The printed electronics equipment market is profitable but subsidised

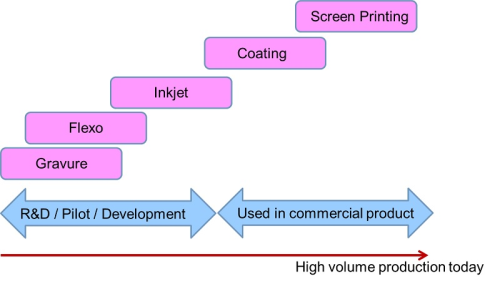

Despite the intense focus on inkjet printing and high volume flexo and gravure printing, screen printing is mainly used in R&D and pilot production rather than manufacturing commercial products. Indeed, the majority of products that use printed functional inks are printed by screen printing. The biggest applications include: bus bars for PV solar cells; glucose test strips; membrane keypads; bezel electrodes for touch screen modules; and antennas.

Coming second is coating, such as slot die coating, which is used in processes such as electrophoretic film manufacture and supercapacitors and batteries.

Current commercial status of printing by volume

Screen printing is moving to finer resolution. This is driven by several applications, such as in PV, where thinner tracks are desired so that less ink can be used, saving cost, or in touch screen bezel electrodes, where consumer electronics companies seek differentiation through thinner edged displays and are therefore pushing towards 30μm track widths from the 40-45μm used today.

While inkjet printing has received a lot of focus, the reality is that it is still not used much in commercial production. In our interviews with the main suppliers, we found that cumulatively around 2,500 inkjet printers for printed electronics had been sold to date. One company reported that a large inkjet printing system was deployed for printing the bus bars of PV and another for thin film encapsulation.

Flexo and gravure printing have been behind the other types covered above, but there has been more interest in these lately. As demand for printed electronics grows these will have greater importance.

Due to the volume of screen printing used, those supplying screens tend to be profitable. IDTechEx also found that many supplying inkjet printers and print heads have a profitable business in terms of printed electronics sales, albeit a small one, with typical revenues of $2-5m. Those supplying integrated systems, including web handling and printing and non-printing processes, report annual sales in this bracket to up to $10m.

However, IDTechEx also found that excluding screen printing, many of the larger projects are being funded by government (particularly EU country) projects. Several countries have identified printed electronics as a key growth technology, and are funding programs which include equipment acquisition and development, to help companies who may not have the ability for the capital equipment expenditure. The market for larger integrated equipment solutions is biggest in Europe followed by Asia.

IDTechEx research also identified many opportunities for equipment suppliers, such as the trend of hybrid electronics, and the need to automate integration of printed and conventional component parts.

'Printing Equipment for Printed Electronics 2014-2025' is the first such assessment of the opportunity for equipment makers. Progress from over 93 companies is given, many with detailed company profiles and product assessment. Markets for each technology type are explored and assessed to give those involved in equipment supply and consumables a thorough analysis of the technologies, markets, challenges and opportunities.