Designing next-generation vehicle architectures: challenge or opportunity

Ever since the first Model T Fords rolled off production lines in 1908, the transformation of the automobile hasn't stopped. Initially focused on simply moving people and goods from A to B, increasing competition and consumer marketing moved the focus to lifestyle and mass customisation. Change has been constant, sometimes driven by safety, other times by differentiation, and technology has led the way for at least the past fifty years.

Mark Patrick from Mouser Electronics further explores.

Much like the aviation industry, modern vehicles increasingly embrace a fly-by-wire approach, further advancing automotive technology innovations. No wonder the automobile is considered a data centre on wheels. The architecture of next-generation vehicles, with a dependence on software, connectivity, cloud, and edge computing capabilities, is indeed emulating a large computing facility on wheels.

For the automotive industry, innovation is iterative and often progresses in step with other developments. For example, the continued adoption of in-vehicle networking has led to a zonal architecture, saving cable weight while enabling more functionality.

But what of the future? What issues and challenges will automotive manufacturers, engineers and system architects confront in the coming years?

To better understand how technology will shape and influence the decision-making process across the industry, Molex joined forces with Mouser Electronics to survey over 500 automotive industry professionals, stakeholders, and technology leaders in 30 countries. The Data Centre on Wheels survey results yield insight into the top trends, challenges and decisions the automotive industry faces in designing and building next-generation vehicles.

Capabilities and timing

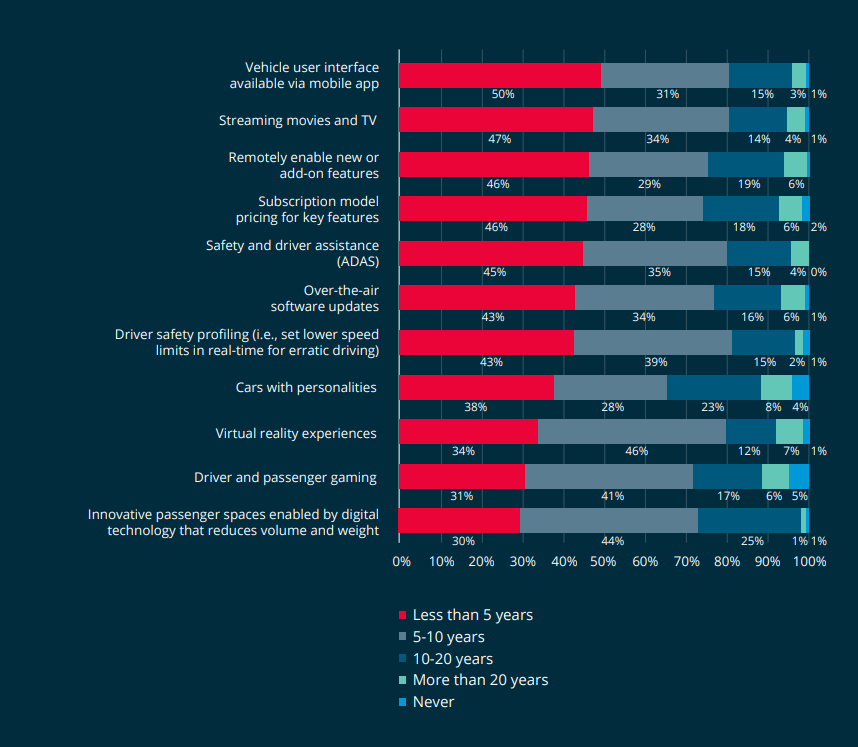

The first set of survey questions (Figure 1) asked respondents to consider which vehicle features and capabilities might be likely and when they will become standard fitments.

Figure 1: Which vehicle features could be enabled in a data centre on wheels, and when do you expect each to be available as a standard new vehicle feature? (Source: Molex & Mouser)

Topping the list was using a smartphone app to control the vehicle, with 50% of respondents voting it possible within less than five years. (Though it is already possible to use an app to control select vehicle features on some top brand platforms.) Another interesting aspect is the ability for manufacturers to control access to features with a subscription model. Technology will underpin making this possible, but ultimately consumers will decide if a subscription model for vehicle features gains popularity.

