Uncooled IR imaging industry: the market is taking off

In a dynamic IR imaging market with ever more competitors, technologies and products, uncooled IR imager shipments are expected to grow at 15.8% CAGR from 2016-2021. The uncooled IR imager market is still expanding, driven by new uses and price decreases, mobile applications are just around the corner and new IR technologies increase competition.

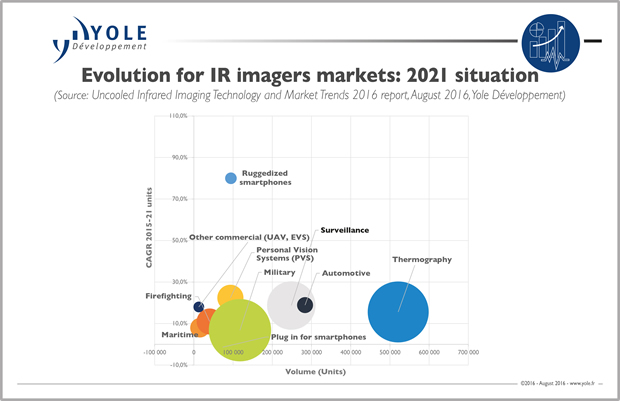

More technologies, more products and more players. The uncooled IR imaging industry is booming. Yole Développement (Yole), the “More than Moore” market research and strategy consulting company announces: the uncooled IR imager shipments are expected to reach 15.8% CAGR between 2016 and 2021, with 1.5 million units in volume in 2021.

“Indeed, in 2021, we believe most uncooled IR applications will move toward more public awareness and added value. And most market value will expand,” analyses Dr Eric Mounier, Senior Technical and Market Analyst at Yole. Today the uncooled IR imaging market is clearly driven by both traditional markets including thermography, surveillance, firefighting and defense and rising opportunities such as PVS, automotive, consumer and medical applications. The consulting company Yole confirms its strong commitment within the IR imaging industry with:

- A new technology and market report, Uncooled IR Imaging Technology & Market Trends

- The organisation of the 1st Executive IR Imaging Forum taking place on 8th September in Shenzhen, China

The IR Imaging Forum, organised in collaboration with CIOE, is an exceptional opportunity to understand the developments of the IR imaging market, meet the leaders of the industry and analyse their strategy. Today, IR imaging companies are making radical strategic choices: developing high-end products, focusing on performances and selecting the best technologies.

After a strong downturn in 2012 and 2013 due to the collapse of the military market, the uncooled IR imaging industry came back into a growth phase in 2014 and 2015. Today, the infrared business is still driven by commercial markets, which will continue to expand quickly, with shipments growing at 16.8% CAGR to account for 92% of the overall market by 2021. The commercial market is divided into three major sub-segments:

- Thermography, which will account for 521,000 units in 2021. In 2015, thermography was still by far the main commercial market in terms of both value and shipments. “Since 2013, Fluke and FLIR have introduced several new products with lower pricing, which has boosted sales,” comments Dr Mounier. The trend towards lower-end thermography cameras has also prompted the introduction of low-resolution technologies such as pyroelectric sensors, thermopiles, and thermodiodes.

- From its side, the automotive market segment will account for 284,000 units by 2021, according to Yole’s analysts. Automotive market shipments grew 15% in 2015, although the growth rate was down from 30% in 2014. Total automotive sales, including OEM and aftermarket, accounted for less than 100,000 units in 2015, generating $61m, which reflects strong price erosion.

- Ultimately, surveillance and security applications will account for 248,000 units in 2021. Surveillance market shipments grew 32% in 2015 due to price erosion and the growing number of suppliers. Until recently, thermal cameras have primarily been used in high-end surveillance for critical and government infrastructure. However, new municipal and commercial applications with lower price points are now appearing, including traffic, parking, power stations and photovoltaic plants.

These results are part of Yole’s uncooled IR imaging technology and market analysis. It presents the latest news and analysis of new market entrants and exits. Yole’s analysts propose an up-to-date survey of 10+ market segments and a scenario focused on IR integration into smartphones as well as 2015 estimates of sensor manufacturers’ market shares and evolution.

The IR Imaging Forum is sponsored by ULIS and welcomes keynote speakers from Autoliv and Heimann Sensors and speakers from ULIS, Umicore, Yole Développement, Device-ALab, INO, Mikrosens, Robert Bosch, Umicore, Shanghai Institute of Technical Physics:

- Dr Andreas Krauss, Product Management Sensor Components from Robert Bosch will highlight the added-value of thermodiode IR technology for mass market applications. According to him, IR detection offers many attractive applications and use cases for mass markets, including non-contact temperature measurements, media sensors and advance presence detection.

- Joerg Schieferdecker, CEO & Co-Founder of Heimann Sensors proposes to discover low cost infrared arrays for high volume applications. Heimann Sensors’ speaker will present the four basic technologies including the bolometer, pyroelectrics, the thermodiode and thermopile and some selected actual and potential near future high volume applications.

- Autoliv’s speaker, Stuart Klapper, Managing Director of Autoliv Global Night Vision offer us the opportunity to discover technologies and market trends related to night vision for every car. Yole’s analysts and CIOE’s team invite you discover speakers’ profiles and abstracts.