Businesses and charging port operators play a crucial role in the sustainable mobility transition

Should businesses extend their offering of fleet cars to include electric vehicles? According to 62% of the UK population the answer is yes, even more so when asking potential (75%) and current EV drivers (83%).

These are some of the findings from this year’s edition of the EVBox Mobility Monitor—EVBox’s market research report on EV adoption conducted alongside Ipsos. The research is supported by responses from over 4,000 European citizens across four countries: the Netherlands, France, Germany, and the UK.

- The responsibility of businesses and employers to provide EV charging infrastructure has increased

- Fast charging as a key driver for EV adoption

- EV drivers value clear indications of charging fees and user-friendliness on (ultra) fast chargers

The responsibility of businesses and employers to provide EV charging infrastructure has increased

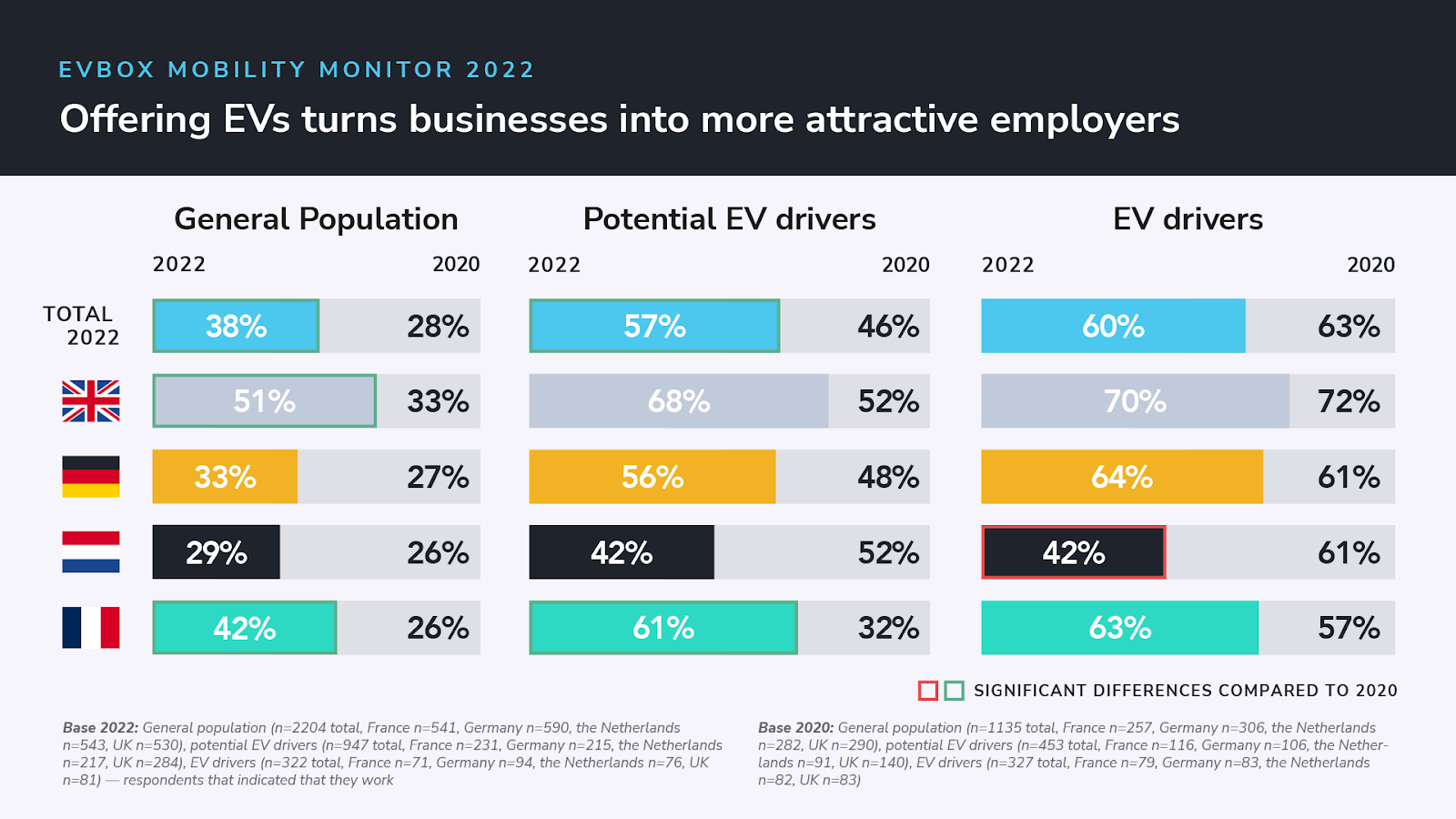

Nearly seven out of ten (68%) potential EV drivers in the UK say that offering electric cars would make a future employer more attractive to them. This percentage has increased from 52% when compared to the figures from the 2020 EVBox Mobility Monitor report. Looking at the general population there’s been a particularly high increase of this perception (33% to 51%).

Exceptionally more Brits expect companies to offer electric cars as part of their business car plans—this expectation has risen largely amongst the general population (from 27% to 62%), potential (from 40% to 75%) and current EV drivers (from 65% to 83%), when compared with 2020 report findings.