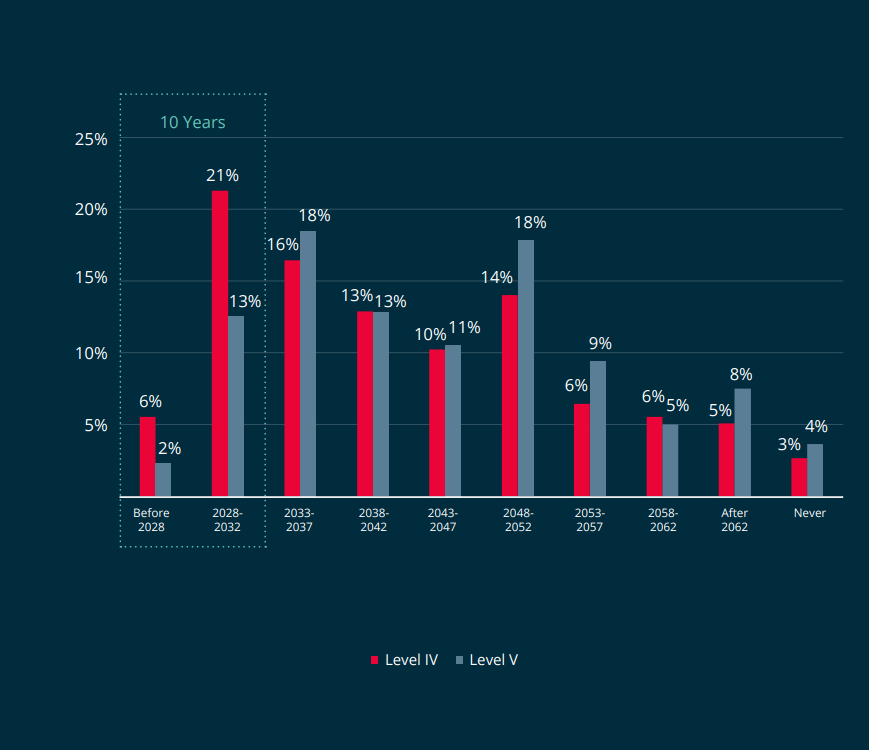

Highly autonomous (Level IV) and fully autonomous (Level V) vehicles have been predicted for many years, and the industry is slowly moving toward these goals. Making autonomy happen requires multiple capabilities and technologies to work reliably together; this is requiring the automotive industry to consider far more than purely the technology methods. There is also insurance, financial, and social consequences to overcome. As Figure 2 illustrates, 27% of survey respondents believe half of new vehicles sold will be Level IV in 10 years, and 15% say Level V in the same period.

Figure 2: What is your best guess when half (50%) of new vehicles sold will be Level IV autonomous? Level V autonomous? (Source: Molex & Mouser)

Enabling technologies

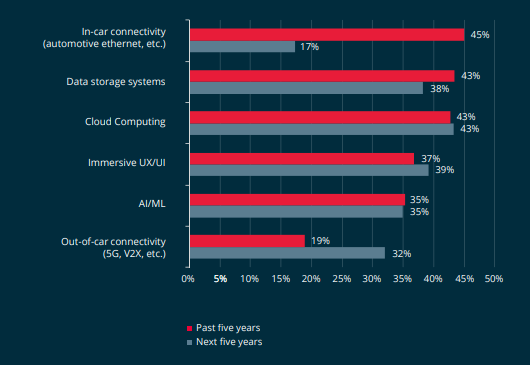

Respondents were polled on which digital technologies have shaped vehicle design over the past five years (Figure 3) and the outlook for the same period moving forward. Advances in vehicle networking, including ratified new standards, have been significant, but the emphasis on networking now moves outside the vehicle moving forward.

Figure 3: In your experience, what digital technologies have impacted vehicle architecture and driver experience in the past five years and for the next five? Choose up to three. (Source: Molex & Mouser)

Cloud computing, together with AI/machine learning and immersive UI/UX, are seen as critical enabling technologies for the future.

