Four ways to eliminate rare earths in EV motors and one you haven’t heard

The use of rare earths in various modern technology has drawn attention over the years. But with the rising demand for electric vehicles (EVs), the issue has been brought to the fore. Dr James Edmondson, Principal Technology Analyst at IDTechEx further explores.

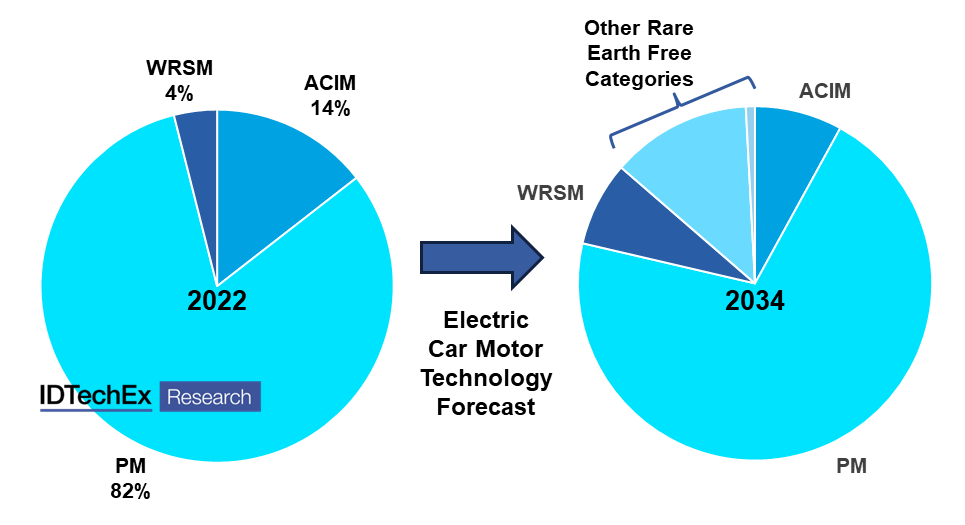

82% of the electric car market in 2022 was using electric motors based on rare earth permanent magnets. China largely controls the supply of rare earths, and this has led to significant price volatility in previous years, with a large spike in 2011/2012 and a big rise between 2021-2022. Crucially, in comparison to some other technologies, several methods can be used to eliminate the use of rare earths in electric motors, which will be outlined in this article along with the pros, cons, and adoption.

This article is based on IDTechEx’s latest ‘Electric Motors for Electric Vehicles 2024-2034’ report that analyses different motor technologies for performance, materials, market adoption, and future potential.

To briefly describe the construction of an electric motor, a stationary part (stator) has coils of metal (typically copper) fed by an electric current to generate a magnetic field. This field will then turn the rotating part of the motor (rotor). In a rare earth permanent magnet (PM) motor, the magnets are located on the rotor.

1 - The induction motor

In an induction motor (or asynchronous motor), the rotating magnet field produced by the stator induces currents on the rotor, which in turn produces a magnetic field that is attracted/repelled from the radial field of the stator windings. The induction motor uses copper or aluminium bars or windings on the rotor. These motors typically present good peak power and torque density over short periods but can prove challenging to thermally manage and typically have lower efficiency than PM options.

Induction motors have been common in the EV market, being the primary choice of Tesla until the release of the Model 3 (which adopted a PM design). In the car market, some proponents remain, such as Audi and Mercedes, but induction motors are now largely used as a secondary motor, used for acceleration boosts as they do not create drag when not in use, eliminating the need for a decoupler.

2 - The wound rotor motor

Also known as an externally excited synchronous motor (EESM), the wound rotor synchronous motor (WRSM) replaces the magnets on the rotor with coil windings that can be fed with a DC current to generate a magnetic field. This has the advantage of being able to control both the stator and rotor field. The downsides are the additional manufacturing steps required to add windings to the rotor and brushes are needed to transmit power to the rotor. These motors have historically also had poorer power and torque density, but modern versions are comparable with PM motors.

