The race to build a quantum computer is paved with gold

According to new reports from IDTechEx, quantum computers are poised to boom in the commercial space.

Quantum computing is pitched as enabling exponentially faster drug discovery, battery chemistry development, multi-variable logistics, vehicle autonomy, accurate asset pricing, and much more. In the last decade, the number of companies actively developing quantum computer hardware has quadrupled. Between 2022 and 2024, multiple funding rounds within the quantum computing market surpassed $100 million were closed, and the transition from lab-based toys to commercial product began.

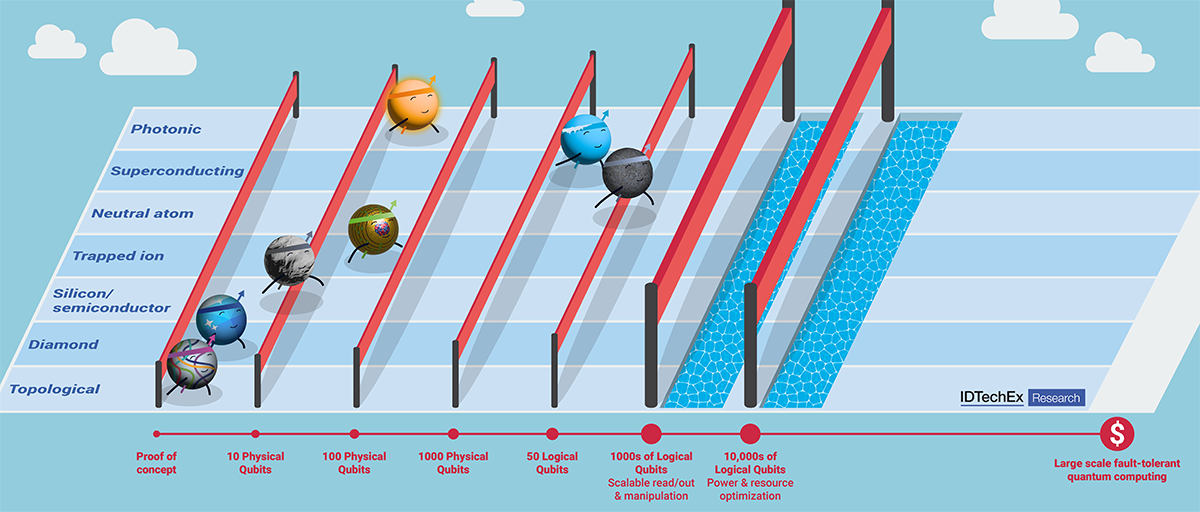

Competition is building in the quantum computing market, not only between different companies but between quantum computing technologies. The focus today has intensified on the need for logical or error-corrected qubits. The challenge ahead is to scale up hardware and increase qubit number while reducing errors as well as infrastructure demand – no mean feat. Leaders today have between 1 and 50 logical qubits, thousands are likely needed to provide a meaningful advantage over classical computing alternatives.

Yet the quantum computing hardware market today has the unique property of seeing rapid growth in revenue generation despite remaining at a low technology readiness level. National laboratories and supercomputing centres are already investing in the installation of early-stage machines on premises, primarily for research but also to allow more local users the ability to ‘pay to play’. This is, in part, a result of the intensifying governmental stake in the technology – and its potential to provide significant economic and national security advantages in conjunction with quantum sensing and quantum communications. As a result, while multiple technical challenges remain, it appears that the race to commercial advantage could well be paved with gold for some. However, towards the end of the decade, as pressure mounts to deliver commercial value and return on investment – some of those leading the charge today may not necessarily prove to be the true winners in the long term.

With so many competing quantum computing technologies across a fragmented landscape, determining which approaches are likely to dominate is essential in identifying opportunities within this exciting industry. IDTechEx’s new report, “Quantum Computing Market 2024-2044: Technology, Trends, Players, Forecasts”, covers the hardware that promises a revolutionary approach to solving the world’s unmet challenges. Drawing on extensive primary and secondary research, including interviews with companies and attendance at multiple conferences, this report provides an in-depth evaluation of the competing quantum computing technologies: superconducting, silicon-spin, photonic, trapped-ion, neutral-atom, topological, diamond-defect and annealing.

These competing quantum computing technologies are compared by key benchmarks, including qubit number, coherence time, and fidelity. The scalability of whole computer systems is appraised – incorporating hardware needs for qubits initialisation, manipulation, and readout. This results in a twenty-year market forecast covering 2024-2044. The total addressable market for quantum computer use is converted to hardware sales over time, accounting for advancing capabilities and the cloud access business model. The entire hardware market is forecast to grow to $800mn by 2034. This growth will be driven by applications in pharmaceutical, chemical, aerospace, and finance, leading to increased installation of quantum computers into data centres, research institutes, and private networks alike. Revenue and volume forecasts are split into eight forecast lines for each methodology covered. Historic data on the number of quantum computer start-ups utilising each methodology and the qubit milestones achieved are also included.