What does 2023 hold for printed/flexible electronics?

With applications ranging from energy harvesting to sensing, and applicability to sectors being as varied as healthcare and automotive, printed/flexible electronics are set to change our expectations of what electronics can provide and where they can be utilised.

This is not just a technology for the future: printed/flexible/hybrid electronics are already used in a wide range of sensors, lighting, photovoltaics, and other components that are commercially available today. However, there is extensive room for growth as the underlying technology is adopted for new use cases.

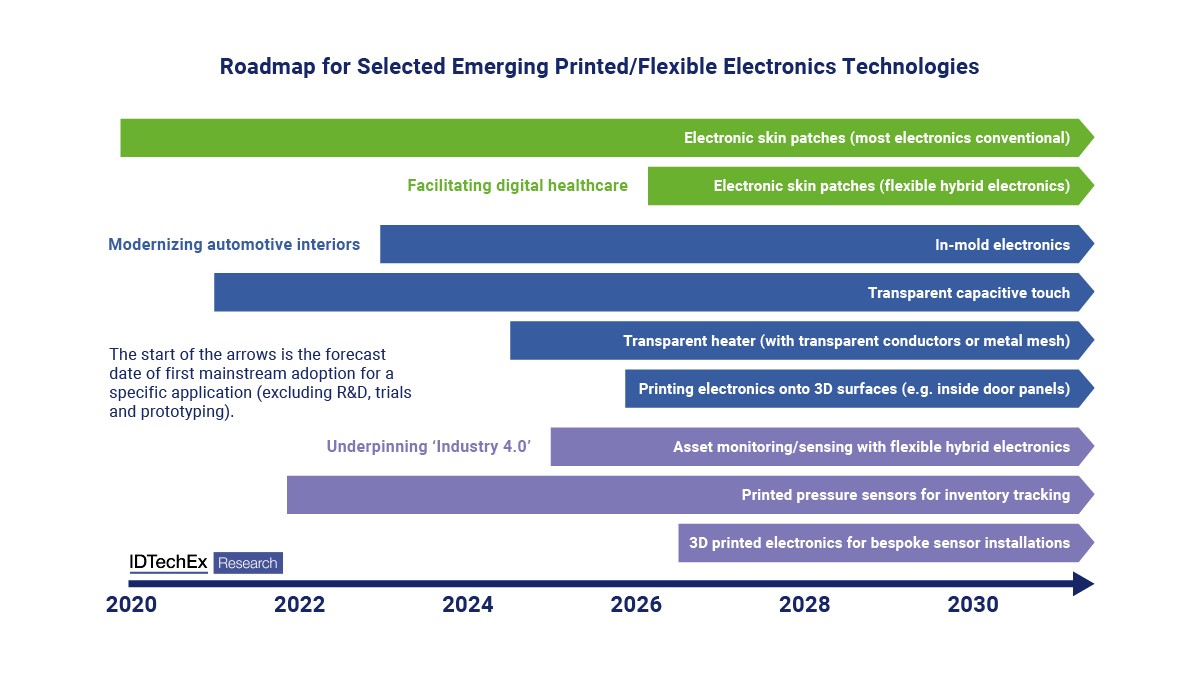

Roadmap for selected emerging printed/flexible electronics technologies. Source: IDTechEx

Roadmap for selected emerging printed/flexible electronics technologies. Source: IDTechEx

One of the most exciting aspects of printed/flexible electronics is how the low-cost, lightweight, flexible form factor and compatibility with digital manufacturing can facilitate new experiences, products, and even business models. The lower cost, relative to conventional circuit boards, facilitated by cheaper material inputs and high throughput continuous manufacturing, will enable increasingly ubiquitous electronics in applications such as smart packaging and smart buildings. The low weight and flexible form factor also ideally make printed/flexible electronics suited to acquiring data for digital healthcare, making automotive interiors ready for autonomous vehicles, and acquiring data from industrial environments.

