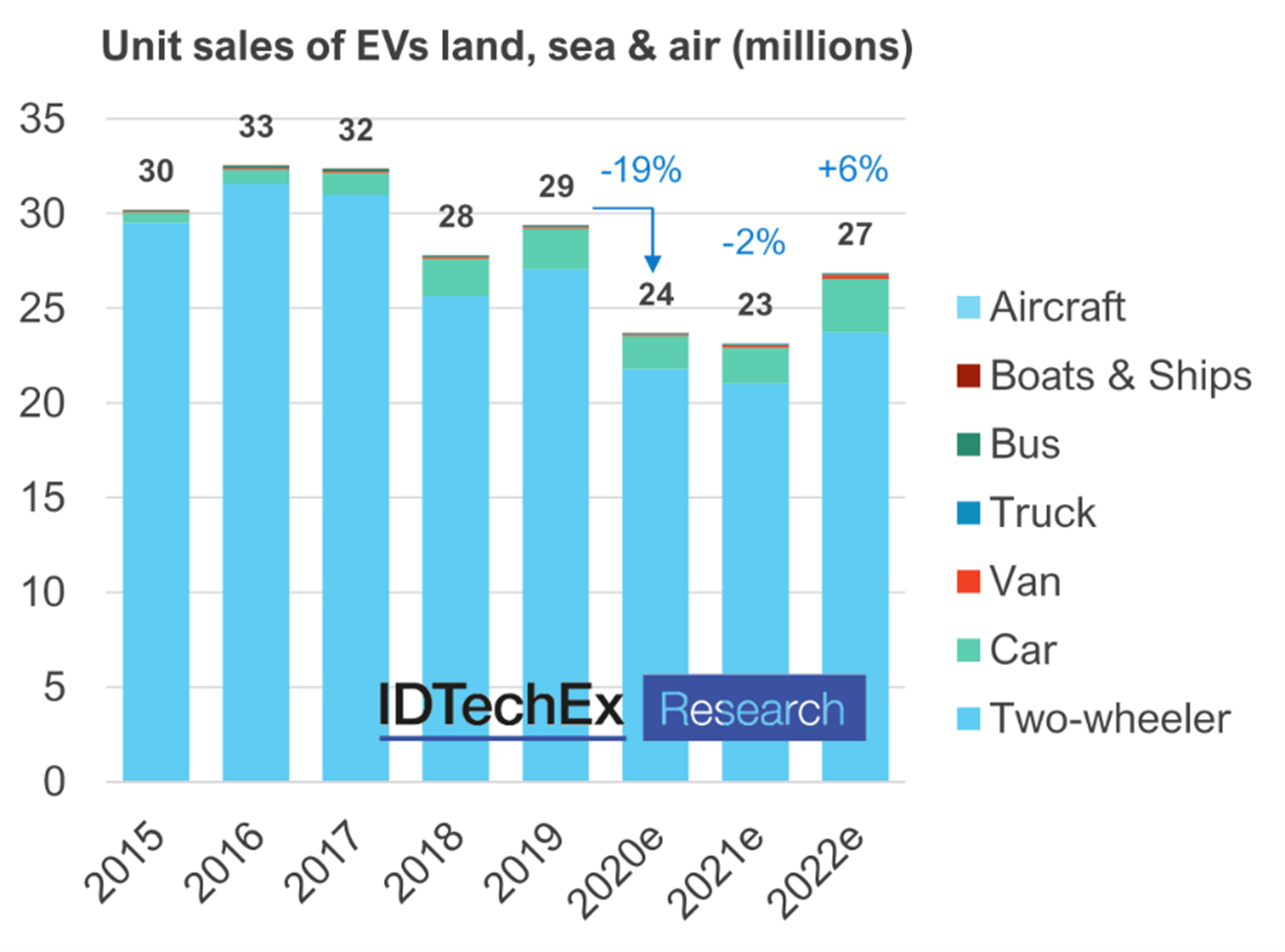

The 24 Million Electric Vehicles of 2020

The market for electric vehicles across land, sea and air will be 24 million unit sales this year, which represents a decline of roughly 19% year on year from the impact of COVID-19. Urban vehicles such as electric cars and two-wheelers have the highest unit volume, battery demand and motor demand, and, as consumer-driven markets, bear the brunt of the pandemic's impact.

Chart represents BEV and PHEV cars, vans, trucks, buses and E2W, and BEV, PHEV and HEV boats, ships and aircraft. Source: 'Electric Vehicles: Land, Sea and Air 2021-2041'

The volume of the electric two-wheeler market, which is just over 90% of the 24 million sales, may seem surprising. This volume comes from China, where the market is not growing. In fact, the S- curve is already over: the market peaked at roughly 30 million sales in 2016 after twenty years of growth and has stabilised at a slightly lower level (some 26 million were sold in 2019).

Since consumer purchasing power has surged, China's urban mobility preference and future growth is now with the car. However, due to the sheer volume of Chinese electric two-wheelers, it will take a while for other motorcycle-dominated regions with a will to electrify (like India) to make a dent in the global market (we predict the 30 million mark will be surpassed again in 2029). Despite making up over 90% of unit sales today, Li-ion battery demand from two-wheelers takes only 11% of the market due to small battery sizes per vehicle and the dominance of lead-acid batteries in Asian micro-mobility segments.

In contrast, electric cars have the second-highest sales volume alongside relatively large battery capacities per vehicle, making up 7% of unit sales but over 70% of the battery demand in the new IDTechEx report 'Electric Vehicles: Land, Sea and Air 2021-2041': a share which increases for the next two decades.

The question is, against the backdrop of COVID-19, how have plug-in electric cars (BEV + PHEV) fared in 2020? The logic is that COVID-19 and a global recession increases consumer price sensitivity, which is a setback for more expensive electric cars. However, due to a backlog of orders from popular models, less price sensitivity from today's electric car demographic and the continued commitment of governments to emissions targets, sales have shown resiliency in Europe and the US and were mostly flat during national lockdowns. IDTechEx expects H2 to show a modest recovery, but uncertainty remains high against the backdrop of a 'second wave'. In contrast, China's growth has been negative, but this was the trend before the pandemic with purchase subsidy reductions of up to 60% from July 2019: COVID-19 amplified but did not set-off this trend.

Moving to the seas, Li-ion battery adoption on ships has flourished in recent years as startups have capitalised on falling battery cell prices from automotive battery suppliers. However, while the industry is used to much longer sales cycles and a decline is less immediately visible, the impact is likely to be less fundamental and isolated to specific subsegments. For example, the cruise sector has seen passenger demand evaporate due to the risk of being confined out at sea with thousands of passengers: IDTechEx has learned of some major orders for hybrid cruises being delayed, whilst other projects have stayed on track.

For more information, the new IDTechEx report 'Electric Vehicles: Land, Sea and Air 2021-2041' puts IDTechEx's core electric vehicle forecasts in one place: unit sales, battery demand, market sizing and more. Each chapter summarises the main drivers, trends and forecasts for a vehicle subsegment (two-wheelers, cars, vans / LCV, trucks, buses, leisure boats, commercial short and deep-sea ships, manned aircraft) or enabling technology (Li-ion batteries, electric motors).

By providing a clearer understanding of relative market sizes, battery demand and the fastest-growing electric vehicle markets beyond cars, our aim is to give those in the industry the knowledge to make more informed decisions on their investments and focus into the electric vehicle industry.