Solid growth continues in the electronic components markets

Sales revenues across electronic component markets in the UK, Europe and most international countries are continuing to demonstrate solid growth. Economists are putting the current situation down to 'all boats rising with the tide' brought about by the exponential pervasiveness of tech-based goods in our daily lives. In this article Adam Fletcher, Chairman of the ecsn provides an insight into the sector’s latest economic data and advises organisations to plan for even faster levels of growth in 2019/20.

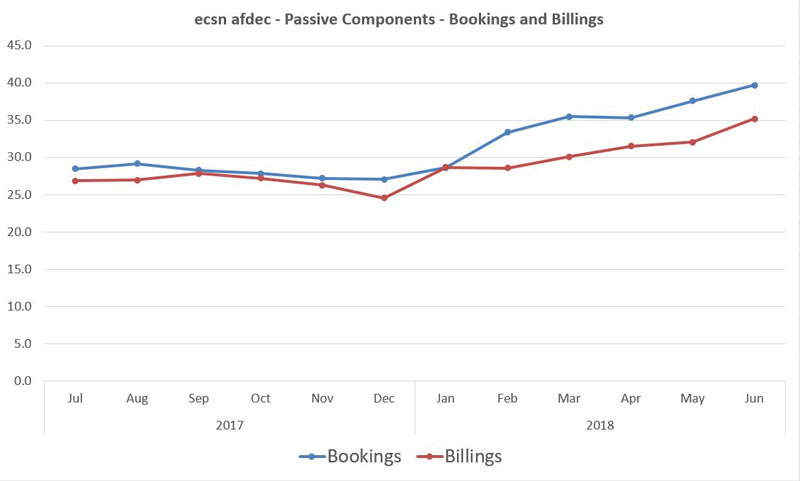

The graphic below 'ecsn-afdec – Passive Components Bookings and Billings' demonstrates the increasing trend in Billings (red line) but Bookings (blue line) are increasing even faster.

The sales backlog (the difference between the two) is also increasing rapidly. This current disparity between supply and demand is likely to peak in 2019 and is then expected to begin to normalise towards equilibrium in 2020.

The current quarter ‘Book to Bill’ ratio (a measure of net new orders entered divided by sales invoiced less credits) suggests that semiconductors are ‘on-track’ at 1.08:1, electro-mechanical products - connectors in particular - are somewhat ‘under-committed’ at 1.03:1, while passive components markets are ‘overshooting’ at 1.14:1.

In passives markets price increases together with increased new order cover placed by customers in a bid to keep up with extending lead-times is increasing the B2B ratio at twice the forecast market growth rate, which is too fast. There may also be an element of ‘double ordering’ as buyers attempt to ensure supply.

The supply problems and extended lead-times affecting larger case size multi-layer ceramic capacitors (MLCC) and chip resistors are a major contributor to the passives ‘overshoot’. Customers for legacy MLCC and chip resistors in US and Europe can expect a particularly bumpy ride over the next 18 months.

UK sales revenue growth continues...

UK customers have responded well overall to the message that lead-times are extending and our domestic market for electronic components is continuing to experience sustained ‘quarter-on-same-quarter-the-previous-year’ growth.

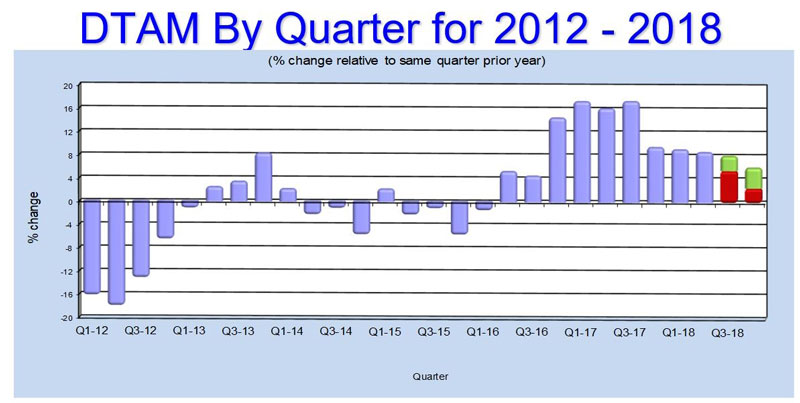

In fact, the last nine quarters has been the longest period of sustained growth in the UK since 2000. See the graphic below “ecsn / afdec – DTAM by Quarter for 2012 to 2018”.

ecsn members forecast that the UK & Ireland market for electronic components would grow in the range 8%-to-12% in Q2’18 compared to the same period in the previous year. In the event the outcome for Q2 was 8.6% growth, just within ecsn’s forecast range.

