Where do companies fit in the $51bn camera module market?

“We have witnessed the Compact Camera Module (CCM) ecosystem’s increasing complexity and its significance with respect to the global microelectronics industry,” says Pierre Cambou, Activity Leader, Yole Développement. “CCMs, mainly developed for mobile phone applications, have become technological marvels. They bring together heterogeneous sub-components from the semiconductor industry, the optical industry in the form of optical lens sets and more recently the micro-motor industry.”

Yole has produced its first deep added-value analysis dedicated to the CCM industry. The Camera Module Industry report (August 2015) provides a market analysis at the module manufacturing, image sensor, lens and autofocus & optical image stabilisation levels. It gives a detailed description of the supply chain, its key players and the dedicated competitive landscape. In this report, Yole’s analysts review the technologies’ evolution and identify future developments.

In its latest report, Yole details a $20bn market in 2014 that will grow to $51bn by 2020 thanks mainly to the mobile phone and automotive sectors. Yole’s experts share their vision of the industry and analyse the CCM supply chain.

Industrial companies, mostly CMOS image sensor manufacturers, want to expand their activities towards the downstream part of the CCM supply chain. In this strategy, such players are developing innovative solutions at the module level. This is the case of CCM leaders Sony, Samsung and Panasonic.

The consumer and mobile phone sectors are following the 'divide and rule' dogma. Smartphone integrators like Apple and Google are served by a very fragmented supply chain, allowing them to select the best suppliers and get the most innovative solutions at the best price. The unstable CCM supply favours Chinese players’ efforts to penetrate the mobile phone market. Samsung, unlike Apple and Google, has its own suppliers and subsidiaries.

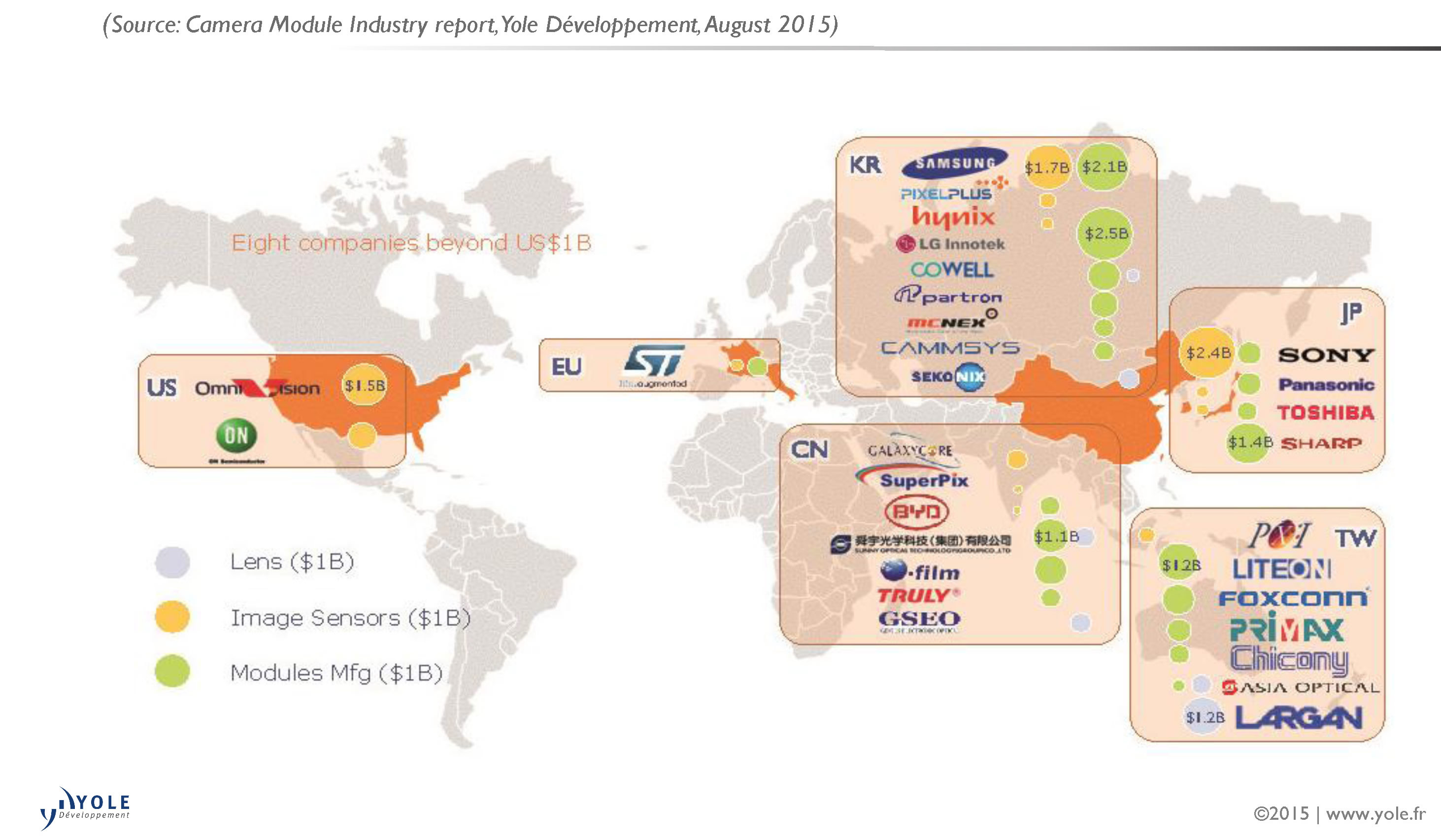

Players of the camera module industry

In the automotive area, Yole’s analysts are seeing a different set of players (including Omnivision, LG Innotek and Sunny) thriving while CCM leaders, such as Sony, Sharp and Largan, are mainly concentrated on mobile phones. Explosive growth will probably reshuffle the automotive camera market several times. Technology is not yet a big driver as it has only just become 'good enough'. CCMs should play an increasing role as ADAS becomes more demanding.

Cambou added: “Because of the supply chain complexity, the wind of change should come from the technology providers. The whole momentum is governed by technology adoption rates. The tempo mainly comes from Apple, particularly in high resolution rear cameras, phase detection pixels, autofocus and optical image stabilisation. Korea is driving laser autofocus and 1.1μm pixels and China high resolution front cameras. Monitoring these technology changes is exactly what Yole is all about. The CCM industry is in the midst of a fascinating innovation drive.”

From a geographical point of view, the CCM industry is controlled by Asian firms, mainly Korean and Japanese. However Yole’s analysts are also witnessing the rise of Chinese firms and restructuring of Taiwanese firms. An ongoing price war has levelled the market and most players have operations in China or Vietnam. There is a clear market split between players mainly delivering sub-5MP resolution cameras for the computing and low-end mobile fronts and players producing above-5MP for high-end rear mobile cameras. Successful strategies exist at both ends of the market, even though the rise in resolution makes the low-resolution option more challenging.

Today, being a part of the main mobile handset makers’ supply chain is a key success factor. While the rich Korean ecosystem has been able to develop itself thanks to Samsung and LG, a threat is growing due to over-dependency on a few main mobile players. Japanese CCM players have successfully negotiated the demise of their own domestic mobile manufacturers, first by serving Apple and then by moving into China and serving the rising stars there. Taiwanese players’ fortunes range widely. Largan, which serves all market players, is Taiwan’s greatest success. However, other Taiwanese players have had limited market access since only a few significant mobile handset manufacturers still use a 100% Taiwanese supply chain.

Yole’s report covers the entire supply chain and provides a complete player ranking analysis with respect to the CCM industry’s different activities.