Energy storage: a global enabler for world energy transition

The energy crisis and decarbonisation requirements speed up the process of finding alternative solutions, and energy storage plays an important role in applications such as electric vehicle applications and renewable energy.

Since their invention in the 1990s, lithium-ion batteries have become increasingly popular due to their relatively lightweight, compact size, long life span, and high energy density.

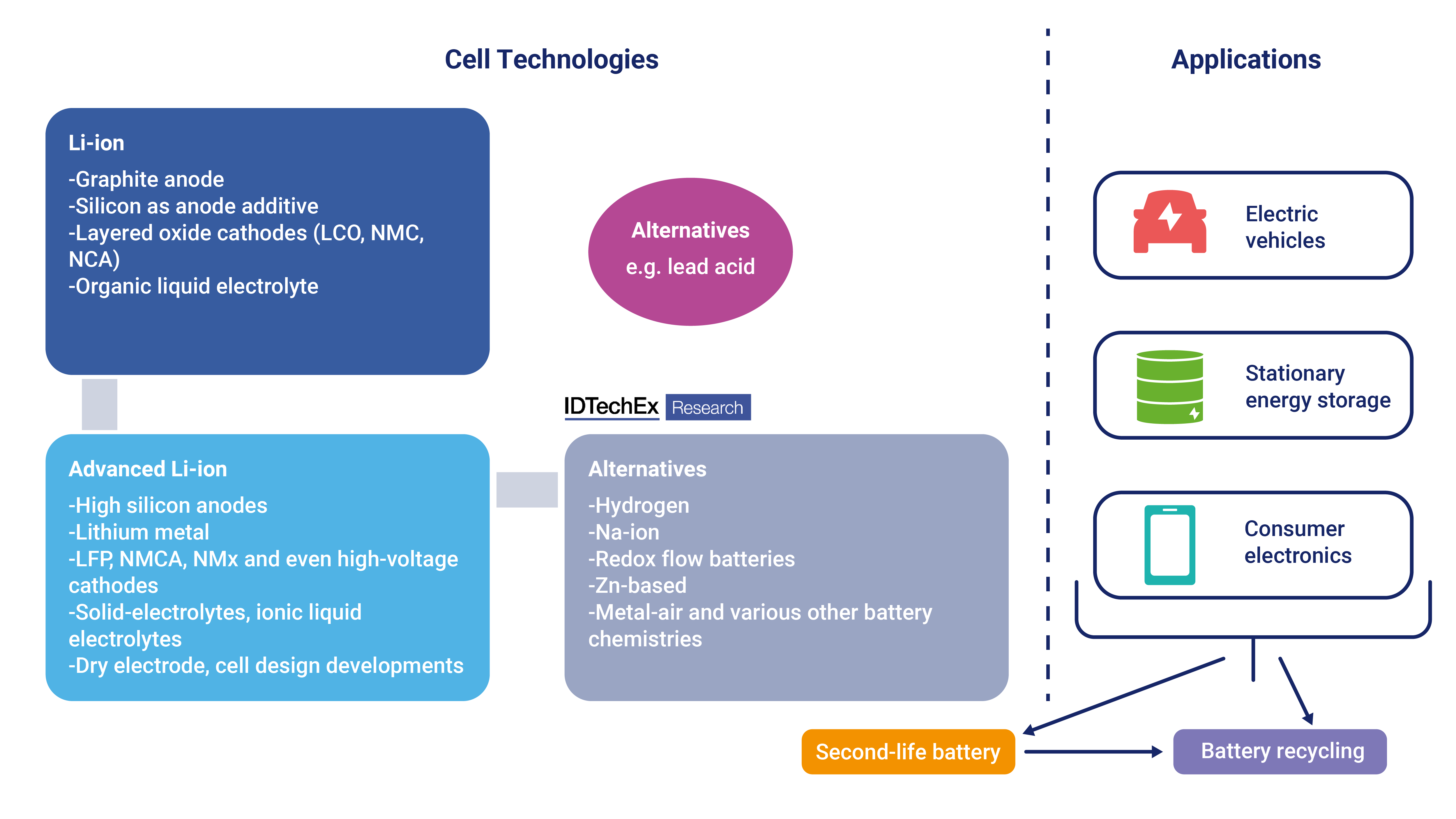

Fundamentally, a Li-ion cell typically consists of a graphite anode and a layered oxide cathode coated onto current collectors and separated by an organic liquid electrolyte-soaked separator. Packaged in pouch, prismatic, or cylindrical formats, they form the basis of Li-ion battery packs. Their comparatively high performance, low cost, and wide availability make Li-ion batteries pre-eminent energy storage technology for many applications, from electronic devices to electric vehicles (EVs) to large stationary energy storage systems.

