Mid year update on UK electronic components market

The first half of 2020 has been ‘eventful’ for the UK electronic components market to say the very least. As a result, the outcome turned out to differ greatly from the forecast released by members of the Electronic Components Supply Network (ecsn) in December last year with the aim of providing the electronic components markets, its customers and investors with a balanced and evidence based analysis.

As we move forward into the second half of the year, ecsn chairman, Adam Fletcher, reviews the figures and provides an update on the association’s collective view of the remaining six month of this year.

Back in December last year the lack of customer forecast visibility in the electronic components market coupled with significant ongoing geo-political uncertainties led ecsn, for the first time in over a decade, to restrict its forecast to the first six months of 2020, and only offer ‘guidance’ on our industry’s prospects into the second half of the year.

The association’s original forecast for the first half of 2020 predicted that the UK & Ireland electronic components market would grow in the range (thee)-to-(two percent) compared to the same period the previous year and show a probable mid-point (one percent) decline.

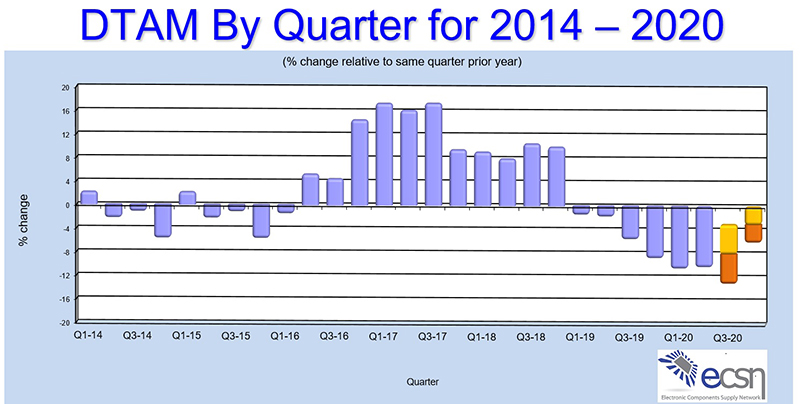

In the event the outcome for the first half of 2020 was that the UK electronic components market declined by (ten percent) when compared to the same period 2019. Returns from ecsn members indicate that the low point in the existing cycle was reached during Q2 ‘20

What’s happened?

The sharp decline in growth in 2020 can be put down primarily to the global economic slowdown caused by the COVID-19 pandemic, something that was not a forecastable issue in 2019. However, the ongoing trade war between China and the US had already reduced demand in Q4 ’19 and enabled customers to de-stock based on tumbling component lead-times increasing their availability but also on raised concerns about ecsn members customers weakening order book.

The ‘Book to Bill’ ratio which was positive in Q1 ’20, declined modestly in Q2 ’20 but the polynomial trend suggests that the B2B ratio is now likely to remain positive into the 2H ’20. Customers who had been destocking in Q4 ’19 increased their in-house inventory and order cover in Q1’20 as manufacturer lead-times for components started to rapidly increase and with it, the potential risk of product shortages due to the population lock-down and manufacturing industry closures imposed in China.

This situation improved somewhat in Q2 ’20, aided in no small part by lower global demand for electronic components.

2H 2020 and full year forecast

Manufacturer Authorised Distributors’ visibility of the electronic components market remains very limited due to the almost total absence of clear guidance coming from their customers. It is understandable that there is a wide and diverse range of opinions on the likely outcome for the full year 2020 but ecsn’s forecast for the second half of the year suggests that the market decline will slow, and final figures for 2H ’20 will reveal a decline in the range (nine)-to-(three percent), with a mid-point decline of (six percent).

The mid-year forecast released by ecsn predicts that the UK & Ireland electronic components market will conclude 2020 showing a full year decline in the range (twelve)-to-(six percent), with a mid-point decline of (nine percent) over the previous year. Please refer to the graphic “DTAM by Quarter for 2012 – 2020. The blue lines show the actual results, the brown and orange lines show the forecast range.

Probably not a bad outcome

If we assume that the final outcome for 2020 is a sales revenue decline of (nine percent) when compared to the previous year, then the performance of the UK electronic components market and the wider electronic industry will have been fairly remarkable given the dreadful economic environment in which we are all currently operating.

I remain confident that stronger underlying growth will return although the odd ‘bump’ along the way will be inevitable: I predicted that any growth would adopt a hockey-stick shaped improvement curve towards the end of 2020 and into 2021 and I haven’t changed my opinion, although I now see the curve shifting to the right by 18 to 24 months, due primarily to the US China Trade War delaying the inevitable 5G roll-out but also reflecting weakness in the automotive market, which was set to return to growth in 2020 but has now been delayed by 12 months.

The anticipated growth in IOT applications has not materialised but PC / laptops, medical and industrial markets look set to continue modest growth while the cloud computing and military markets are growing strongly. The impact of COVID-19 on the commercial avionics sector is likely to keep aircraft sales and servicing depressed well in to 2023.

Concluding thoughts

It’s never easy to predict what is going to happen in domestic and global electronic components markets but I suspect that manufacturer lead-times will remain extended into 2021 and as a result unit pricing will increase slightly, particularly for ‘merchant market commodity products’. The COVID-19 pandemic has done absolutely nothing to sooth US / China relations and the current trade war looks set to continue and may even escalate further with UK based organisations possibly getting dragged in.

ecsn members are continually updating their websites with the latest product information and availability and providing information on the evolving situation and their organisations’ responses to issues as they arise. I urge everyone