Obstacles and challenges

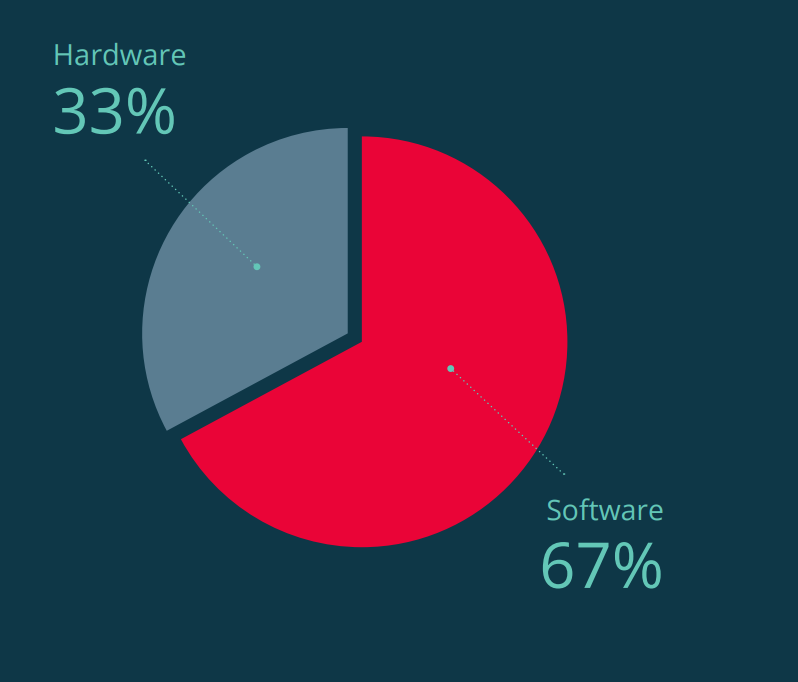

Next-generation vehicles are a hotbed of technology innovation; but as we all know, no technology deployment, especially with so many interrelated systems, is trouble-free, as highlighted in Figure 4. Respondents cited double the number of challenges with software developments than with hardware.

Figure 4: In your opinion, which will cause more technology challenges when building a data centre on wheels? Choose the one answer that most closely applies. (Source: Molex & Mouser)

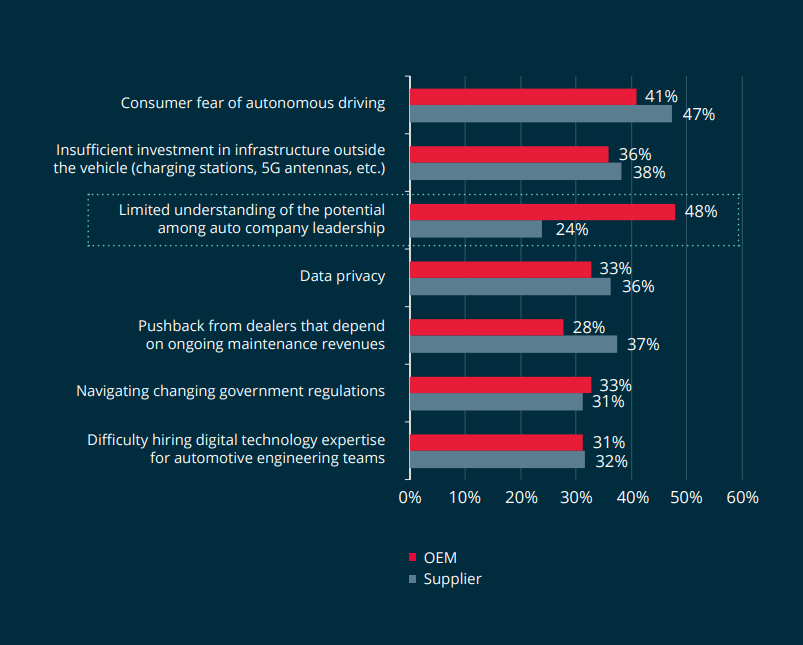

Technology challenges are not the only obstacles the industry faces. The inherent success of sales of next-generation vehicles highlights other factors (Figure 5), such as consumer fear of autonomous vehicles, investment in roadside V2X/V2C infrastructure, and pushback from vehicle dealerships against lost revenues.

Figure 5: What industry issues will be the most difficult to overcome when building a data centre on wheels? (Source: Molex & Mouser)