Renault was an early proponent of this technology in the Zoe, but now BMW and Nissan have adopted this design, and tier 1 MAHLE has presented a version with wireless power transfer to the rotor, eliminating the brushes.

3 - The switched reluctance motor

Switched reluctance motors (SRMs) are potentially the simplest to construct, with the rotor largely being constructed of steel. The steel of the rotor has low reluctance compared to the air around it, so magnetic flux preferentially travels through the steel while attempting to shorten its flux path, rotating the rotor. Despite their simplicity and reliability, SRMs have typically been plagued with poorer power and torque density with other issues, including torque ripple and acoustic noise.

While SRMs have largely been confined to more industrial or heavy-duty applications, significant efforts are going into their development for EVs. Companies like Turntide Technologies have added more rotor and stator poles and come up with more sophisticated control systems to overcome traditional issues. UK-based Advanced Electric Machines have developed a new type of motor with a segmented rotor that remains simple in construction but is said to eliminate the acoustic noise and torque ripple while improving power and torque density; this design is the centre of a project alongside Bentley.

4 - Alternative magnetic materials

While many OEMs have steadily reduced the rare earth content of their motors, Tesla gained much interest by saying that its next-generation drive system will be a PM motor without rare earths. There are several ongoing projects to develop rare earth free magnets that can compete on magnetic performance; these are at varying levels of commercialisation.

The problem with alternative magnetic materials is that their magnetic performance is generally much worse. For example, some manufacturers that make rare earth and ferrite magnet motors show a reduction in power by 50-70% for ferrite version of the same size motor, meaning that to match performance, much more magnetic material and/or a much larger motor is required.

Proterial has developed magnets with magnetic properties that it states “deliver the world’s highest levels among ferrite magnets”. The motor design only requires 20% more magnetic material to keep the motor power density the same. Niron Magnetics are developing iron nitride magnets, and its next-generation versions are planned to compete with neodymium performance. PASSENGER is a European project developing strontium ferrite and manganese aluminium carbon alloys. While efforts are underway, materials with a truly comparable performance are still some ways into the future; however, with other changes to the motor design, they might not need to.

5 - A high speed ferrite motor with further optimisations

While the adoption of ferrite magnets would significantly reduce motor performance, optimising many other motor features could minimise this impact. Australian technology company Ultimate Transmissions has submitted a patent for a ferrite motor design that it believes could be one route Tesla could take to eliminate rare earths in a PM motor.

The design uses much larger ferrite magnets and higher speeds (20,000rpm) to achieve comparable power to a similarly sized rare earth PM motor. One challenge comes from containing the magnets effectively in the rotor; a potential solution would be using a carbon fibre wrap on the rotor (a technology Tesla has already demonstrated in its Plaid vehicles). Another challenge is that the ferrite magnets would need to be heated for optimal operation, the opposite issue faced by neodymium magnets, but not unachievable.

It should be noted that this design is still in the simulation phase, and Tesla could well be taking a different approach, such as its own alternative magnetic materials. But in simulations, this approach has shown similar power, reduced costs, and reduced weight at the expense of slightly reduced torque and a longer stack.

Conclusions for the future

There is an increasing focus, especially outside of China, on reducing the rare earth content of electric motors. There are several strategies, each with its own trade-offs and opportunities for motor manufacturers and material suppliers. IDTechEx is predicting that rare earth PM motors will remain the dominant technology, largely thanks to China’s dominance in the EV market and other mines starting to come online worldwide. However, it anticipates that rare earth free options, including those mentioned above, will account for nearly 30% of the market in 2034.

IDTechEx’s latest iteration of ‘Electric Motors for Electric Vehicles 2024-2034’ takes a deep dive into motor technology, market adoption, material utilization, and market forecasts. It draws from a large database of vehicles and motors across vehicle segments, including cars, buses, trucks, vans, 2-wheelers, 3-wheeler, microcars, and aircraft.