Total MPU sales surprise with strong gains in 2020

IC Insights recently released its 2021 edition of The McClean Report. The new analysis and forecast of the IC industry includes an analysis and forecast of the total microprocessor (MPU) market, including computer CPUs for PCs, tablets, and servers, embedded MPUs, and cellphone application MPUs.

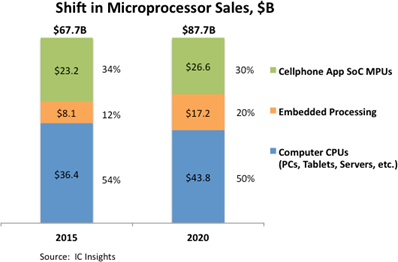

Sales growth in the total microprocessor market climbed 12% in 2020 to reach a record-high $87.7bn (Figure 1). The 2020 MPU sales increase was primarily due to strong demand for portable computers and powerful large-screen smartphones, which were used to access the Internet and cloud computing when the COVID-19 virus was rapidly spreading around the world.

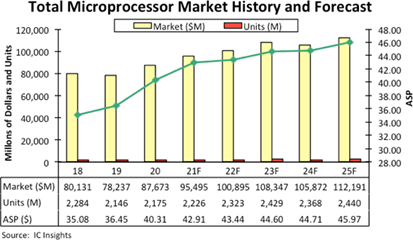

Investments in expansion of data-center computers and systems also gave MPU sales a boost in 2020. In 2021, total MPU market growth is forecast to ease back slightly and register an above-average 9% increase to about $95.5bn.

In the 2020-2025 forecast period, total microprocessor sales are projected to grow by a CAGR of 5.1% with the only annual decrease occurring in 2024 (-2%), which is expected to be a global economic slowdown year. Worldwide microprocessor unit growth is forecast to rise by a CAGR of 2.3% through 2025. It is expected that total MPU unit growth will be held back through the forecast period by flat unit shipment growth of cellphone application processors even as embedded processor shipments are forecast to enjoy annual double-digit percentage increases during this same time.

Starting in 2020, IC Insights realigned its three microprocessor categories to increase visibility into growth and trends in computer CPU processors and the rapid expansion of embedded MPUs. The Computer CPU category combines tablet SoC processors with central microprocessors used in all types of computers. Embedded processors are now a separate market category and cellphone application processors remain a third market category.

Over the past five years, the fastest growing microprocessor market category was embedded processors, with sales climbing 114% between 2015 and 2020. Figure 2 shows sales of computer CPU processors—the largest MPU category in dollar volume—grew 20% in the last five years, while cellphone application processor revenues increased just 15% between 2015 and 2020 because of a slowdown in the maturing smartphone business during the second half of the last decade.