As such, for most applications, Li-ion batteries, in one form or another, are unlikely to be superseded within the next ten years. Nevertheless, developments and innovations continue to be made in Li-ion materials. Manufacturing, cell design, as well as pack design, and investment in the Li-ion industry continue at a rapid pace. IDTechEx research the energy storage topic from various angles, materials, cell technologies, targeting applications, and how to deal with them at the end of their lives.

Rapid evolving of well-established, state-of-the-art Li-ion batteries

LFP has been regaining market share in EVs since 2021 due to its recapture of market share in China in particular. High nickel-layered oxide (NMC/NCA/NCMA) materials will continue to be important. Additionally, major cathode manufacturers are looking to move toward 90+% NMC and NCA in a bid to reduce cobalt content further and increase capacity, if only marginally.

Difficulties remain in ensuring the safety and longevity of these materials. While reducing cobalt content can help reduce material costs and limit exposure to potentially problematically sourced cobalt, a push to limit reliance on cobalt and nickel will increase reliance on China, with the vast majority of LFP production controlled by Chinese companies and fewer plans for LFP production outside the country.

IDTechEx forecast the Li-ion market to grow to over $430 billion by 2033, driven by demand for electric vehicles.

Given the rapid increase in forecast demand for Li-ion batteries, there has been significant growth in the number of gigafactories planned and announced over the past two to three years. Much of this has been driven by incumbent manufacturers such as CATL, LG Energy Solution, SK Innovation, and Samsung SDI. However, start-ups and early-stage companies are also looking to enter the market, especially in Europe and North America, where there is a drive to develop domestic capability.

IDTechEx analysis shows that current plans and announcements for new cell production capacity will reach 3TWh by 2030. While this would not meet forecast demand, the relatively short period needed to build new cell production factories allows time for additional investment and expansion in cell production capacity. This is needed to meet forecast demand from EVs.

Li-ion batteries based on graphite anodes and layered oxide cathodes (LCO, NMC, NCA) have been ubiquitous in consumer electronics for over a decade and have come to dominate large parts of both the electric vehicle and stationary energy storage markets.

IDTechEx’s report “Li-ion Battery Market 2023-2033: Technologies, Players, Applications, Outlooks, and Forecasts” provides analysis and reporting on key components, including cathodes, anodes, electrolytes, separators, copper collectors, and additives.

For each component, the report provides a breakdown of the key technological developments, in addition to an analysis of the market through a study of the key manufacturers, production regions, and expansion plans. The report also offers a comprehensive view of the Li-ion battery market, players, and technology trends. Cost analyses, price forecasts, and ten-year forecasts are provided for Li-ion battery demand by volume (GWh) and value ($) and broken down by application, cathode type, and anode type.

