fleets represent huge opportunities for developing dedicated charging infrastructure for electric buses and trucks.

In the IDTechEx report, there is a section that specifically addresses charging infrastructure and technologies for electric fleet vehicles. It is worth noting that although electric fleet charging represents less than five percent of the total charging infrastructure in volume, it constitutes over 30% of the total market value of the charging industry, which could bring tremendous opportunities for players along the EV charging value chain.

As the charging industry evolves, players move along the value chain and contribute to further complexifying and densifying it. Currently, the business cases for home or workplace level 2 chargers are straightforward, given low up-front capital and operating expenses.

Making the business case work for public fast charging stations is more difficult due to the higher up-front capital, higher operating costs, and currently low utilisation. However, big oil companies such as Shell and BP have been proactive in securing their shares of the market and big utilities companies are integrating EV charging as part of their business.

In the latest report from IDTechEx, 'Charging Infrastructure for Electric Vehicles 2020-2030', an in-depth analysis of the EV charging value chain and the key market players will be provided. An overview of the existing business models of charging network providers will also be addressed with insights into emerging business models, such as smart charging, V2H/V2G.