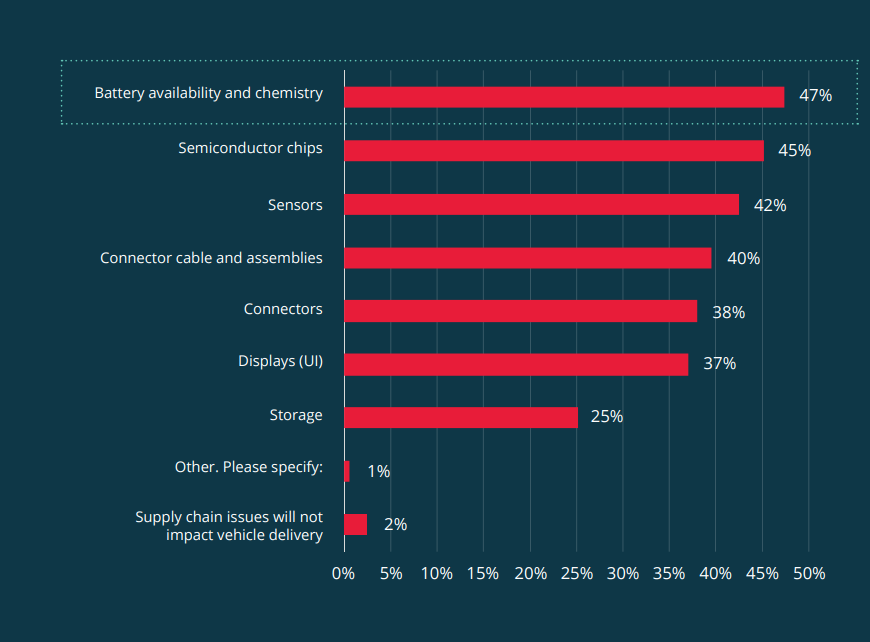

With the current semiconductor shortages across the electronics industry, it is perhaps no surprise that supply chain issues are featured prominently (Figure 6). While semiconductors and other critical electronic components and modules rated high, the technology shortage that worried respondents the most was for EV batteries and the raw materials essential to their chemistry.

Figure 6: When you think of the future supply chain for the data centre on wheels, what types of technology shortages do you expect could dramatically impact the delivery of vehicles? (Source: Molex & Mouser)

Designing the Data Centre on Wheels – the opportunity of next-generation vehicles

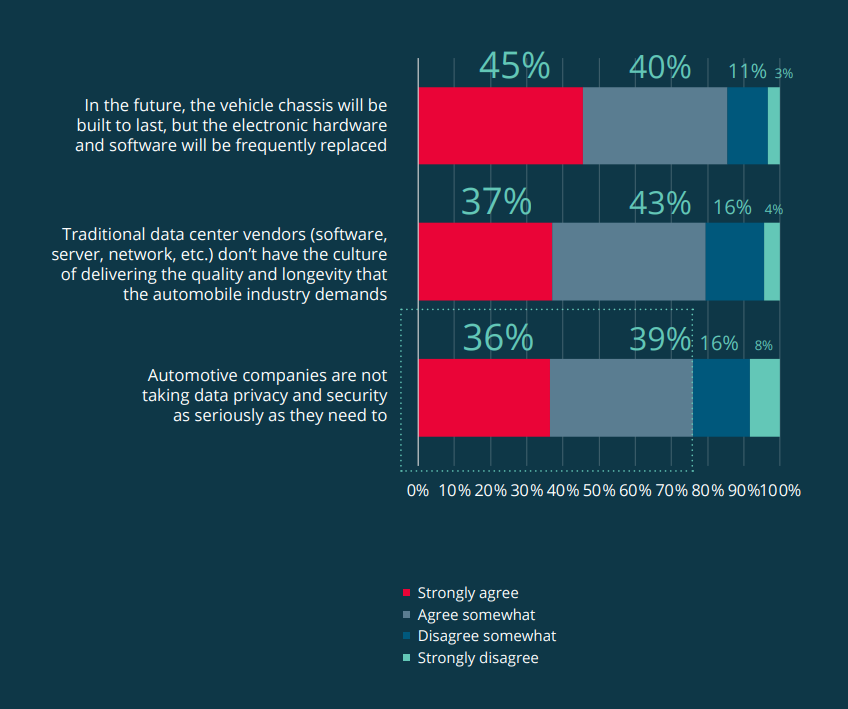

Over 94% of respondents agreed on the profound opportunity to design the next generation of vehicles and the focus on the data centre on wheels approach. This goal will not only rely heavily on enabling digital technologies but will also demand greater cooperation between OEMs, suppliers, and sub-suppliers. Several factors will continue to challenge the industry, with data security and privacy, technology replacement, and company culture highlighted by respondents (Figure 7).

Figure 7: Respondents were asked to rate their level of agreement with these three statements (Source: Molex & Mouser)

Across the three topics, there was broad agreement. The belief that hardware and software will require frequent changes – presumably to incorporate new features and enhance interoperability with popular consumer technologies – raises concern about the differences in cultures between enterprise IT vendors and the automotive industry. This includes the approach to architecting robust data privacy and security regimes, which 75% of respondents agreed needs improving.

You can access the complete Data Centre on Wheels report here.