Additionally, EV drivers expect their employers to fully cover charging costs at the workplace (74%), as well as their homes (59%). Over half of the general population (52%) believes that businesses should be forward-thinking by offering EVs as business cars and/or electrify their fleets, and that they should be entitled to receive more tax benefits from the government.

Nearly four out of ten EV drivers report missing charging opportunities at their workplace

Although workplace charging is desired by many respondents, 65% of current EV drivers report that there are not enough charging ports available to them at their place of work. Most EV drivers currently charge their car at home (65%), compared to 40% at their workplace.

An incentive to install more charging ports at workplaces should be governmental policy. Over half of the general population (54%) believe that the government should provide more tax benefits to forward-thinking businesses that offer EVs to employees and/or electrify their fleets.

Fast charging as a key driver for EV adoption

Fast charging is seen as a key factor in the adoption of electric cars and demand is increasing – 51% of the general population and 75% of potential EV drivers would switch to electric driving (sooner) if there were more (ultra) fast charging possibilities along the road. However, 43% of EV drivers do not believe that the charging infrastructure in the UK is well-established.

In regards to where fast charging is most used, the results show that motorway services and petrol stations (58%*) and supermarkets (58%*) are the most prominent locations. UK EV drivers also have a preference for more fast chargers at public and commercial car parks.

