The importance of the UX in automotive innovation

Held at the World Conference Center in Bonn, Germany, the international VDI Congress ELIV (Electronics In Vehicles) defines new trends and establishes the main basis for decision making in the automotive industry. ELIV is the most significant networking event for professionals in automotive electronics. Daisy Stapley-Bunten reports.

As expected, the usual themes cropped up - connectivity, security, autonomy. Another less predictable theme was that of User Experience (UX). It seems that the IoT has some competition in the buzzword arena.

UX is often associated with product design in terms of small electronics products and now IoT connected products. ELIV showcased UX more in terms of the product application rather than design - what these new innovations could achieve for the benefit of the user of the car, rather than the benefit of the car specs.

Maxim Integrated was a great example of a company gearing their specific automotive technology towards a user end application. After all, it will be the consumers who eventually fork out thousands for the new computers on wheels. Maxim Integrated were showcasing two new innovations at ELIV this year - next-gen GMSL (Gigabit Multimedia Serial Link) technology and a next-gen car radio.

GMSL is a multi-gigabit automotive interconnect technology that transports high definition video, audio, sensor data, control information and Gigabit Ethernet. It transports these over 15m of a single coaxial cable or ten metres of shielded twisted pair. It does this while meeting the most stringent automotive EMC applications.

The serial link provides many benefits for the car, but Kent Robinett, Vice President of Automotive Business Management at Maxim Integrated spoke about how this would affect the consumer. It’s all very well talking about electronic components for cars achieving higher speeds, but how does this actually change the automotive scene directly for consumers?

Robinett explained that at a basic level, the cables were smaller and considering that there could be up to ten metres of this cabling used in a car, this greatly contributes to the overall weight, which leads to better fuel performance for the user, with the added benefit of being ‘green’.

The serial link provides higher speeds for connectivity between videos and the Central Processing Module (CPM), which basically means that the car’s imaging capabilities (think parking sensor video feed at autonomy level 1 and autonomous braking at autonomy level 2 and 3), are heightened. Maxim Integrated’s GMSL technology enables simultaneous transmission of audio, video, Gigabit Ethernet and control information, with video aggregation and splitting. It is compatible with a single coax cable and has the diagnostic capability for real time link analysis.

The video aggregation is particularly relevant in terms of assisted driving as it enables multiple camera systems, for example with surround views, to aggregate their data in high definition at high speed for real time analysis.

Maxim Integrated’s next-gen Remote Tuner radio provides the user with the best signal radio at all times, including FM, AM and DAB. Again Robinett related the benefits of smaller cables. The system continually scans the signal so that it doesn’t drop during your favourite song, for example. It does this by utilising two antennas positioned on opposite sides of the car, so that if one has a bad signal, the other one will save the day – well, song.

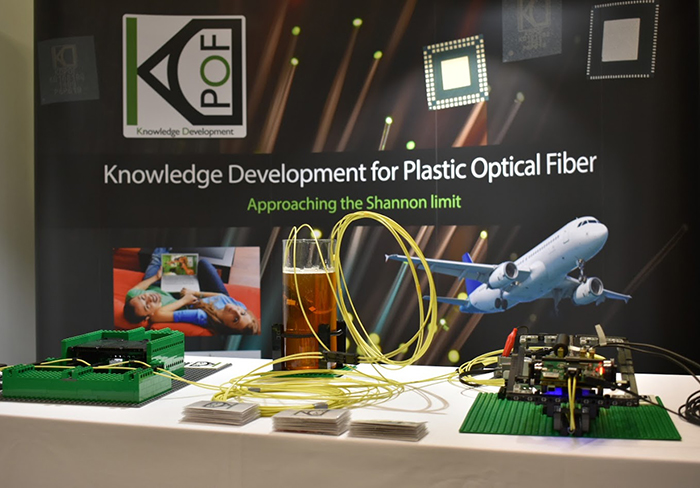

KDPOF also showcased cables (see below) – except these were POD (Plastic Optical Fibre). Its display managed to incorporate LEGO, which straight away had my attention. They announced the shipment of the first automotive grade Gigabit Ethernet POF (GEPOF) transceiver KD1053 devices to carmakers and Tier 1 suppliers.

The KD1053 provides high connectivity and low latency – which provides unique capabilities for applications where long link lengths are not required. Infineon did not have anything new to showcase at the event. The company were featuring its automotive products that – that’s right – were related to UX.

UX is still a new term

In an interview with Hans Adlkofer, the Vice President of Automotive Systems at Infineon Technologies, he told us: “UX is still a new term.” As the automotive environment develops, the user experience changes.

