In the driving seat

The use of MCUs in automotive applications is growing, but Steve Rogerson found there were differences in how the chip makers see the market evolving.

The pressure for more connectivity in automotive is leading to tasks that were once the domain of 8- and 16-bit MCUs now requiring 32-bit units, a trend helped by the falling prices of the more powerful chips. On the flip side, the increase in sensors and basic motor functions - such as window raisers and seat position adjusters - has meant that 8-bit MCUs still have a place.

Such 8-bit MCUs do not need deep technical requirements; they just have a simple job to do. The problem comes when the simple job becomes more complicated because of networking needs, even for the traditional CAN and LIN bus but also with the spread of Autosar. On cost, the 8- and 16-bit units can be got for below a dollar compared with nearer $2 for a 32-bit unit, though that price is coming down.

“As the cars get more complex, you need more networking functions and diagnostic capability,” said Juergen Jagst, Technical Specialist, Automotive, ARM. “For example, it is not enough to know the window lifter is not working; they have to work out why and network that information, and this is why there is a shift to 32-bit.”

Ross Bannatyne, General Manager, NXP, said that the growing use of software in vehicles was the key driver behind the move to 32-bit: “The amount of software is increasing and that means more Flash and other memory,” he said. “Companies are spending a lot more time, effort and money developing software, which is more costly than the hardware.”

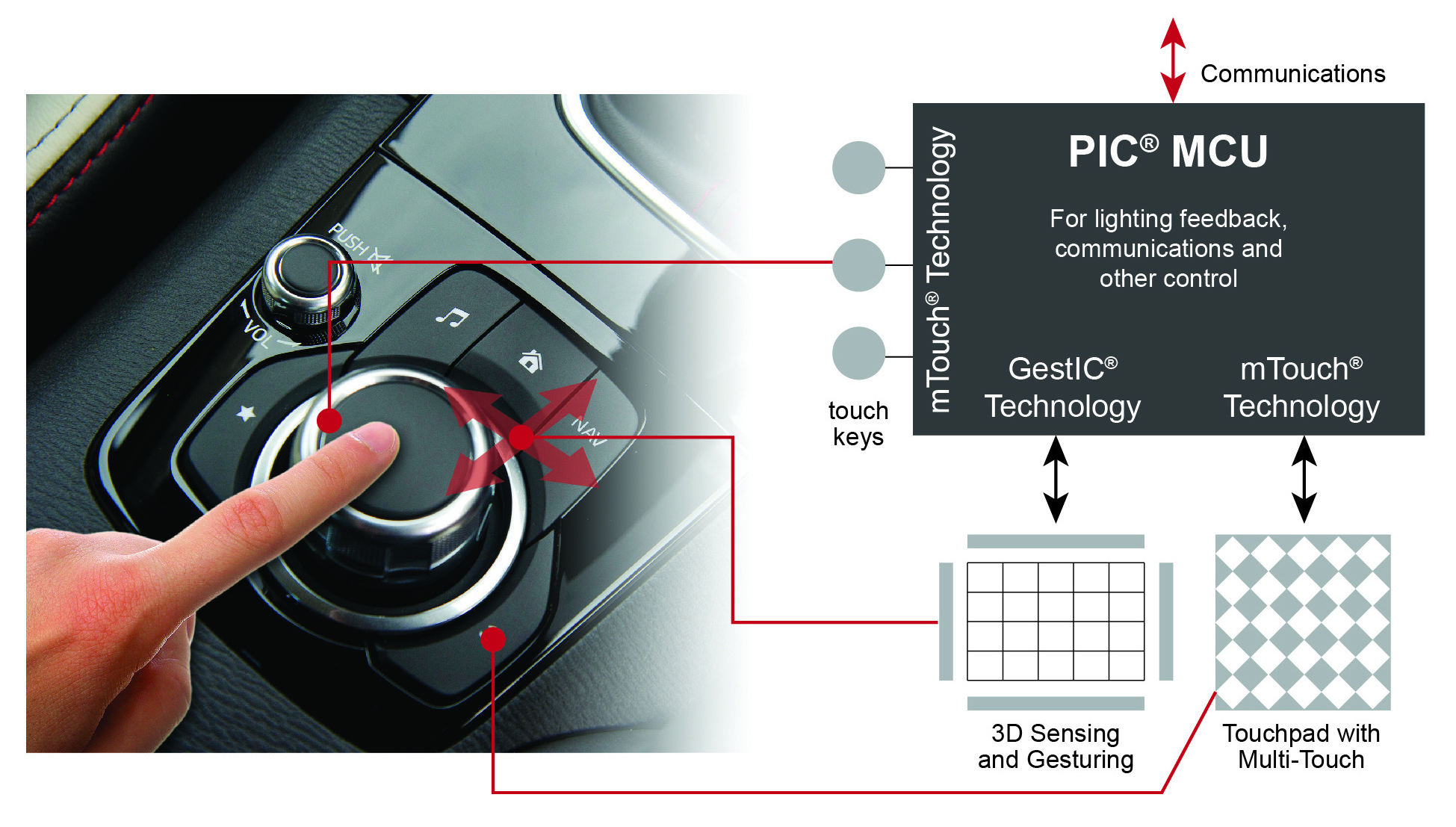

Willie Fitzgerald, Director, Automotive Products Group, Microchip, added: “We have focused on the 8- and 16-bit area but we are starting to enter the 32-bit space in this market as well.” The 8-bit MCUs can also be found in seatbelt tensioners, HVAC controls, pumps, switches, touchscreens, including capacitive touch sensing, and lighting.

