Electric scooters to continue skyrocketing in popularity

Asia accounts for more than 90% of all global two-wheeler sales, and it is unusual for a family not to own one in some countries.

The three largest markets ranked by annual sales are China, India, and Southeast Asia. When compared to cars, light electric two-wheelers are much easier to produce, are subject to significantly fewer regulations, can carry much lower price tags, and are likely to entice a wider range of riders. The reasons for growth in these regions include personal disposable incomes remaining low on average, making cars unaffordable; fuel inflation rates making the direct cost of owning a petrol vehicle high and dense and crowded urban centres with slow-moving traffic making two-wheelers the transport of choice for the masses.

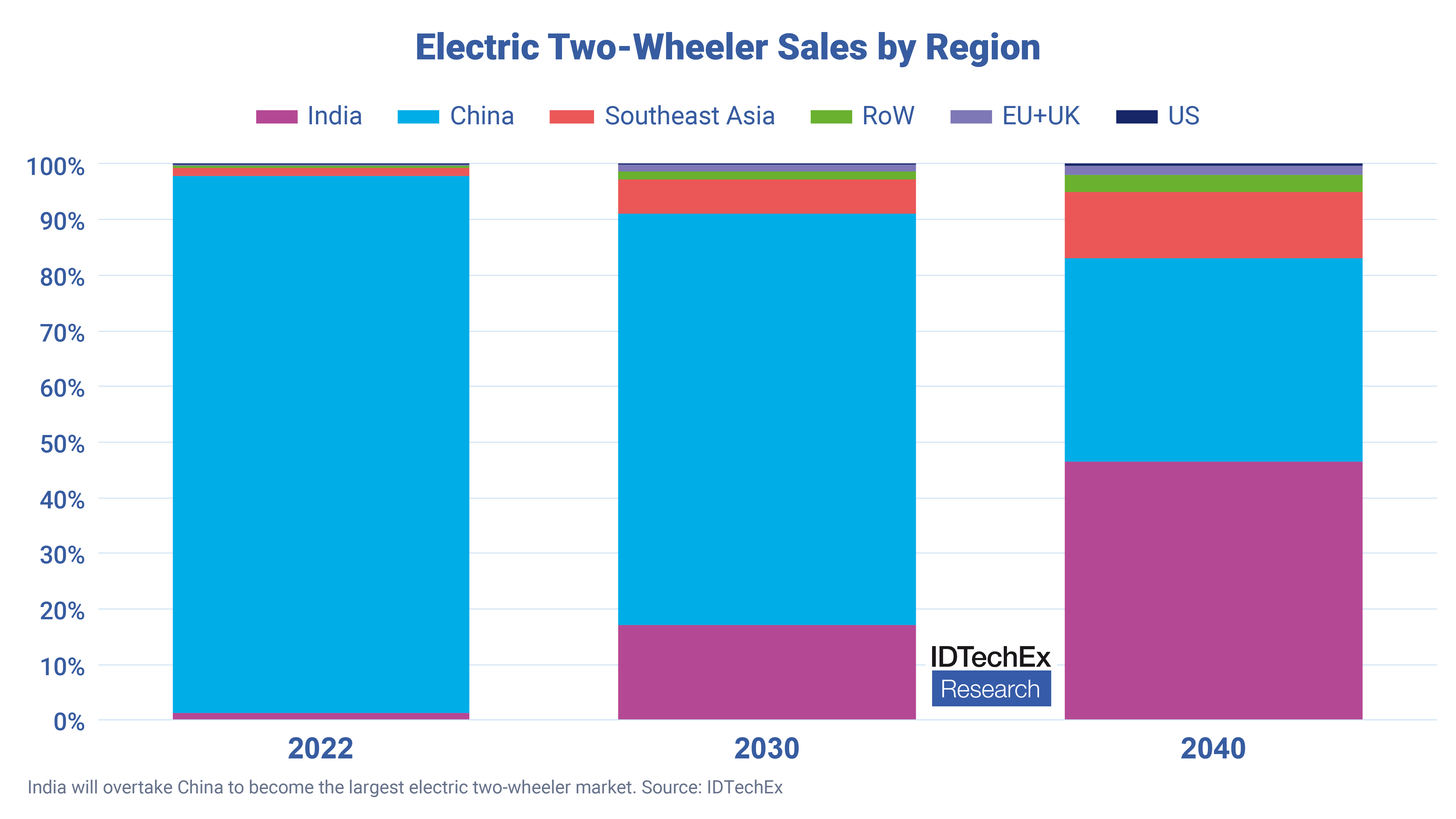

The market for electric scooters and motorcycles is booming outside of China as more countries are looking to shift away from ICE counterparts. While China is the largest market by sales volume, sales boomed early and are now on the decline. IDTechEx expects growing markets like Vietnam and India to take up larger market shares in the coming years as Chinese sales decline. Both China and India, being the largest domestic production and sales markets for two-wheelers globally, export their products overseas as well. Two-wheeler export performance is expected to increase due to increased requirements of e-commerce and last-mile deliveries in many export markets. The latest report from IDTechEx, ‘Micro EVs 2023-2043: Electric Two-Wheelers, Three-Wheelers, and Microcars’, includes a comprehensive analysis of the Indian, Chinese, and Southeast Asian electric two-wheeler market, covering model benchmarking, OEM market shares, and a 20-year sales forecast split by battery type and motor power.