Longing for advanced and beyond Lithium-ion batteries

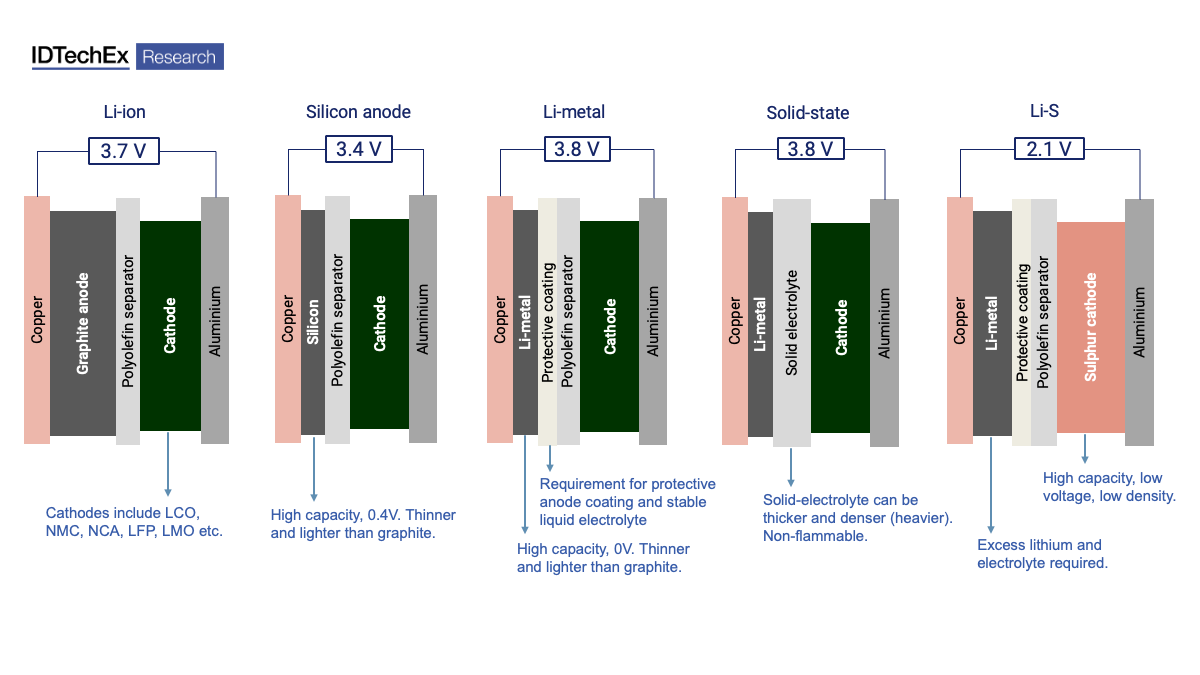

Lithium-ion batteries are dominating applications such as consumer electronics and electric vehicles. However, as they start to reach their performance limits and as environmental and supply risks are highlighted, improvements and alternatives to Li-ion batteries will become increasingly important. Advanced Li-ion refers to silicon and Li-metal anodes, solid-electrolytes, high-Nickel, and LNMO cathodes, as well as various cell design factors.

Two of the most exciting material developments in Li-ion are the development and adoption of silicon anodes and Li-metal anodes, the latter often but not always in conjunction with solid electrolytes. The excitement stems primarily from the possibility of these anode materials significantly improving energy density, although enhancements to rate capability, safety, and even cost are being sought.

Na-ion has seen renewed interest after CATL’s announcement of their development of Na-ion. Similar in many ways to Li-ion batteries, Na-ion batteries utilise sodium as the working instead of Li, as the name would suggest. Na-ion batteries are generally characterised by having slightly higher powers and cycle lives than NMC and LFP Li-ion cells but with slightly lower gravimetric energy densities. While Na-ion will reduce reliance on lithium, their cathodes can still make use of cobalt and nickel. So, whether they can be utilised to reduce reliance on these materials depends entirely on the specific cathode chemistries used.

Redox flow batteries store energy in the electrolyte, separate to the electrochemical cell, thus allowing the de-coupling of energy power. This key aspect makes RFBs well-suited to stationary storage applications, especially long-duration applications.

Vanadium is the most widely deployed chemistry, with 15-20 companies commercialising their systems. However, the high cost of vanadium leads to high capital costs that may be prohibitive to widespread use.

Though, schemes such as electrolyte leasing are being explored to try and reduce the initial capital expenditure. Nevertheless, the high cost of vanadium has led to the development of alternative RFB chemistries that utilise low-cost active materials. Such as the all-iron-based chemistry being developed by ESS, or even flow batteries that can utilise low-cost use widely available organic compounds as the electrolyte active material.

The IDTechEx report, “Advanced Li-ion and Beyond Lithium Batteries 2022-2032: Technologies, Players, Trends, Markets”, focuses on next-generation battery technologies providing in-depth analysis. It details trends and developments in advanced and alternative battery technologies, including Li-ion cell designs and materials, silicon anodes, Li-metal anodes, lithium-sulphur, Na-ion, and redox flow battery chemistries, amongst others. Details on the key players and start-ups in each technology are outlined. Addressable markets and forecasts are provided for silicon, Li-metal, Na-ion, RFBs, and large Zn-based batteries.

A solid future?

