Thermal interface materials to reach $3.7bn by 2015

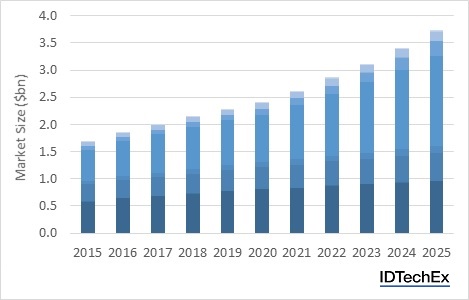

Recent research, conducted by IDTechEx, finds that the Thermal Interface Materials market (TIM), including tapes, adhesives, greases, gels, pastes, elastomeric pads, phase change materials, graphite, solders, compressible materials and liquid metals, will grow from $1.7bn in 2015 to $3.7bn in 2025. Most growth is due to elastomeric pads, phase change materials and solders. Full details of the analysis is available in the IDTechEx Research report Thermal Interface Materials 2015-2025: Status, Opportunities, Market Forecasts.

The LED lighting industry is set to see the biggest growth, with 13.7% CAGR to reach a market of $1.5bn in 2025. This is driven by a world-wide push for greener lighting. LEDs are replacing traditional lighting, for lower energy and higher brightness, especially in the automotive industry. There is an increasing market for thermal management at the high power density chip-level. Pads are most suitable for the fastest-growing medium brightness applications.

Fig 1. Market forecasts for thermal interface materials 2015-2025

Fig 1. Market forecasts for thermal interface materials 2015-2025

Another fast-growing industry is consumer and industrial computing. Until 2004, CPU designers were fitting more transistors into a given area and increasing clock speeds to get better performance, both trends growing exponentially. CPU speed was doubling every 18 months. This continued for decades but has slowed because the heat can’t be efficiently dissipated. The industry is worth $65m and is expected to rise to $142m.

However, new chip designs, such as ARM chips used in mobile phones and tablets have lower power consumption, therefore, the heat is 'designed out'. If these chips were used in consumer and industrial computing, they could drastically reduce the amount of TIM needed. After extensive interviews with suppliers, IDTechEx found that the biggest players offer a wide range options and increasingly offer advice and expertise to create a full thermal solution.

However, manufacturers of polymeric and metallic TIM do not consider each other competitors because they are suitable for different applications and target different markets. Metallic TIMs are only used in applications where the very high intrinsic thermal conductivity is a requirement. The history, technology offerings, business model and addressable markets for 28 key players are described in detail.