Biden's EV revolution: A boon for electric trucks

The electric truck market in the US is primed for huge growth. Having largely lagged behind China and Europe in electric commercial vehicle deployment, the transition to zero-emission vehicles in this sector now seems set to begin in earnest. The IDTechEx report, 'Electric Truck Markets 2021-2041' contains twenty-year regional forecasts for the battery electric and fuel cell truck markets.

Whilst the Biden presidency is only a week old, the step change that has occurred in the US Government's attitude towards confronting climate change and reducing road transport emissions could not have been made any clearer.

Just five days into his presidency, President Biden announced that his Government is planning to replace the federal Government's fleet of combustion engine vehicles with electric vehicles manufactured in the US, creating a million clean-energy automotive jobs, in what he described as the 'largest mobilisation of public investment in procurement, infrastructure and R&D since World War Two'.

According to the US General Services Administration (GSA), the US federal fleet comprises near 650,000 vehicles with around 100,000 medium-duty and 40,000 heavy-duty trucks in the inventory.

Whilst the strategy, funding, and timelines behind the policy are yet to be expounded upon, it is clear that the new Government sees vehicle electrification both as a strategy for reducing greenhouse gas emission (with the co-benefit of improving air quality) and for supporting the US automotive sector.

Biden's announcement, alongside factors such as the California Air Resources Board's Advanced Clean Trucks regulation, which last year mandated that 75% of new Class 4-8 ridged truck and 55% of new tractor truck sales in California must be zero-emission by 2035 and growing evidence of significant demand for commercial EVs from major US corporations, should give great confidence to truck manufacturers and their supply chain that the market for electric trucks will be worth the resources and investment that is necessary to transition away from the combustion engine.

Established OEMs such as Freightliner (Daimler), Volvo, and Paccar are already conducting extensive real-world pilots of heavy-duty electric trucks; however, Biden's support for EV should result in efforts being ramped up to get significant numbers of zero-emission trucks on the road.

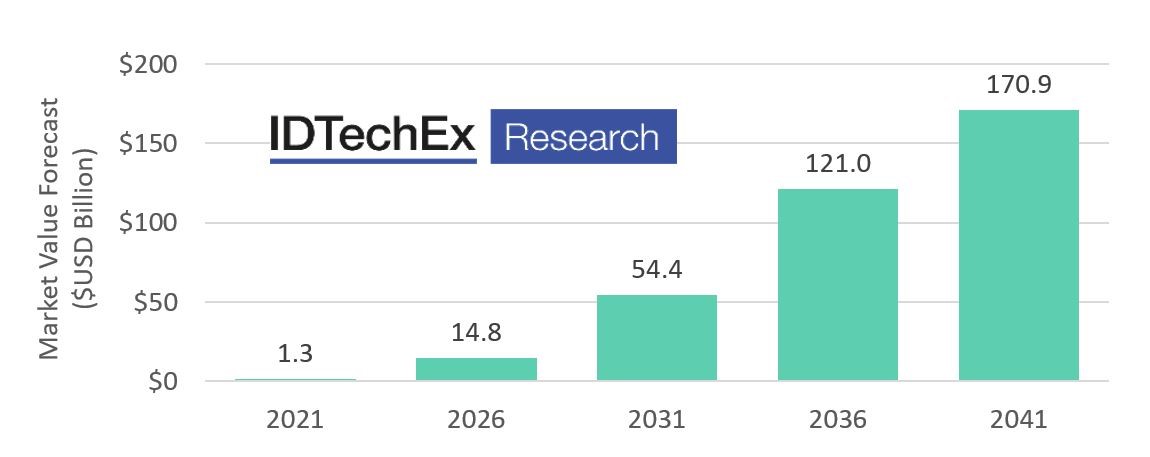

IDTechEx's 'Electric Truck Markets 2021-2041' report provides a COVID-19 adjusted, 20-year outlook for both the medium-duty (MDT) and heavy-duty truck (HDT) markets, with separate forecast lines for battery electric, plug-in hybrid (PHEV), and fuel cell M&HDTs, both at the global scale and for key regions: the US, China, and Europe. Regional forecasts are presented for electric M&HDT unit sales, battery demand (GWh), and market size value ($ billion).

Global Medium and Heavy-Duty Electric Trucks Market Value Forecast (Battery Electric, Plug-in Hybrid Electric and Fuel Cell Electric Trucks)

Source: IDTechEx 'Electric Truck Markets 2021-2041'

Source: IDTechEx 'Electric Truck Markets 2021-2041'

A great deal of attention is given to whether battery electric trucks will be able to offer the range to make long-haul trucking applications viable with an electric powertrain. This question will be addressed to some extent by the first delivery of Tesla Semi trucks, which at least provisionally is still penciled in for 2021 (though production timelines have slipped on multiple occasions).

While the mass of batteries required and the likely need for ultra-fast charging undoubtedly make long haul EV trucking a challenge, there is a significant market for medium and heavy-duty trucks that do not require extensive range.

For example, at the Novi Battery Show, Keshav Sondhi, Director of Fleet Engineering and Sustainability at Pepsi, said that of their Class 8 trucks at their Sacramento facility, 93% operate less than 100 miles a day and are parked for 15+ hours, time which is more than adequate for charging.

The duty cycles of a large percentage of medium and heavy-duty trucks are suitable for electrification with current battery technology. There are plenty of lower daily range applications; low hanging fruit that mean long haul is not a necessity for market growth in the short term.

Swedish heavy-duty truck and bus manufacturer Scania's recent forecasts highlight how quickly the market is progressing around the world. By 2025 they expect 10% of their total vehicle sales will be electric vehicles, rising to 50% of sales by 2030. With this pace of change, manufacturers and parts suppliers not already making strong plans to transition to zero-emission powertrains are likely to find themselves left behind.

IDTechEx's report 'Electric Truck Markets 2021-2041' is intended to help businesses across the automotive value chain plan for the future in this changing market. The report provides detail about industry efforts to commercialise zero-emission trucks; background to electric truck technologies, including fuel cells and electric hybridisation; and discussion of key enabling technologies for electric truck deployment such as batteries, motors, and charging infrastructure.

This report forms part of the broader electric vehicle and energy storage research from IDTechEx, who track the adoption of electric vehicles, battery trends, and demand across more than 100 different mobility sectors.