TCF report explores complex yet booming market landscape

Already a large and well-established business, transparent conductive sheets (on glass or other substrates) are used in a variety of applications. The non-display sector alone (including touch) is set to generate $1.4 billion in 2014 at the sheet level. This is a fast growing sector with a 6% CAGR between 2014 and 2024.

Needs and solutions are changing meaning this market is in a transformation phase. A report from IDTechEx, Transparent Conductive Films (TCF) 2014-2024: Forecasts, Markets, Technologies, analyses the key trends shaping the industry, assesses all the key existing and emerging solutions, and provides detailed interview-based business intelligence and forecasts.

Changing needs

Ultra-low sheet resistance values and mechanical flexibility are looking to be the key trends changing the needs of the market. Applications such as current-driven OLED lighting and photovoltaics are applications demanding sheet resistance values substantially below the 150-250Ω/sqm required by existing capacitive touch technologies; while touch applications themselves are also growing in size.

Fig 1. Touch screen applications are growing in size.

Mechanical flexibility is also a growing trend. In the short term, robustness will be phased in, followed by devices with a fixed curvature before bendable versions are launched.

Fig 2. Robust, curved and/or flexible devices are emerging.

Solutions and suppliers are many and buyers few, resulting in intense cost pressures. At the same time, a number of key end applications are fast becoming commoditised thus cost is becoming a key differentiator. This in turn translates into a cost pressures onto the entire value chain.

Multiple solutions

Indium tin oxide (ITO) controls almost the entire market. ITO-on-glass gives the best results, but is rigid and requires a high annealing temperature. ITO-on-glass has fast been losing market share in the touch screen sector to ITO-on-PET, which has a higher sheet resistance but offers lower cost, increased robustness and limited flexibility. This shift, coupled with the increase in demand from the touch sector (particularly large-sized ones), has convinced key suppliers to heavily invest in increasing ITO-on-PET production capacity worldwide.

ITO-on-PET itself is also facing pressures. The uncertainty associated with the cost of raw indium is forcing many users to consider alternatives. The limited sheet resistance (150-350Ω/sqm) will also not readily meet the needs of emerging applications. ITO-on-PET offers limited flexibility, but it does not survive when bent too much and/or too many times. These market forces are opening up the space for ITO alternatives.

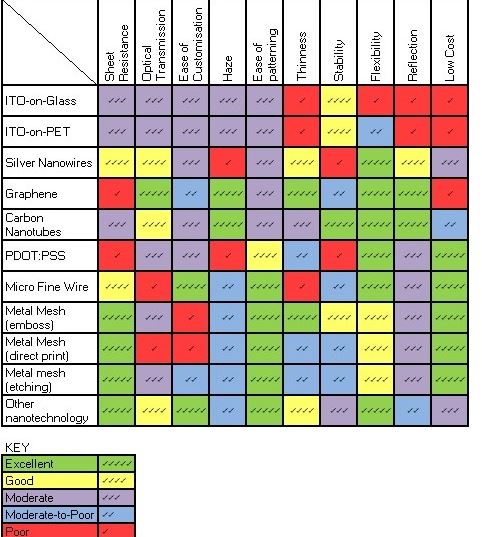

Many ITO alternatives are also emerging on the market. Key emerging solutions include silver nanowires, carbon nanotubes, PEDOT, graphene and a variety of metal mesh technologies. No single technology is a one-size-fits-all solution satisfying all the emerging needs.

Over-priced and under-performing, graphene has been a late entrant onto the scene but is witnessing large R&D investment and rapid innovation. Silver nanowire is a commercially well-funded solution and has already demonstrated initial product acceptance from a variety of end users. Carbon nanotubes offer a mediocre sheet resistance but promise to minimise stack layers. PEDOT has come a long way in terms of sheet resistance but is today only on a par with existing ITO-on-PET solutions. Metal mesh offers low sheet resistance, low cost and the potential to skip the patterning step. There are multiple ways of manufacturing metal mesh TCFs and supplier numbers are fast multiplying. In many instances, however, yield is still a sticky question mark. The table below benchmarks various technologies on the basis of several important parameters, demonstrates that there exists trade-offs.

Fig 3. Benchmarking different TCF and TCG technologies on the basis of sheet resistance, optical transmission, ease of customisation, haze, ease of patterning, thinness, stability, flexibility, reflection and low cost. The technology compared include ITO-on-Glass, ITO-on-PET, silver nanowires, graphene, carbon nanotubes, PEDOT, metal mesh, and other nano-based solutions.

Full analysis and assessment

The report provides a detailed and complete assessment of incumbent and emerging technology solutions. For each technology, IDTechEx has assessed production method, key cost drives, key figures-of-merit including sheet resistance, optical transmission, haze, flexibility, surface smoothness, stability, etc. SWOT analysis is provided for each technology, whilst all global suppliers have been indentified and their commercialisation progress outlined.

A detailed, granular and accurate market forecast model has been used to provide the following key market data charts.

Ten year forecasts in unit sales or market value, for TCF and TCG by area and value for the following applications:

• Mobile and smart phones

• Notebooks and touch notebooks

• Montiors and touch monitors

• Tablets

• OLED lighting-

• Organic phototovotaics

• Dye-sensitised solar cells

• Electroluminescent displays

Ten year market forecasts in area, market share, and value for the following technologies:

• ITO-on-Glass

• ITO-on-PET

• Silver nanowires

• Carbon nanotubes

• Graphene

• PEDOT

• Metal mesh