The future of LEDs is promising

“The LED market is a complex but promising market,” said Pars Mukish, Business Unit Manager, LED, OLED and Sapphire at Yole Développement (Yole). In 2015, companies are not relying on more technical breakthroughs, except at the LED module level, where integration remains an important issue. “However, there is still overcapacity,” adds Mukish. “This is causing many changes in the supply chain, first at the chip level, then at the module/system level. The spin-off Royal Philips announced in July 2014 of its LED business, which grew from its acquisition of Lumileds in 2005, is one example.”

The LED industry’s complexity results from numerous technical issues, its many players and a multitude of lighting applications. The industry’s promise comes thanks to especially large volume lighting opportunities, stresses Yole in its latest reports. The company foresees a global business reaching almost $516m at the system level by 2016

Today, LED technology’s average penetration rate is from 10-20%, depending on geographic area. Each country has its own policy and has set up different measures to help LED implementation. For example, in Japan, penetration has reached 30% thanks to government involvement.

Governmental measures are clearly welcome, as the technology is still considered expensive by the public. “Even though we saw a real breakthrough for LED technology from 2006 to 2014, upfront LED costs are still high compared to existing technologies,” commented Mukish. Today, the real growth is in external lighting applications where LED technology is partially implemented. Commercial and industrial lighting players are also considering LED technology but today implementation is still developing.

In 2015, technical issues are different to previous years. They are mainly located at the LED module level. LED market leaders are therefore developing answers to packaging and integration needs. In the report entitled LED Packaging Technology and Market trends, Yole has detailed the positive impact of advanced packaging technologies on LED manufacturing, especially LED packaging materials.