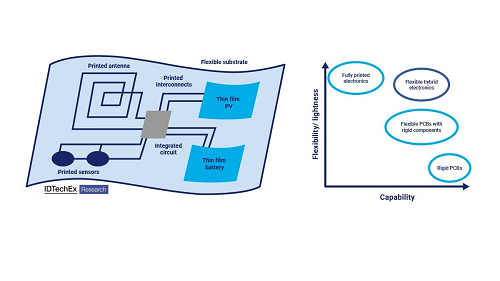

FHE circuit schematic. Source: IDTechEx

FHE circuit schematic. Source: IDTechEx

Facilitating digital healthcare

Societies worldwide face a significant challenge in meeting the healthcare needs of an aging population. Addressing this demand cost-effectively will almost certainly require increased digitisation via, for example, remote patient monitoring and automated diagnosis.

Electronic skin patches based on printed/flexible electronics are likely to be a component of this emerging digital healthcare landscape. By continuously tracking vital biometric parameters such as heart rate, movement, and temperature, patients can potentially be released earlier from hospital. Furthermore, the patches can facilitate decentralised clinical trials. This would both reduce costs and provide more representative results as the trial subject can continue with day-to-day activities.

Interest in electronic skin patches has continued to grow throughout 2022, with contract manufacturers such as ScreenTec and Quad Industries reporting full order books and expansion plans. In 2023, expect to see more trial projects utilizing electronic skin patches for continuous monitoring, including decentralised clinical trials. These will build on experience gained when skin patches were utilised for respiratory monitoring during the COVID-19 pandemic but will be applied to a much wider range of conditions. There will also be continual improvements in the capabilities of skin patches in terms of stretchability, comfort, and the fidelity of biometric data recorded.

Modernising automotive interiors

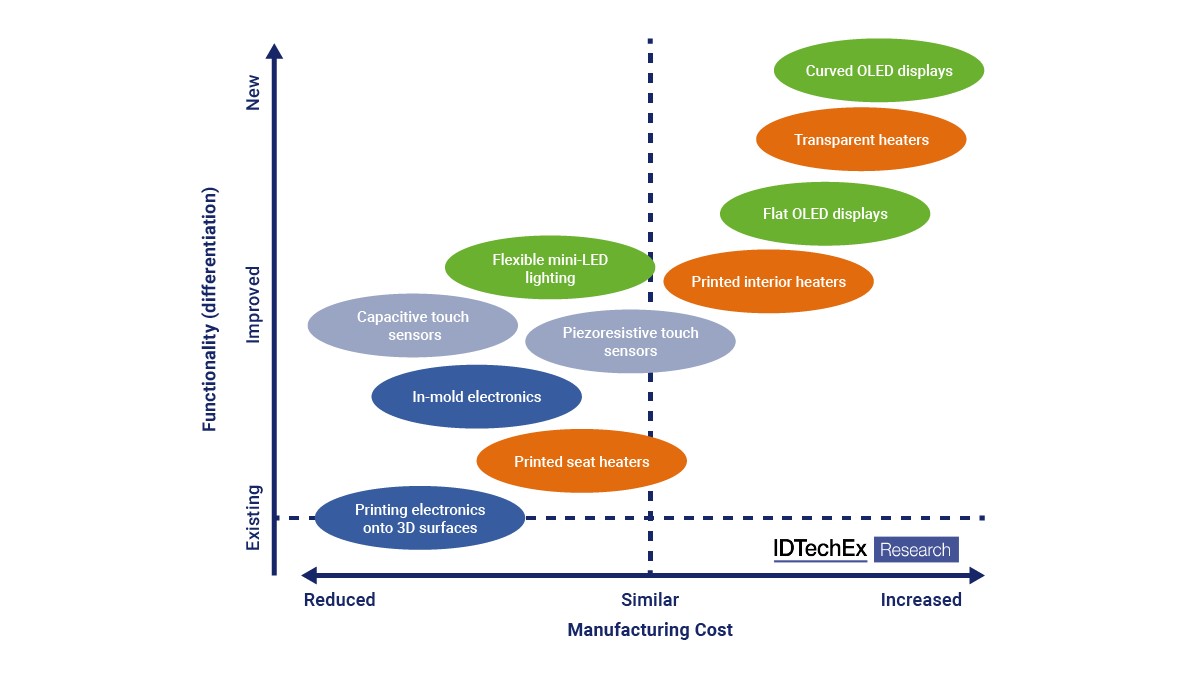

As vehicles become increasingly autonomous, the interior rather than the driving experience becomes the key source of differentiation between models and hence a key focus for innovation by manufacturers. This transition creates extensive opportunities for printed/flexible electronics, which can leverage their light weight and conformality to produce thin-film heaters, flexible backlighting, and capacitive touch surfaces. Indeed, backlit capacitive touch sensors comprising inlayed transparent printed metal mesh films and thermoformed parts developed by PolyIC are now utilised in commercially available vehicles from multiple brands.