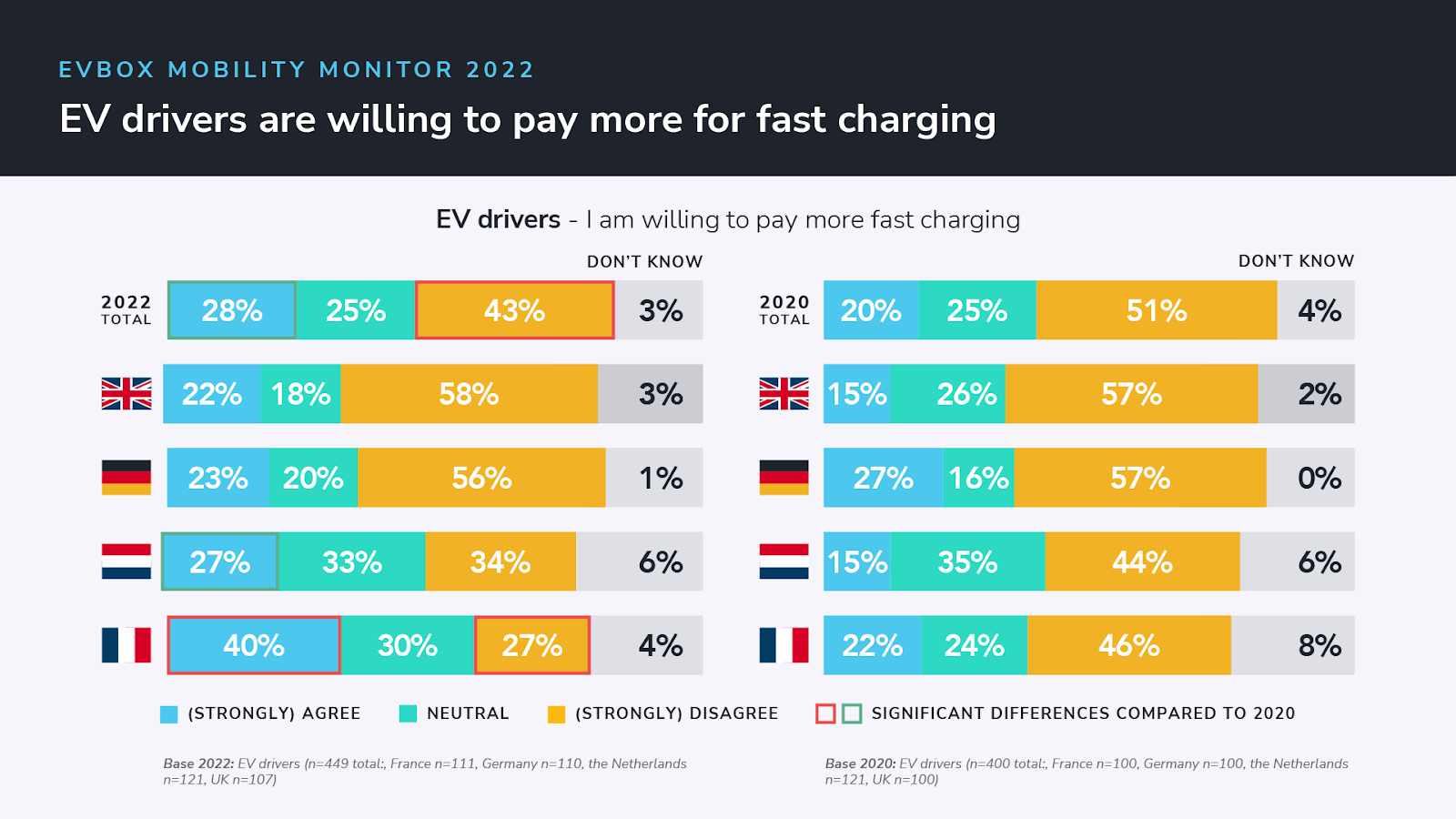

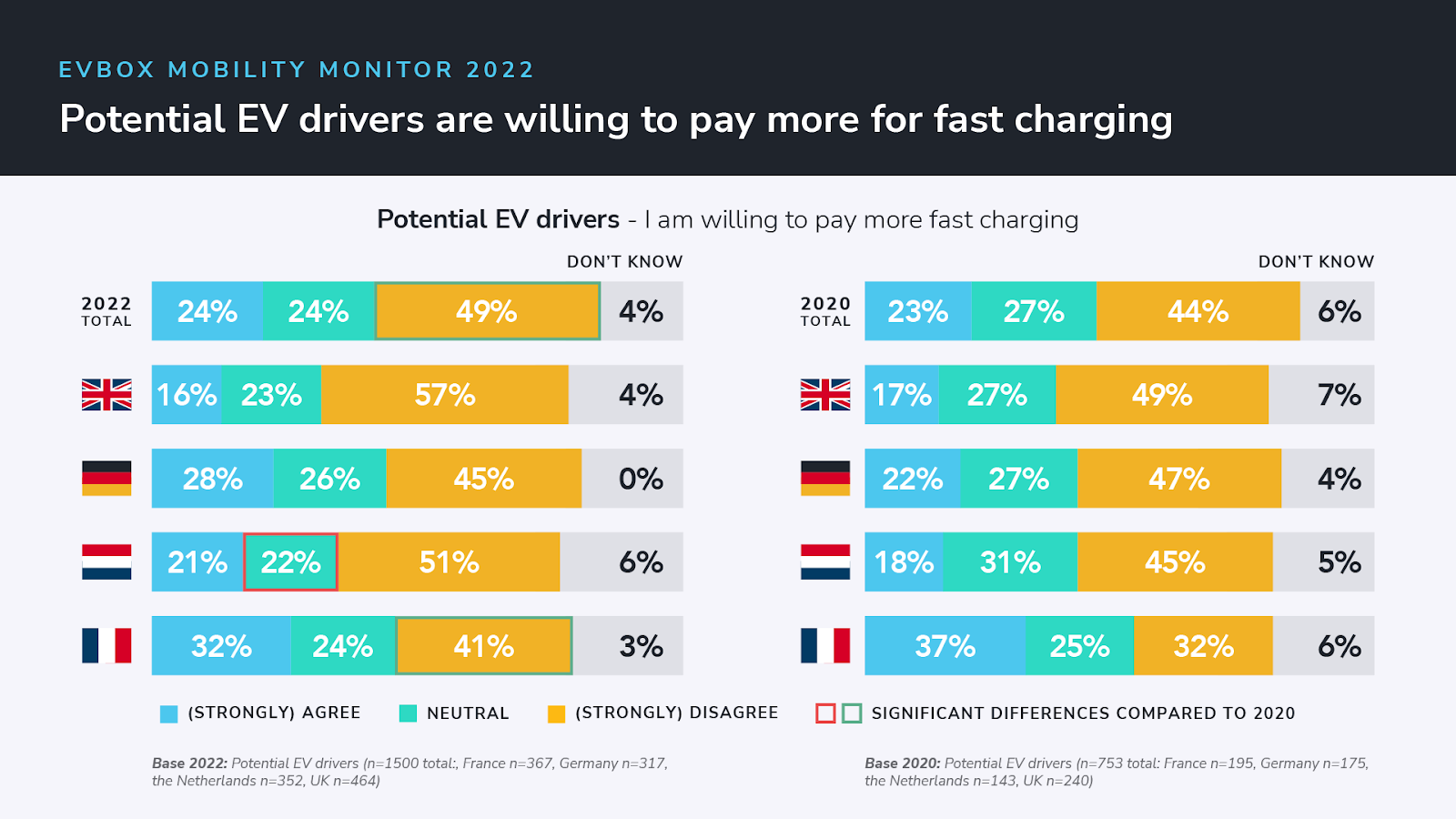

Over half of future EV drivers are willing to pay more for public charging if their car will be charged faster

Over half (57%) of potential EV drivers are even willing to pay more if their car is charged faster. Compared to 2020, more EV drivers are familiar with the differences between normal EV charging and fast charging (from 65% to 75%*), but the use of fast charging has declined significantly in the UK compared to 2020 (31%* never use fast charging). 31% use it 1-3 times a month and 15%* 3-5 times a month.

EV drivers value clear indications of charging fees and user-friendliness on (ultra) fast chargers

Current EV drivers expect (ultra) fast chargers to provide them with all the features necessary to make the charging experience as easy as possible. For example, 48%* rank a clear indication on charging fees as the most important feature, followed by user-friendliness (40%), the possibility to spot an available station from a distance such as guiding LED lights (35%*) and the convenience of EMV payment (31%*).

“We published the EVBox Mobility Monitor 2022 to promote and understand how the transition to sustainable mobility can become more accessible for everyone. Workplaces should now open their eyes to the benefits of offering electric cars to employees and the UK government should see the importance of tax benefits to assist businesses in providing charging options. In addition, Charging Port Operators (CPOs), petrol station owners, and other businesses are now expected to embrace the responsibility of installing more fast charging stations to help speed up the switch to EV driving. At EVBox we are always learning and developing to meet the requirements respondents highlight. This is why we’re constantly working on improving our (fast) charging solutions—making a modular design absolutely necessary—ensuring infrastructure can grow with our customers’ business.” Said Jonathan Goose, Regional Director UK & Ireland at EVBox.

*Limited numbers of observations