MCU in automotive capacitive touch application

“We still see 8-bits in low performance ECUs, doing say a smart actuator or a light sensor,” said Axel Hahn, Senior Director of Powertrain MCUs at Infineon. “They are used for window lifting and things like that. They will continue to be used.” The 16-bit MCUs still appear in fuel pumps, cooling fans, distance trackers, low-end braking and low-end power steering. The 32-bit chips have traditionally been for the main engine and transmission controllers, but now are being used wherever there is a need for network intelligence.

“We have seen the trend for five or six years of a shrinking market for 8- and 16-bit,” said Fitzgerald. “But these chips have applications not in the core but in the peripherals around the core. Look at airbags, they were once 8-, and then 16 and now 32-bit. But then around the 32-bit, you’ll have smaller processors doing the crash sensing. Steering used to have one MPU with one core, but that is not enough, so now they have two cores for safety reasons and small MCUs around them that measure things such as the steering angle.”

There is also still a booming market for the smaller MCUs in the budget sector in the west and less sophisticated cars in some areas of the world. “We are still selling 16-bit controllers into low-end cars in South America and China,” said Mathias Braeuer, Director, Automotive MCU Marketing, Spansion. “But in Europe, there is the trend towards Autosar and thus you need the more powerful controllers."

On top of that, there is an increasing deployment of 64-bit MCUs for high-reliability and more complicated applications such as those found in ADAS, for example using radar for distance controls and cameras for object detection. Also, the bird’s eye view systems now being found in high-end models where the images from several cameras are combined to give what appears to be a view from above the car. “Some use DSPs for this, some use high-performance classical CPUs,” said Jagst. “It depends on which Tier 1 designed it. There is no clear direction of which is best.”

Multicore

Multicore processors are being used more in cars but at present most of the software is not making the best use of them, treating them the same as single-core processors. However, there is a lot evaluation work that looks like changing that with virtualisation used to create separate partitions to allow, say, an RTOS to run on one core for safety critical systems and a more general-purpose OS, such as Linux or QNX, on a different core. “This is not yet being heavily used in cars,” said Jagst, “but it will be in the future, up to about 2020. One of the problems is that Autosar, for example, is not written in a way that accesses multicore. There is no splitting of tasks.”

But up and coming ADAS functions are more likely to use the benefits of multicore, and these will start to be more widely available in the next two to three years. “The challenge for many users is to benefit from the performance that multicore can offer,” said Hahn. “To do that they have to redesign software that has been developed over a decade or more. That is a challenge for the development teams, but they are doing it.”

