The IP landscape of advanced fan-out packaging

In today's fast-growing fan-out market showing an 80% increase between 2015 and 2017, it is essential to deeply understand the patent strategies of the key players. The Technology Intelligence and IP Strategy Company, KnowMade, has thoroughly investigated the fan-out packaging patent landscape and has released a patent landscape analysis entitled Fan-Out Wafer Level Packaging.

KnowMade report reviews detailed patent analyses including countries of filing, patents’ legal status, and patented technologies, as well as patent owners, their IP position, and IP strategies.

“The knowledge of the IP ecosystem allows companies to anticipate changes, identify harvest business opportunities, mitigate risks, and make strategic decisions in order to strengthen one’s market position and maximise return on one’s IP portfolio”, commented Dr Nicolas Baron, CEO and Founder, KnowMade. What are the fan-out IP trends? Who are the main patent applicants? What is the IP position for each key fan-out companies? KnowMade invites you to discover the status of the fan-out patents ecosystem and its impact on the advanced packaging industry.

With Apple and its A10 processor employing TSMC’s InFO-PoP technology, the fan-out market has exploded. A detailed technology analysis of Apple’s processor has been performed by KnowMade sister company, System Plus Consulting last month to provide a comprehensive understanding of the A10 manufacturing processes including TSMC’s InFO-PoP technology as well as accurate estimations of manufacturing costs and selling prices.

Apple’s involvement will undoubtedly generate increased interest in the fan-out platform, and market revenue is forecast to reach around $2.5bn in 2021, with an impressive growth between 2015 and 2017. Moreover, following the high-volume adoption of InFO and the further development of fan-out wafer level packaging technologies, a wave of new players may enter the market. The supply chain is also expected to evolve, with a considerable amount of investment in Fan-Out packaging capabilities.

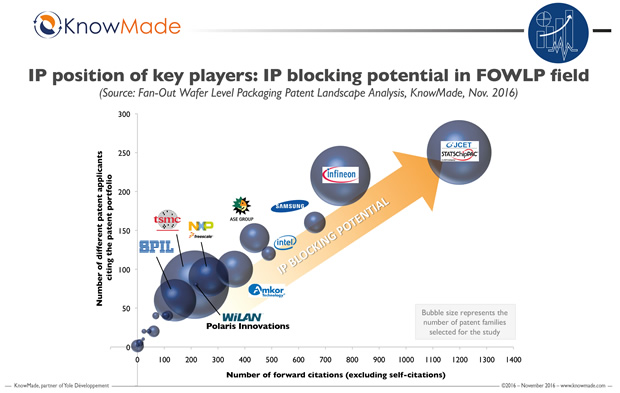

More than 3,100 patents related to over 1,200 inventions on fan-out packaging have been published worldwide through September 2016, coming from 100+ patent applicants, announces KnowMade in its FOWLP patent analysis report. A first wave of patent applications occurred between 1999 and 2006, induced by Infineon Technologies. Patent applications have increased since then, with Freescale, STATS ChipPAC (JCET), SPIL, Amkor, and TSMC entering the Fan-Out IP arena. “Today the number of enforceable patents is increasing worldwide, with several companies already standing out by virtue of their strong IP position”, asserted Dr Nicolas Baron, KnowMade.

All major players involved have filed patents on fan-out packaging, except for Nanium, which does not file any patents at all but instead has adopted a different IP strategy detailed in KnowMade patent analysis. Another special case is the presence of patent licensing companies like Polaris Innovations, wholly-owned subsidiary of WiLAN, which in 2015 acquired key patents from Infineon Technologies/Qimonda. The visibility of such companies in the patent landscape is a tangible sign of the market explodes. In the next few years Polaris Innovations could assert its patents to make money.

KnowMade’s experts have also noted Samsung’s IP presence in the FOWLP patent landscape, despite the company’s unclear market position. R&D labs, including Fraunhofer, A*STAR, and CEA, are also present but to a lesser extent. Most new entrants in the FOWLP patent landscape are the Chinese players, HuaTian Technology, NCAP and SMIC. More recently, KnowMade’s team has observed Apple’s appearance. Apple, which this year chose TSMC’s InFO-PoP technology for its A10 APE, has recently filed some patents on fan-out wafer level packaging, reflecting a genuine interest in the FOWLP platform.

JCET/STATS ChipPAC and TSMC lead the FOWLP patent landscape. From a quantitative point of view, TSMC is the most prolific patent applicant of the last few years, but according to KnowMade’s analyses, JCET/STATS ChipPAC has by far the strongest IP position. “The company has formidable 'IP blocking potential' that empowers it to deter other players to patent inventions that are similar to its own IP portfolio”, detailed Dr Nicolas Baron, KnowMade. “Indeed TSMC is the most serious IP challenger, and it may reshape the patent landscape in the near future upon the approval of its numerous pending patent applications. Both companies feature a large enforceable patent portfolio and a long remaining lifetime of their patents.”

More than 1,200 inventions selected by KnowMade for its FOWLP patent landscape analysis are categorised by technology solution (chip first, chip last), process step (molding, redistribution layers), architecture (Package-on-Package, System-in-Package) and technical challenges (warpage, die shift). In this report, the company also reveals the IP strategy and technical choices of the main patent assignees with an IP profile for 18 key players. This report also includes an useful Excel database containing over 3,100 patents analysed in the study, including technology segmentation.