The focus turns to the ambience and the environment of the interior design of the car. Companies start to focus on lighting and LEDs, and the fusion of this kind of superficial technology with functionality.

For example, the interior of a car could have a flashing LED ambient lighting system to signal a cyclist approaching before the passenger goes to open the car door. There is a development of ‘practical solutions’ for the user experience.

Certain elements of the automotive environment have to be standardised for handling. Now there is competition for how to execute this. A lot of focus has been put on vision systems.

Infotainment displays and screens in the car equal driver distraction. This is leading to the development of technology such as gesture control, or HUD (head-up displays). This was discussed in the ELIV session ‘AR head-up display system requirements for precise augmentation’ by Dr. Arne Jachens, Head of Software Algorithms HUD at Continental.

Jachens explained that Continental have been working on HUD since 2013 with vehicle tests under road conditions to prove usability. There are many factors to take into consideration. He spoke in great detail about the human perception of the superposition of virtual objects, and the challenges this technology faces.

The market

All of these vision systems have to be developed with user experience in mind. They also have to adapt to different situations, as the car is a dynamic environment. Then there is the autonomous car to think about as well – but that’s a whole other kettle of fish.

Autonomous driving needs to cater for individual mobility – otherwise people might as well take the bus. Again, user experience comes into play. Companies will have to justify the expense for customers, there has to be price performance. Autonomous vehicles will be far more expensive, as they require advanced vision systems and sensors.

However, once someone has experienced assisted driving, Adlkofer believes, they won’t look back. Level 2 autonomy will enter the market over the next five to ten years. He believes the technology will penetrate into normal cars.

Whilst autonomy can provide independence for many who would not otherwise enjoy it, are there enough customers to finance this new technology?

Autonomous vehicle technology is a learning curve in both technology and legality that companies have to go through. This will take time and requires collaboration.

LIDAR and RADAR

From ADAS to autonomy, the difference is with sensors – and with LIDAR (Light Detection and Ranging) in particular. LIDAR is not needed for assisted driving.

One year ago, Infineon Technologies acquired Innoluce, a spin-off from Dutch electric giant Royal Philips. Innoluce sells a platform of solid-state laser scanning modules. Innoluce could help to develop a robust LIDAR system in order to achieve the same success Infineon Technologies has with RADAR (Radio Detecting and Ranging), in developing the technology and driving the price down.

Currently LIDAR sensors are €20-30,000, and not only does Infineon Technologies want to drive the price down to make this technology more accessible, but they also want to make it smaller and provide a chipset. They estimate an integrated and robust LIDAR chipset will be achieved by 2021/2022.

Infineon are working on a sensor fusion box with Nvidia and Intel to create a reliable ISO 26262 (functional automotive safety standard) solution. They are implementing and ensuring reliability throughout the development flow, from production to testing.

The sensor fusion box is a platform for combining the car model, environment model and the driver model – in order to drive the autonomous car.

Audi are using Infineon Technologies’ zFAS sensor fusion system in their Audi A8 – which was frequently talked about at ELIV.

Redundancy: the plan B

Aside from sensors, Infineon Technologies also focus on power systems for the autonomous car and ADAS systems. ‘Redundancy’ is a big concern. Contingency backup power systems need to be readily available should one microcontroller fail. For example, Infineon Technologies’ microcontrollers have six internal cores, so that if one were to fail, five others would be ready to recover the situation. This is an example of how Infineon Technologies are thinking along the whole chain of data.

It wouldn’t have been possible to go to an automotive conference and not hear about security at least once.

Adlkofer spoke about how, as connectivity increases in the car, black and white hackers start to appear. The latter useful, and the former, not so much.

Automotive security is paramount. Infineon Technologies has vast experience in security from smartphones, the IT industry and bank cards. Now they are transferring this expertise into the automotive industry. Implementing security at hardware level and again in their software, implementing a security architecture – to protect the whole ecosystem.

Adlkofer commented: “Product-wise we have everything we need for autonomous driving, it is no longer so much a technology challenge, but a deployment challenge.”

The stakes are higher. With banking card security, the worst case scenario is fraud and monetary theft. In automotive security, someone’s life is at risk – and a company cannot regain trust after this event.

E-mobility

China is leading the deployment of electric cars with high levels of hybridised and EVs going into production at volume. For Europe, the 2021 CO2 and emissions target will see e-mobility in volume also.