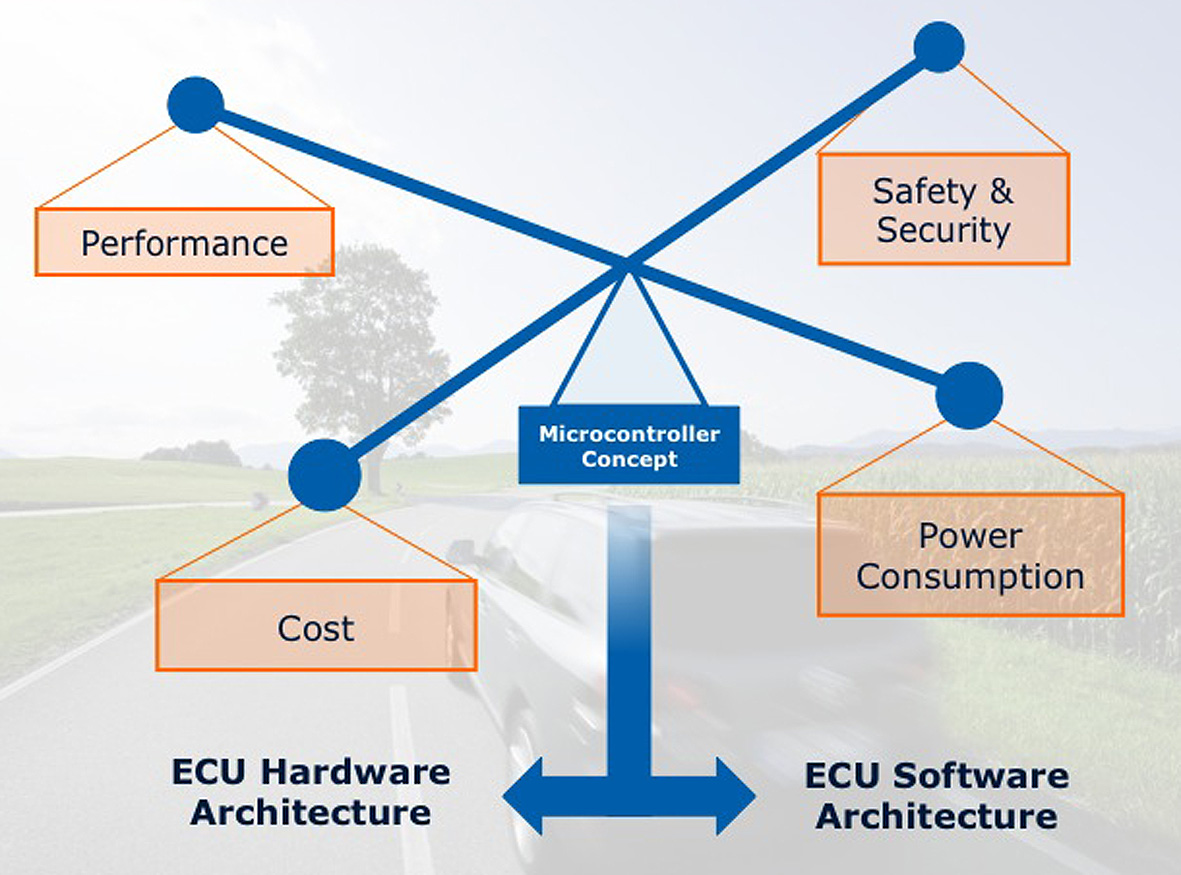

Challenge for modern MCUs

There is also a possibility of using multicore for safety critical functions where each core will perform the same task and the results compared before making a crucial decision such as automatically applying the brakes. Some will even use three cores for this. Meeting the requirements in ISO26262 will lead to more of this type use of multicore for safety reasons. “As they want to be more safety oriented, there is a need for the MCUs to do more functions,” said Fitzgerald.

Architectures

Still the most popular chip architectures in automotive are the proprietary systems such as found in the RH850 series from Renesas, the PowerPC from Freescale and Tricore from Infineon. But ARM’s Cortex cores are starting to find more automotive applications as the company sees this as a key target market.

“ARM has a very strong offering and will be successful,” said Braeuer. “If you look at what others are offering, Freescale is starting to offer ARM in automotive and a lot of ASIC devices are based on ARM. Renesas and Freescale are using their own architectures but they are also starting to use ARM controllers. I suspect ARM will grow in automotive.”

Bannatyne added: “Engineers are trying to standardise software over the different cores and that is why there is success with ARM. A lot of companies are standardising on that. But there are some very good MCU architectures such as from Freescale and Renesas. They have been in the business a long time and a lot of engineers are very familiar with the architectures. But one of the benefits of ARM is that it is CPU agnostic. Engineers want to use the same tools across as many CPUs as possible so they can reuse software. That is one of the benefits of ARM, the compatibility between these cores and the number of suppliers that support it.”

But Hahn said: “We are not seeing widespread use of ARM - people are sticking with their incumbent architectures. One of the challengers for the designer is to meet ISO26262 safety standards. If they have the core totally under their control, they can tweak that to meet the safety targets. You don’t have that flexibility with the ARM architecture. You would have to have discussions with ARM to change that so it will not be under your control.”

Intel architectures tend to be used more in the multimedia and infotainment domains, an area also where ARM is scoring. MIPS is being used, though mostly in the smaller MCUs. “We use MIPS,” said Fitzgerald. “But we are not competing with the ARM and PowerPC. We have our own areas doing the likes of watchdog functions and other facilities around the larger processors.”

But Bannatyne said: “Body electronics was one area where it was more typical for 8- and 16-bit micros for things like mirrors and windows, but now it is more efficient to use 32-bit and standardise on a single architecture.” And Hahn said: “Companies want a whole portfolio with software compatibility from low to high end so you can reuse software. We don’t see MIPS in the mid to high end.”

The dramatic increase in the use of electronics in motor vehicles has led to a shift in the whole way the car is perceived. What were once simple tasks that could be handled by small MCUs now involve networking and diagnostic functions that can only be supplied by more powerful processors. But with these processors comes a need for more peripheral functions that still provide a market for the smaller devices.

On that, most players agree, but there is strong disagreement on how that will be implemented in terms of architectures with many strongly rooted in their own path. While some are sticking with proprietary architectures, others are strongly aware of ARM’s move into this market and some are hedging their bets. This is a battle that looks set to be played out over the next few years as more sophisticated safety and control systems find their way in the automotive segment.