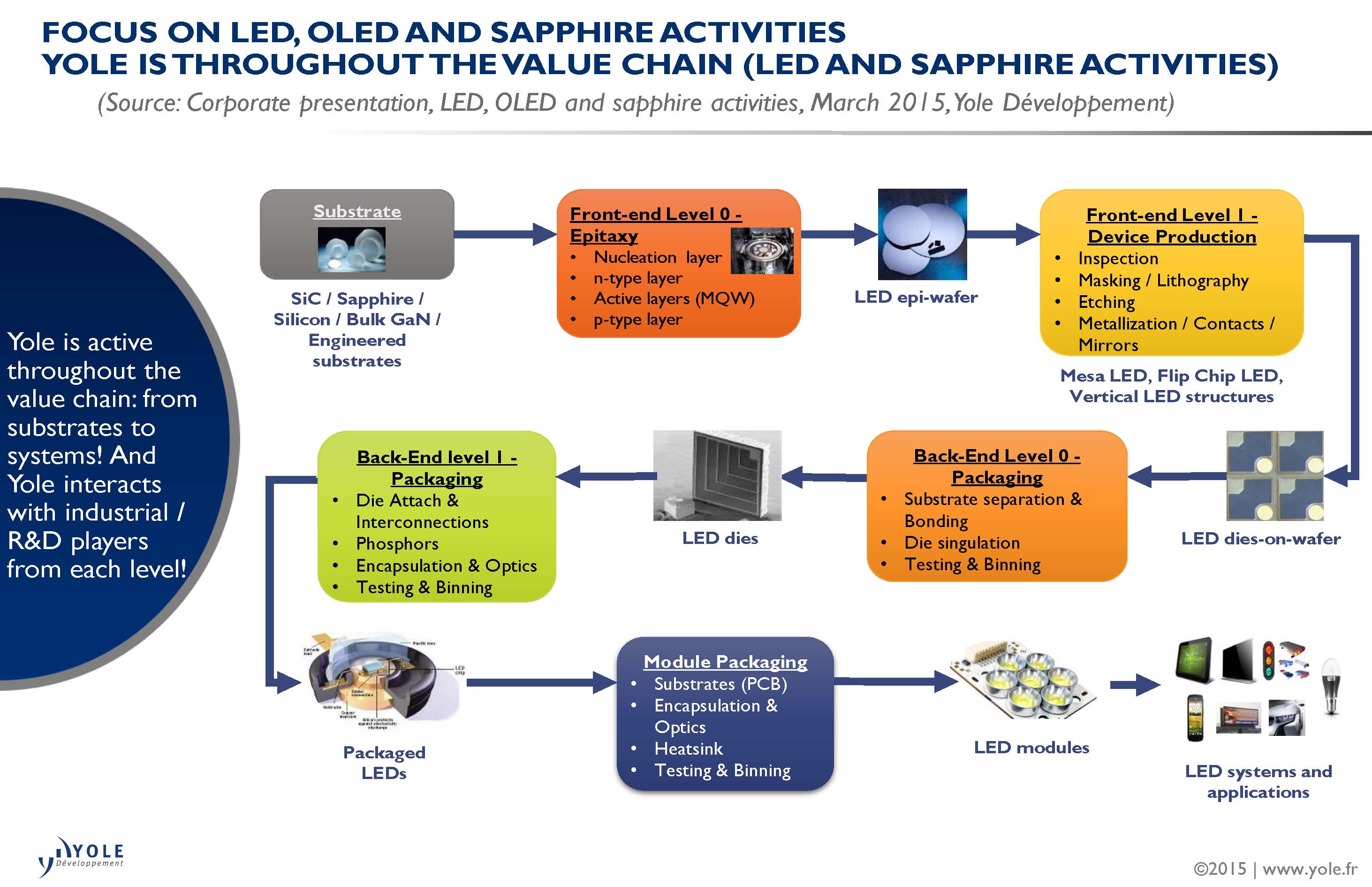

Mukish adds: “In 2015, we clearly see the value moving later in the supply chain. It was initially at the LED chip level, but we have identified strong investments at the module and system level to develop smart solutions in terms of packaging technologies and functionalities.” In this context, Yole is focusing its 2015 activities on analysing new technologies at the LED module level. The company is investigating the impact on the supply chain and determining key players’ strategies (LED module, related technologies and equipment report: available mid-2015).

Mukish is newly appointed to the management of Yole’s business in the LED, OLED and Sapphire areas. He is in charge of developing consulting activities and producing technology and market analysis at Yole. Using his strong expertise in LED and compound semiconductor materials sectors and his past experience at the French Commissariat à l’Energie Atomique research centre, Pars, with his team, Mukish will analyse disruptive technologies and emerging markets. They are providing high added-value studies by combining two approaches: ‘Bottom-up’, from technology to final applications; and ‘Top-down’ taking into account business opportunities from innovative technologies.

Mukish is newly appointed to the management of Yole’s business in the LED, OLED and Sapphire areas. He is in charge of developing consulting activities and producing technology and market analysis at Yole. Using his strong expertise in LED and compound semiconductor materials sectors and his past experience at the French Commissariat à l’Energie Atomique research centre, Pars, with his team, Mukish will analyse disruptive technologies and emerging markets. They are providing high added-value studies by combining two approaches: ‘Bottom-up’, from technology to final applications; and ‘Top-down’ taking into account business opportunities from innovative technologies.

The team also collaborates with both of Yole’s sister companies, System Plus Consulting and KnowMade to complete its understanding and knowledge of the industry. System Plus Consulting performs reverse engineering and costing analysis. Its engineers explore lighting systems and modules to identify and analyse technologies developed by LED makers. In this process, they collect accurate and powerful information about LED manufacturing, packaging and integration and evaluate the related costs. In parallel, KnowMade is focused on IP analysis. This start-up identifies key players, their positioning all along the supply chain and potential interactions between them, through their patent portfolio analysis. KnowMade’s analysts also determine the knowledge of each player and provide a patent landscape related to a technology. In 2012, Yole and KnowMade collaborated to investigate the LED phosphor industry. An update of this analysis plus a new patent analysis dedicated to GaN devices will be available mid- 2015. Detailed information is coming soon on i-micronews.

All through 2015, Yole will pursue the development of its expertise in the LED area. The consulting company will explore new hot topics such as OLED, UV LED, sapphire or high purity alumina. With that knowledge, Mukish and his team will work to understand technological evolution, related breakthroughs and identify emerging markets. “We encourage you to interact with our team during key trade shows and conference and visit our website, i-micronews, to discover our analysis as well as the latest news from the LED & Compound Semiconductor. industry”, concludes Mukish.