Electric vehicles require nearly the same amount of semiconductors. Infineon Technologies enjoy a high level of penetration in the semiconductor market. With 18 out of the top 20 electric vehicles using Infineon semiconductors, Infineon is the main beneficiary of electro-mobility with a power semiconductor content in drivetrain increasing by ~15x.

The main electronics difference between normal cars and electric cars, aside from motors and engines, is about 250g, and it is a chipset.

This is where UX comes in. Carmakers will need to optimise the user experience for e-mobility. This will be the difference that sets them apart from other electric cars, with the technology being the same. Brand and design come into the forecourt.

Adlkofer said that Infineon Technologies are the enablers, not the appliers of this technology. They need to understand the application of the system, but they don’t want to be in competition with their clients.

Advances in power technology

Infineon are working on utilising technologies such as GaN and SiC to increase efficiency through less losses. Most power is lost through thermal energy, rather than utilised in kinetic energy. This technology could achieve both micro and macro benefits - from more efficient technology at the heart of the car, to the impact on the overall weight of the car – and the efficiency benefits this affords in itself.

However, price remains a sticking point. Where is the motivation for customers to buy technology that is more power efficient if it costs considerably more?

Infineon believes that premium cars will adopt SiC first by 2020. Though the company believes mass market flow will not be before 2025 – and that modules will be the preferred form factor.

Infineon Technologies are first working on applying this new technology to consumer products with a three year lifecycle, before the automotive scene where the lifecycle is ten years. This is one of its long term focuses for automotive development. The company are no stranger to innovation.

Eighty percent of innovation in cars is in semiconductors. With a 10.7% share of the automotive semiconductor market, this means that Infineon Technologies is a driving force behind automotive development. This represents both a huge duty to push forward innovation, and a heavy responsibility – in terms of reliability and safety.

This is something that Infineon Technologies pride themselves on, with their failing parts record of 0.5PPM, over the automotive average of one to five PPM. Although Adlkofer said that UX is still a new term, ELIV jumped on the bandwagon with a whole session devoted to it.

Automotive UI and UX

One of the talks in the session was given by Michael Zeyn, Director of R&D UX/UI concepts and functions at Audi AG. His talk was titled ‘The automotive UI in the change through digitalisation’ and was in relation to the new Audi A8.

This session was packed, with participants crowding the floor for a chance to hear. When we wake up, we reach for our phones – instinctively. Cars need to fulfill certain requirements to participate in the personal digital lifestyle. To the extent that the car becomes the ultimate mobile device.

Zeyn provided four reasons why smartphone integration was not enough.

- Car related functions and ADAS are an important part of an integrated UI.

- Mode awareness for AD becomes an important part of the interior UI.

- Infotainment is in third place after exterior and interior design regarding purchase criteria.

- Brand specific services and differentiation is crucial.

There is no average customer but one interface needs to fit to varying functional requirements and importance in the UI (User Interface). The average age of Audi A8 customers varies between 39 and 63, and different geographic regions have different preferences. Carmakers have to take into consideration that the importance of function varies on the market. The UI needs to address this.

Expectations for the customer world outside of the car are based on full attention to the mobile or tablet. While driving interaction in the car is always second. Therefore haptic and speech interaction needs to be optimised for the UI and UX.

To address driver distraction, there are increasingly stricter guidelines, stated by the US NHTSA Guideline.

The Audi A8

Finally the Audi A8. Zeyn explained that the UI of the new Audi A8 is an integrated part of the interior design. It incorporates balanced functional integration between displays and buttons. Even the MMI touch response has smart learning interaction technologies for minimum interaction. The car learns your preferences, your handwriting and your voice – to reduce interaction time.

The Audi A8 has HUD and Audi virtual cockpit with driving related information and safe hands-on-steering-wheel operations of prior infotainment functions. It has the Audi MMI central displays with touch response technology for infotainment browsing, AC, car functions and settings. Lastly, the Audi speech dialogue system with natural dialogue-based interaction.

The Audi A8 is the world’s first Level 3 automated driving system in a production vehicle. It is to be launched in Barcelona in 2019. It has piloted driving with traffic-jam-assist and piloted parking.

As earlier explained, with the increase of assisted driving systems, UX becomes more important. Hence Zeyn elaborated the multi-media personalised UI capabilities of the Audi A8. The Audi A8 enables a connection to a personal ecosystem with knowledge of the user. For example, integrated Netflix and Spotify channels. Thereby bringing the personal world into the car - not forcing users to create an entirely new one for their car.

However, as much as the Audi A8 integrates smartphones, I’m sure some users will still not be able to refrain from using the actual handheld devices while they drive.