TSMC to enter the FanOut business

“The fact that TSMC is interested in advanced packaging isn’t 'new news'," comments Jean-Christophe Eloy, President & CEO, Yole Développement. “Over the last few years TSMC has significantly invested in flip-chip copper pillar capacities (Source: 2015 Flip Chip Business Update report, October 2015) and 3DIC stacking for CMOS image sensors and logic devices.”

What is new is TSMC’s interest in supporting the FanOut packaging platform for volume production, using its own proprietary InFO technology. Yole’s analysts have confirmed that TSMC will begin volume production in 2016 and it’s likely that the Apple A10 will be its first customer - one of what will be a wave of new customers, with Qualcomm, Mediatek and other big companies eyeing this field.

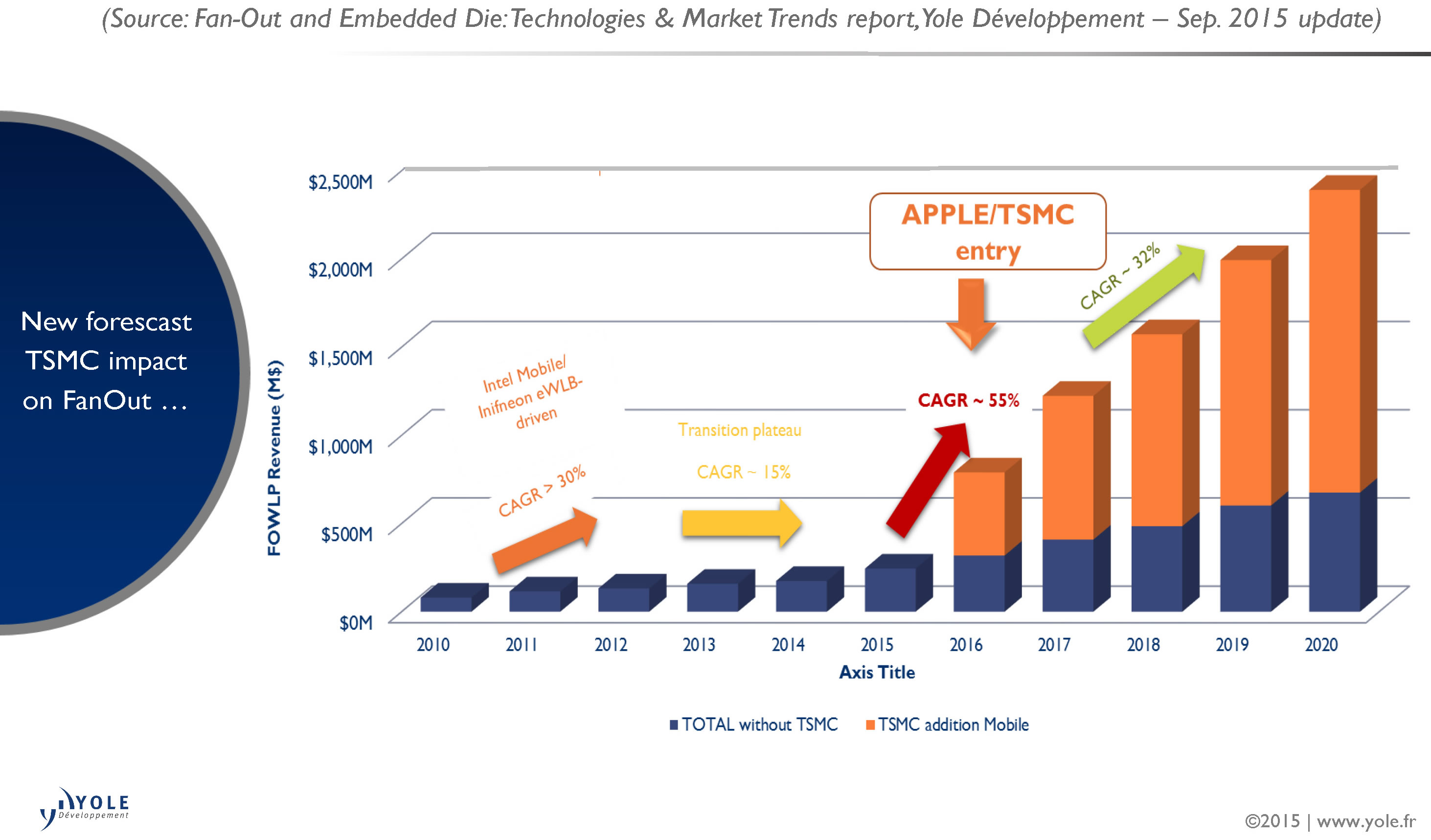

Yole’s estimation is that TSMC’s 2016 business will be at least a few hundred million dollars, giving a significant boost to FanOut sales. Linked to this estimate, Yole’s advanced packaging team has updated its FanOut market forecast (see graph) in order to account for the potential sales increase starting in 2016.

FOWLP activity revenues - $m

“It’s clear that TSMC is making these technological investments in order to have a complete offer for application processor, MCU and GPU manufacturers, from front-end manufacturing to full back-end processing,” explains Jean-Christophe Eloy, Yole Développement. TSMC will gain a significant advantage over Samsung and GLOBALFOUNDRIES if it’s able to capture and retain Apple, Qualcomm and Mediatek’s business in-house.

The sales forecast for FanOut at TSMC will not hugely impact the company but the effect of TSMC’s involvement in FanOut, and its ability to attract big customers, will dramatically impact another part of the industry: OSAT and substrate makers. Substrate makers will be most impacted, and the reason is simple: inFO means no substrate and TSMC providing a complete service to Apple means that OSATs will lose business. High-end packaging and advanced substrate activities are moving away from their existing providers: Shinko, Ibiden, Unimicron, etc. - and advanced substrates will be heavily affected in 2016-2017 when one of their largest profit centres disappears. The impact on OSATs is clear, but TSMC customers will likely continue requesting second and third sources, meaning OSATs will be able to partially limit their sales losses.

This TSMC development is another example of the importance of middle-end foundry services that are assembled step by step in order to use semiconductor front-end processes to provide back-end services. TSMC’s investment, and that of several other foundries (i.e. CWLCSP), along with the recent M&A activities occurring in advanced packaging: for example the acquisition of STATS ChipPAC by JCET or the acquisition of FCI by TianShui Huatian Technology Co. This is a great sign of advanced packaging’s growing importance (and not just cost-related) as an added value to the chip.