The choice between STTMRAM/MRAM & RRAM will be made by 2017

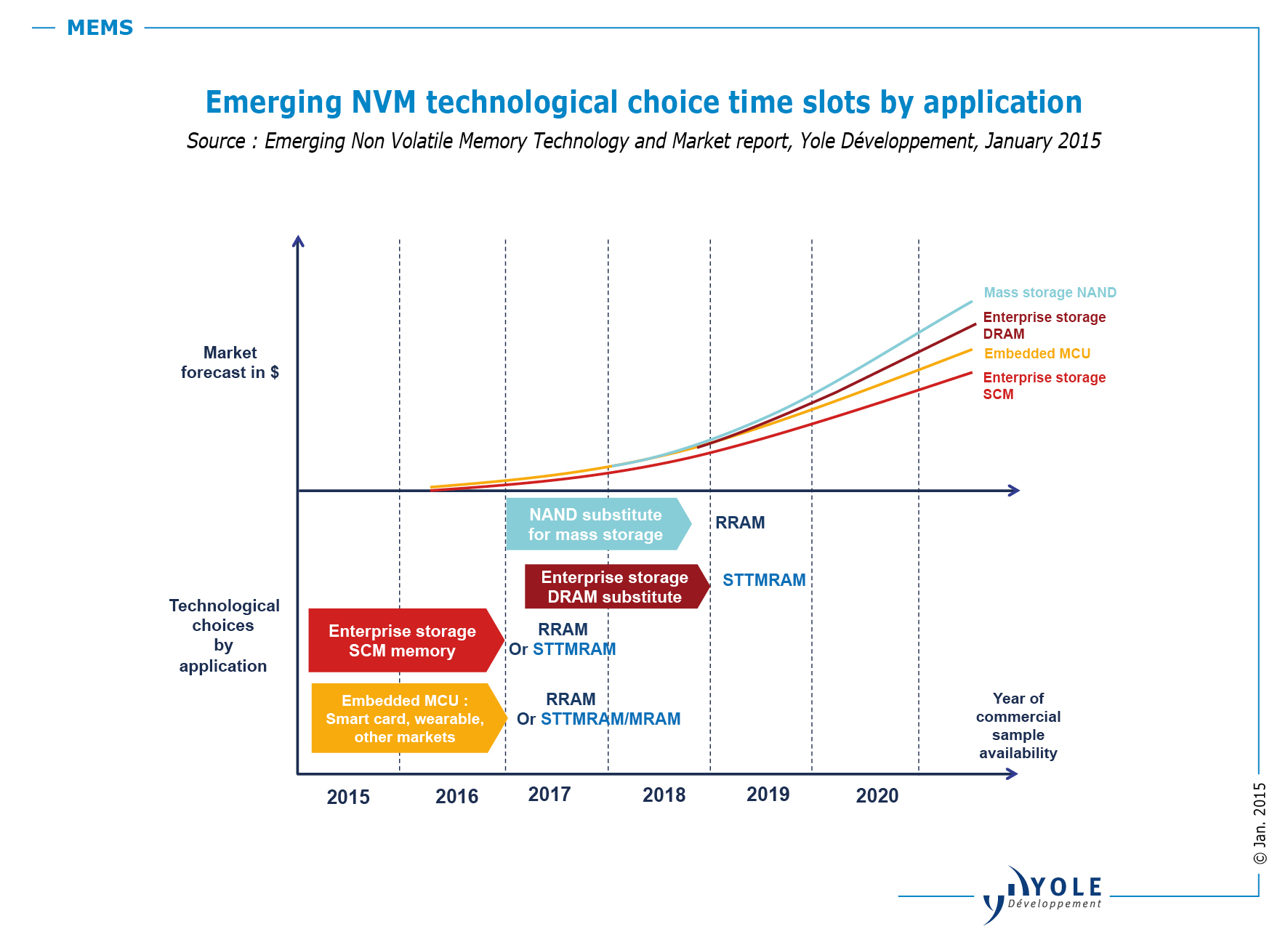

According to Yole Développement, the technological choice between STTMRAM/MRAM and RRAM will be made in the next two years. In its report, titled 'Emerging Non Volatile Memory (NVM) Technology & Market Trends', the company describes why and how emerging NVM technologies will be increasingly used in industrial and transportation, enterprise storage, wearables, mobiles devices, mass storage and MCU smart cards.

Yole presents an overview of the semiconductor memory market including NAND, DRAM, embedded MCU and mobile CPU. The company details the related applications and market forecasts. Indeed, over the last two years, the complex emerging NVM situation has been greatly simplified.

In 2014, Micron, the main Phase-Change Memory (PCM) promoter for stand-alone memory, stopped actively selling PCM chips following the collapse of sales targeting the shrinking entry-level mobile phone market. At the same time, Micron developed a Resistive RAM (RRAM or ReRAM) chip with Sony, part of a technology class that includes Conductive Bridge RAM (CBRAM).

At 16Gb the Micron-Sony RRAM has the highest density commercialised among emerging NVM technologies. Thus, Yole believes that PCM is now out of the race for stand-alone memory. For embedded MCU applications, 2015 will be a key year as STMicroelectronics, the main PCM promoter in this market, will choose if PCM will remain in its roadmap.

The NVM report is thus focused on the two most promising technologies: RRAM and Magnetoresistive RAM (MRAM). The most attractive category of MRAM is Spin-Transfer Torque Magnetoresistive RAM (STTMRAM) that provides higher scalability/density. A main selection criterion for memory is the scalability/density of the chips, as this impacts both performance and cost. The company’s report provides a precise memory roadmap in terms of technological nodes, chip density and pricing.

STTMRAM/MRAM and RRAM have different features and positioning. Nevertheless, they will compete in 2015 and 2016 in some standalone markets, with storage class memory for enterprise storage being the biggest one. They will also compete in embedded MCU markets in the wearable, smart card and other markets. Micron has already selected RRAM for 2015 and other key stand-alone players like Samsung and SK Hynix should react quickly. In the embedded memory space, only Panasonic has selected RRAM and many key players have not yet made their choice. There is still high uncertainty over what will be the best technology to adopt. The next two years will therefore be critical for the future. There are multiple selection criteria, including scalability, retention, speed, endurance and cost. Making the right choice is not an easy task. And Yole, in its report, provides insights about the main market drivers for each type of memory in each application. In the long term, STTMRAM is sure to be the only candidate to substitute DRAM thanks to its high endurance. RRAM is sure to substitute NAND thanks to its high scalability/low cost.

STTMRAM/MRAM and RRAM have different features and positioning. Nevertheless, they will compete in 2015 and 2016 in some standalone markets, with storage class memory for enterprise storage being the biggest one. They will also compete in embedded MCU markets in the wearable, smart card and other markets. Micron has already selected RRAM for 2015 and other key stand-alone players like Samsung and SK Hynix should react quickly. In the embedded memory space, only Panasonic has selected RRAM and many key players have not yet made their choice. There is still high uncertainty over what will be the best technology to adopt. The next two years will therefore be critical for the future. There are multiple selection criteria, including scalability, retention, speed, endurance and cost. Making the right choice is not an easy task. And Yole, in its report, provides insights about the main market drivers for each type of memory in each application. In the long term, STTMRAM is sure to be the only candidate to substitute DRAM thanks to its high endurance. RRAM is sure to substitute NAND thanks to its high scalability/low cost.

The company’s analysis provides a market forecast for each technology by application, in units, in Gbit, revenues and also number of wafers. Yole also presents a precise review of all the latest technical developments by the main players to understand the status of the technology and the main technical challenges.