Solid-state batteries are mostly referred to as lithium batteries with solid-state electrolytes, although solid-state batteries beyond lithium-ion technologies exist. Solid-state batteries were brought to the public initially because of the many value propositions they could provide. These included better safety, potentially higher energy density due to the high-voltage cathode and high-capacity anode that can be applied, flexible cell design, a wider temperature operating range, fast charging possibilities, etc. Solid-state batteries have attracted tremendous attention from academia and industry, and corresponding players have received huge investments.

After years of development, a few solid-state batteries have been commercialised, with more under development. At the same time, with the continuous improvement of Li-ion batteries, there are discussions around which technologies are worth the resources and investment. There are hypes in solid-state batteries. However, better safety, potential energy density increase, and system-level design simplification are still the major drivers for solid-state batteries.

After years of development, a few solid-state batteries have been commercialised, with more under development. At the same time, with the continuous improvement of Li-ion batteries, there are discussions around which technologies are worth the resources and investment. There are hypes in solid-state batteries. However, better safety, potential energy density increase, and system-level design simplification are still the major drivers for solid-state batteries.

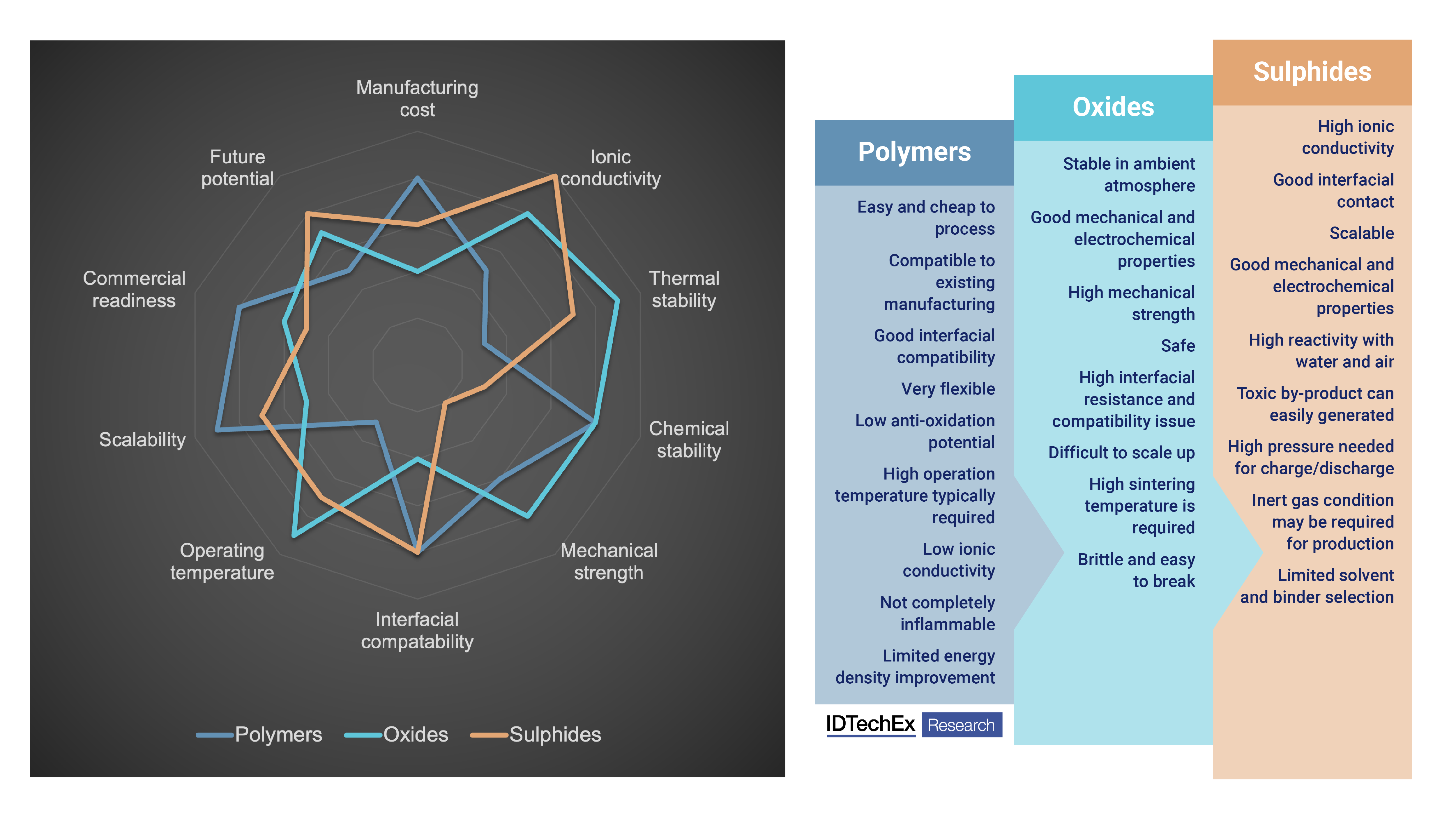

Within solid-state batteries, there are various technology approaches. In general, oxide, sulphide, and polymer systems have become popular options in next-generation development. Sulphide electrolytes have advantages of high ionic conductivity, even better than liquid electrolyte. They also have a low processing temperature, wide electrochemical stability window, and more.

