What's driving in-vehicle infotainment systems?

Across mid-top end trims, in-vehicle infotainment systems are becoming a standard feature. It is still considered as a luxury feature in some markets but as a necessity in others. The infotainment system offers luxury, convenience, and a host of other features that connect the car to the cloud and other connected services. The infotainment system is a combination of components such as control panel, telematics device, and head up displays but the main component of system is the infotainment head unit.

Author: Kumar Rohit, Research Analyst, MarketsAndMarkets

The in-vehicle infotainment system had its origin in 1930s, but the first ever car radio, named 'Motorola', was introduced in 1950. After several advancements in the automotive industry, during 1970−1977 automotive cassette tape player was introduced. Integrated GPS navigation system was introduced by Toyota in 1987, followed by other players in the following years.

In the late 1990s remote diagnostics came into the picture and after 2003 vehicle health report became an inclusive part of connected car services. In the late 1990s smartphone technology also evolved and around 2004−2006 smartphone connectivity for in-vehicle infotainment was introduced. By the end of the decade, alternates for in-vehicle smartphone usage, such as large display screen that includes services like audio, visual, e-mail, vehicle diagnostics, navigation and compatibility of mobile apps came into the picture. This system reduces the risk of driver distraction.

Entertainment and navigation are the most used applications of infotainment systems

Application of in-vehicle infotainment system differs vehicle to vehicle; more premium the car is, more advanced is the infotainment system. Applications of an in-vehicle infotainment system are infotainment, navigation, communication and connectivity, remote services, and telematics services. In developed markets people use infotainment systems even for accessing social media and mails, checking the availability of parking spots across the city, and streaming high definition video and audio.

However, the main application of in-vehicle infotainment systems has been limited to entertainment and navigation in most of the markets. This is primarily due to the limitations in the connectivity infrastructure in developing countries. In these regions, the lack of high-speed internet connection limits the use of infotainment applications.

Going forward, the infotainment system will act as the control center for the vehicle where the display unit and the instrument cluster will integrate into one big display and will be a common feature in the cars of the future. The integration of augmented and virtual reality with in-vehicle infotainment systems will be the next level in driving experience and comfort. A majority of these innovations are in pre-development stages; however, the day is not far when these technologies will start penetrating the automotive infotainment landscape.

The form factor

The infotainment unit has three different form factors, Embedded, Tethered, and Integrated. Embedded systems are those where the intelligence (software and applications) and the connectivity (modem) are built into the infotainment unit. Tethered systems have the intelligence built in but require an external device for connectivity. Integrated systems are simpler and are totally dependent on the user’s smartphone for intelligence and connectivity. Users connect their smartphones with the infotainment unit and their screen is mirrored on to the infotainment unit’s display and all the features and functions of the phone can be accessed through the infotainment unit.

Embedded systems are expensive and are mainly found on mid- to high-end cars. Tethered systems are cheaper than embedded system but expensive than integrated systems. Integrated systems are inexpensive and user friendly. Additionally, the customer need not purchase separate data plans as required for embedded systems, keeping post-purchase expenses at a minimum.

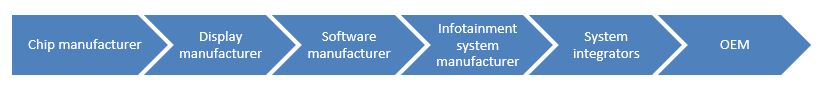

The value chain

The infotainment system is a combination of chip, display, software, and services. Chip and display make the body of the in-vehicle infotainment system. After chip manufacturer and display manufacturer, software and service provider plays the crucial role in the supply side of the infotainment system value chain. The finished product, that is the infotainment head unit, is supplied to the system integrators and then to the OEM. The major push for the in-vehicle infotainment system comes from the OEM, the OEMs brief their requirement (on the basis of customer’s feedback) to the infotainment system manufacturer, followed by chip manufacturer, display manufacturer and software provider.

Many companies are present on multiple stages of the value chain; for instance, Panasonic and LG manufacture both displays and infotainment systems. Denso and Continental manufacture infotainment systems, and they are also system integrators who provide the complete dashboard and center console solutions to OEMs.

Harman is one of the leading manufacturers of in-vehicle infotainment systems

Harman International (recently acquired by consumer electronics giant Samsung) is one of the leading players in the in-vehicle infotainment business. The company supplies to Ferrari in Italy, to BMW in Germany, to Ford in the US, and to Suzuki in Japan. The company has a wide varity of products to choose from and has systems for high-end and entry level vehicles as well. Other major suppliers of infotainment systems are Panasonic, LG, Mitsubishi, Alpine, Continental AG, Robert Bosch, Delphi, and Denso. The business for in-vehicle infotainment is highly competitive and companies are fighting to increase their market share by developing new products and collaborating with OEMs.

Product innovations will drive the development of infotainment systems

The in-vehicle infotainment industry has seen multiple innovations over the past couple of years. Players across the value chain contribute to these developments. For example, Intel recently introduced Intel GO, a new brand for automotive connectivity and cloud. Intel GO's platform will take sensor data from cameras on the vehicle and collate them with high-definition maps and artificial intelligence.

NVIDIA introduced Xavier, the NVIDIA AI super computer for the autonomous cars of the future. The processor will perform 20 trillion operations per second, while consuming only 20W of power. Even Qualcomm introduced a Snapdragon 820A automotive processor, which has continuous connected Wi-Fi and advanced graphics with 4K resolution.

Denso introduced a new display with interactive and virtual reality features. LG introduced a new flexible OLED 12.3” HD display.Google has a tie up with Audi and Volvo, and is developing a version of Android for automobile.

Future opportunities

The current in-vehicle infotainment market is driven by high-end vehicles as OEMs are offering them as standard features in that vehicle segment. However, the penetration of in-vehicle infotainment systems in low- to mid-segment vehicles is also increasing. In many countries infotainment systems are offered as an option in some of the mid-segment cars. North America and Europe are the developed markets for in-vehicle infotainment systems, and Asia-Oceania region is the next avenue for growth.

To attract buyers, many OEMs are now offering integrated infotainment units in entry level cars as well. For example, Renault Kwid, an entry level hatchback in the Indian market offers a 7” infotainment unit in its top-end variant. Going forward it is likely that OEMs will include infotainment units in their mid- and low-end trims as well.

The introduction of 5G in the coming years will be one of the biggest technological advancements that will boost the market for in-vehicle infotainment. Consumers will be able to access high speed data, on-demand entertainment, high definition maps, and a whole lot of services with the introduction of this technology.

The upcoming telematics mandates in Europe will ensure that all cars are equipped with a telematics control unit for emergency calls. This will facilitate the growth of embedded and tethered infotainment systems in the region as the connectivity will now be built in to the vehicle itself. US regulators are also considering a similar regulation to be implemented; however, no timeline has been set for the same.

Smartphone integration is a fast-growing trend in the infotainment industry as consumers can directly link their smartphone with their infotainment units and access all applications, network features, and navigation on the main infotainment display. Integrated infotainment solutions are the future of entry to mid-level vehicle infotainment across the globe, whereas embedded and tethered systems are being installed in high end cars.

Industry experts suggest that an infotainment unit is only as good as the operating system it runs on. Blackberry-owned QNX is currently the market leader for infotainment operating systems followed by Microsoft. Linux is a fast-growing operating system as it is free to use and can be customised to specific needs of the OEMs. Google and Apple have also developed their automotive operating systems but the installation rates are very low as of now.

With the growing need of connected vehicles and entertainment on the go, in-vehicle infotainment systems have a bright future ahead with double digit global growth rate.