China: a saturated market

The electric two-wheeler market in China has been growing for twenty years (with lead-acid batteries), driven by the need to travel quickly around cities and the relative unaffordability of the car (consumer preference). The S curve has already happened: the market peaked at over 30 million sales in 2016 and was expected to decline steadily. However, due to the introduction of a new national technical standard in 2019, sales are expected to peak once again (only briefly during the transition period spanning 2019-2025) before stabilizing and exhibiting negative growth rates. The 2019 regulation will drive the uptake of Li-ion batteries from 27% in 2022 to over 90% by 2040, according to IDTechEx forecasts. Many of the electric scooters in China are simple, low-end models (<4kW motor power) designed to be affordable to the masses made by market leaders like Yadea and Aima, who continue to dominate sales. Premium brands like Niu capture lesser market shares.

India: a growing market

India is one of the largest two-wheeler markets in the world. The two-wheeler is the most preferred means of commuting for the Indian population. India has witnessed strong growth in electric two-wheeler sales in recent years. The main factors driving sales growth are supportive government policies, lower total cost of ownership, rising fuel prices, increased localisation of electric two-wheeler manufacturing, and adoption of e-commerce platforms. In terms of power split, IDTechEx anticipates that the market will be dominated by <4kW e-scooters that have reached price parity with ICE equivalent models. IDTechEx expects the models with >4kW of power to slowly increase in sales as battery prices fall. The introduction of Ola’s S1 and Ather’s 450X models (both in the top five-unit sales volume in 2022) is establishing the premium high-power electric scooter segment in India, with further new models expected to be launched that will drive the >4kW market share higher.

Southeast Asia: ICE dominant with opportunity for electrification

The two-wheeler market is dominated by ICE two-wheelers in Indonesia, Thailand, the Philippines, and Vietnam – collectively the Southeast Asian market leaders. The 2 and 3W sales in these four market leaders account for over 90% of total 2 and 3W sales in Southeast Asian countries. The market share of electric two-wheelers in Indonesia, Thailand, and the Philippines is relatively small, with less than 1.5% of all two-wheelers sold in these countries. Vietnam has the largest share of electric two-wheelers among these countries, and it grew substantially, from 5% in 2019 to 8% in 2020 and 10% in 2021. The Vietnamese electric two-wheeler market is thriving, with the emergence of domestic makers like VinFast, Datbike, Arevo, and Pega, as well as foreign brands, including Yadea, Dibao, and Niu. The use of battery swapping to eliminate charging woes is seeing prominence as well. In 2022, about 470,000 electric two-wheelers (mainly low-power e-scooters) were sold, with IDTechEx forecasting sales to cross over nine million units by 2043.

The IDTechEx report covers the regions mentioned above in more detail and EU+UK and US markets for electric two-wheelers. It provides insights into these markets from a technical and commercial perspective with forecasts for future demand.

Electric motorcycle market to grow steadily although challenges exist

The scooter segment has a higher number of electric models on offer (thanks to various Chinese products sold overseas) and offers a much lower total cost of ownership compared to ICE counterparts. This explains their popularity and growth.

Electric motorcycles, however, remain a premium niche segment that must appeal to a crowd of enthusiastic riders. High-performance electric motorcycles are now coming to market, aiming to offer the thrills without the emissions. Italy is the largest European market, followed by Spain, France, Germany, and UK. These countries account for about 80% of electric motorcycle registrations in the EU+UK block. An upward trend in sales for the last three consecutive years is noticed across most countries, confirming the attractiveness of electric motorcycles. Motorcycles in the US are predominantly ridden for enjoyment and as part of a lifestyle choice; this, in turn, makes it harder to sell the electric motorcycle because of the nostalgia and lifestyle associated with ‘loud pipes’.

Electric motorcycles offer a variety of motor power outputs based on their type – everyday cruisers typically use lower-power motors, whereas performance superbikes use high-power motors. The general takeaway found from IDTechEx benchmarking is that e-motorcycles with a premium price tag (around ~$15,000) use larger capacity batteries and powerful motors (often based on a higher voltage platform 120-400V). In contrast, more entry-level variants offer performance more comparable to some premium e-scooters (often using similar componentry packaged in a motorcycle frame).

In the case of zero-emission motorcycles, particularly in the premium market segments, current product availability, price point, the current state of electric bike technology, and rider acceptability suggest that much more will need to happen before this market takes off. Today, battery-powered motorcycles have a much shorter range than typical petrol models, as the extra weight from batteries increases the overall weight. Incumbent Kawasaki’s target for electrification is to convert small displacement commuter motorcycles and mopeds that emphasize practicality and have a shorter range. However, disruptors like Energica and Zero Motorcycles are tackling this challenge head-on and launching high-performance models at a premium cost. IDTechEx’s latest report, ‘Micro EVs 2023-2043: Electric Two-Wheelers, Three-Wheelers, and Microcars’, covers the electric motorcycle market across various regions and benchmarks models from leading players, along with insights into the opportunity for growth within this segment.

To find out more about this IDTechEx report, including downloadable sample pages, please visit www.IDTechEx.com/microEVs.