Many features make them appealing, and they are considered by many as the ultimate option. However, the difficulty of manufacturing and the toxic by-product hydrogen sulphide generated in the process make the commercialisation relatively slow. Polymer systems are easy to fabricate, and they are closest to commercialisation. While the relatively high operating temperature, low anti-oxide potential, and worse stability indicate challenges. Oxide systems are stable and safe, while the higher interface resistance and high processing temperature generally show some difficulties.

Lithium-ion battery manufacturing has been dominated by East Asia, with Japan, China, and South Korea playing a significant role. The US and European countries are competing in the race, shifting the added values away from East Asia and building battery manufacturing close to the application market. New material selection and changes in manufacturing procedures show an indication of reshuffling the battery supply chain.

From both a technology and business point of view, the development of a solid-state battery has become part of the next-generation battery strategy. It has become a global game with regional interest and governmental support. Opportunities will be available with new materials, components, systems, manufacturing methods, and know-how.

There are many questions around solid-state batteries, from technology benchmarking and analysis, market estimation and forecasts, player activity tracking and evaluation, to supply chain establishment and security. It is important to understand the science and business behind it to make the correct strategic decisions.

IDTechEx’s new report, “Solid-State and Polymer Batteries 2023-2033: Technology, Forecasts, Players”, answers the major questions, challenges, and opportunities on solid-state batteries. Please refer to the aforementioned report to further understand the markets, players, technologies, opportunities, and challenges.