Transparent antennas are another emerging automotive application to which printed/flexible electronics are well suited. One use case is radar. Transparency enables the radar area and accuracy to be increased without inhibiting aesthetic (or cooling) requirements since they could be placed on the vehicle bodywork. Another automotive use case is improved connection with telecommunications infrastructure. This is vital to the ‘connected car’ concept, where cars will always have excellent internet connectivity for both occupants and vehicle systems. This is already being explored by automotive manufacturers such as Nissan and telecom providers such as NTT Docomo. Transparent antennas can be mounted high on the windows for an easier line-of-sight without constraining the vehicle design.

In 2023 expect to see the first commercial automotive release of in-mould electronics, in which electronics are printed and mounted onto a flat substrate that is subsequently thermoformed and injection moulded. Increased use of capacitive touch sensors, often integrated into curved surfaces of aesthetically appealing materials, is an automotive interior trend set to continue. Additionally, printed/flexible electronics will increasingly be used to add heating and lighting to surfaces throughout the interior to create a more compelling occupant environment while improving energy efficiency and reducing weight.

Underpinning ‘Industry 4.0’

Industry 4.0 promises substantial enhancements in manufacturing productivity. Greater digitisation, adoption of machine learning, AI, and wireless connectivity enable continuous monitoring of multiple production aspects and corresponding optimisation processes. Sensors are increasingly being adopted within factories to provide data for these analysis algorithms. These are used not just to monitor the product being produced but to track the performance of machines and keep track of inventory and other assets. In some cases, the ultimate aspiration is to produce a digital twin, in which the condition and location of every asset in the factory is tracked in real-time. For example, at the FLEX2022 conference, Boeing outlined its aspiration to utilise flexible hybrid electronic circuits with sensing and communication ability throughout its factories.

Enabling predictive maintenance is a substantial driver for Industry 4.0, as it could reduce costly downtime of a production line. Vibration and temperature sensors can be integrated or retrofitted to mechanical equipment so that any changes outside agreed parameters can be identified and resolved during routine maintenance. Integrated sensors can also be used to ensure that crucial components are installed correctly to prevent costly subsequent failures. For example, TT Gaskets is developing gaskets with integrated pressure sensors that can be read out with an RFID scanner to ensure that they are seated correctly.

Tracking inventory, even for small, frequently used items, enables automatic reordering. One such example comes from Trelleborg in collaboration with InnovationLab. A printed piezoresistive sensor is placed at the base of parts bins, with the reordering triggered whenever the weight of parts reaches an assigned threshold. Printed electronics is ideal for such systems since large-area sensors can be produced at a low cost.

In 2023, expect to see more trial projects utilising flexible hybrid electronics to enable asset tracking and predictive maintenance throughout an industrial environment. Leak sensing using low-cost capacitive sensors, such as that developed by early-stage UK firm Laiier, will gain traction across a wide range of commercial environments. 3D electronics will also be increasingly used to enable sensors to be retrofitted to existing production infrastructure. This is due to the ability of cost-effectively producing bespoke parts.

Position of printed/flexible electronics technologies. Source: IDTechEx

Position of printed/flexible electronics technologies. Source: IDTechEx

Continued commercialisation

This commercialisation of printed/flexible electronics is expected to continue in 2023 across all the technologies and applications outlined above. While there is still extensive opportunity for hardware development, especially regarding durability, yield, and connections between flexible and conventional/rigid electronics, many of the remaining challenges are commercial. This is especially true where printed/flexible electronics facilitate new business models that require substantial changes to embedded working practices. For example, continuous health monitoring or the comprehensive redesigning of existing products, such as moving from wiring harnesses to printed wiring. Increasingly, printed/flexible electronics providers are establishing industry partners to overcome these barriers and facilitate the adoption into new applications.