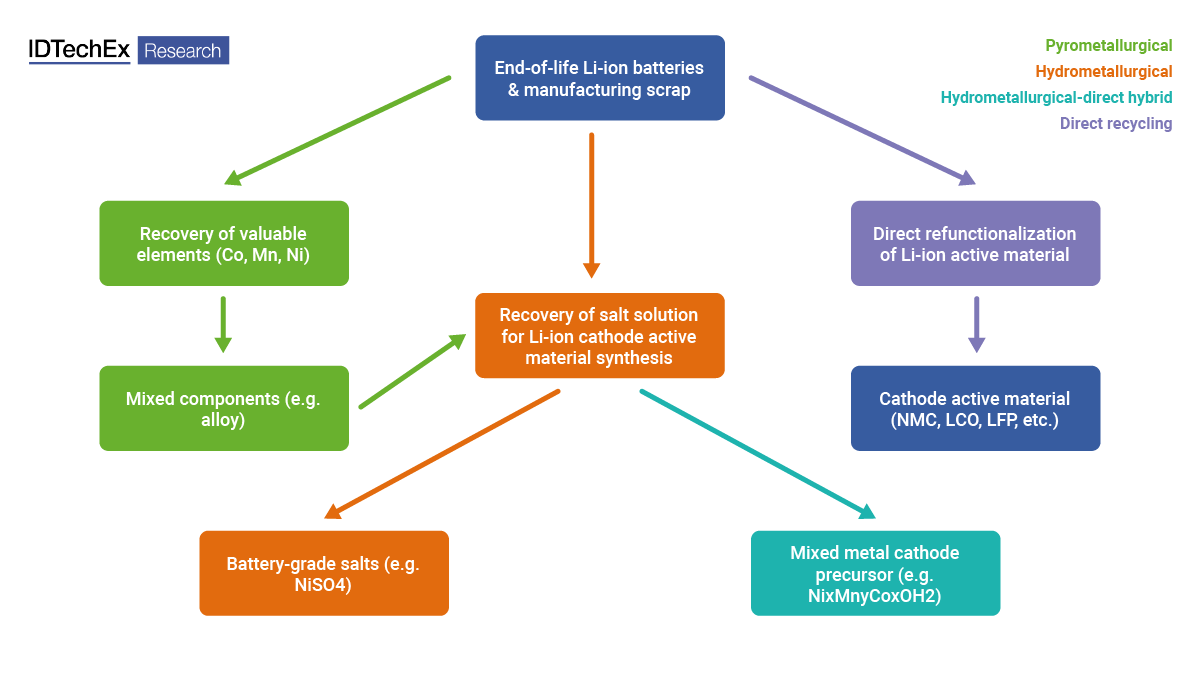

Increasing emphasis on Li-ion battery recycling

Recycling offers a partial solution to the sustainability and supply chain issues faced by the Li-ion industry by providing a degree of circularity. Materials from waste and end-of-life batteries can be extracted and refined to be re-used in cell and battery manufacturing. This can have several beneficial impacts. It can diversify material supplies, helping to reduce reliance on any single country or region. Environmentally, Li-ion recycling, especially via hydrometallurgical or direct recycling routes, is expected to reduce the total energy requirements of producing a cell compared to using virgin materials.

Other emissions, including SOx, NOx, and particulates, as well as CO2, are also expected to be lower by using recycled material over primary extraction. Local recycling and refining capabilities, like those starting to be built up in Europe and the US, can also reduce the distance travelled by materials, further reducing the emissions profile of Li-ion batteries.

Currently, mainly metals are recycled from Li-ion batteries, and the costs of processes are still high. However, regulations and policies are pushing in this direction. With the increasing scaling of lithium-ion battery production, more recycling activities will be expected in the future.

For a detailed discussion on lithium-ion battery recycling, please refer to IDTechEx’s “Li-ion Battery Recycling Market 2022-2042” report.

Despite the undoubted importance of the EV market for the Li-ion industry, stationary energy storage systems are forecast to be the fastest-growing market for Li-ion batteries. This is due to the continued drive to adopt increasing levels of variable renewable power sources such as solar PV and wind.

While growth in Li-ion demand for electronic devices is forecast to grow at a much slower rate than stationary storage or EVs, the higher price of cells and batteries for electronic devices means considerable market value remains available in these applications. New technologies can therefore make their way onto the market via these applications first, with higher margins on offer alongside shorter product cycles and often less demanding performance requirements compared to EVs.

IDTechEx has researched the global stationary battery storage market. The new report, “Batteries for Stationary Energy Storage 2023-2033”, provides insights into different technologies, global markets, and major players.

Hydrogen alternative to batteries

2022 has boosted the development of the so-called ‘hydrogen economy’. Plans from the European Union, the US, the RePowerEU strategy, and the Inflation Reduction Act look to significantly increase clean hydrogen production and consumption over the coming decade. This adds to ambitious hydrogen strategies from countries including Japan and South Korea. Considerable public funding is now expected to be spent on developing green and blue hydrogen production systems, infrastructure for storage and distribution, and encouraging hydrogen use.

Whether or not the funding, credits, and measures provided by these regions can lead to long-term, cost-effective, green hydrogen production and use rely on various factors. However, central to this is the water electrolysis technology, of which there are broadly three categories. These include alkaline water electrolysers (AEL), polymer electrolyte membrane or proton exchange membrane electrolysers (PEMEL), and solid-oxide electrolysers (SOEL).

AEL constitutes the most developed system have been used industrially for around 100 years. SOELs represent the youngest technology relatively early in their commercial development journey, with PEMEL sitting somewhere in between. Each have their own set of advantages and disadvantages. AEL and PEMEL make up most of the market, but the higher efficiency of SOELs and their lower usage of critical materials are characteristics that may become increasingly important in the future.

To learn more about electrolyser technology, markets, and players, please refer to IDTechEx’s new report, “Green Hydrogen Production: Electrolyser Markets 2023-2033”.