However, the 8.9% growth achieved in 1H’18 fell just outside the association’s forecast range of 9%-to-14%, suggesting that although the UK electronic components market is continuing to grow, it is not growing as strongly as ecsn members anticipated. That said, ecsn are continuing to follow the historic trend in the UK for electronic components markets to grow faster is the first half of the year than they do in the second half.

The green and orange bars in the graph indicate ecsn’s forecast range for the next two quarters. Member companies are forecasting growth in the range 5.5%-to-7% in Q3, which should be achieved.

Impact of US import duties

The punitive 25% increase in import duty imposed by the US on many Chinese manufactured electronic components came into force on 23rd August 2018.

As expected, it has resulted in a tidal wave of forward purchasing by all members of the electronic components supply network to avoid the inevitable knock-on increases in purchase prices.

Statistical data for Q3’18 will of course, reflect this skew and will likely show a temporary peak followed by a decline before demand for electronic components in the US re-stabilises into Q1‘19.

Continuing global growth

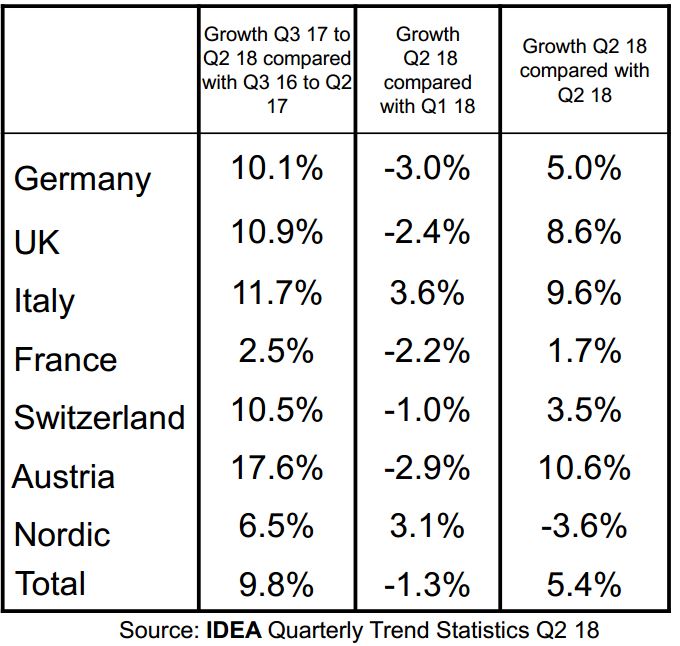

The European electronic components distributor total available market (DTAM) continued to grow in Q2 2018. Members of the International Distributors of Electronics Association (IDEA) reported Billings growth of 5.4% when compared to the same calendar quarter 2017.

The Austrian, Italian and UK electronic components markets saw growth above the European average but the overall market declined by (1.3%) when compared to Q1’18, which again, is in-line with historic trends. These figures are the latest in a period of continuous growth spanning 20 calendar quarters and an ongoing period of double digit growth going back to Q4 2015.

IDEA members continue to upbeat about the market. They believe that the European electronic components market will continue to grow throughout 2018 and into 2019, albeit at a somewhat slower rate. See the table below IDEA Quarterly Trend Statistics for full details.

The largest global electronic components market driver remains mobile phones, but current sales appear static and there are no indications of a significant upswing until 5G phones become available. Industrial, Automotive, Medical, High-Rel and Aerospace markets all continue to experience solid but not remarkable growth.

Full statistical data for the Global electronic components market in Q2’18 is not yet available but preliminary information suggests that sales (excluding commodity memory) continues to be strong with estimated growth in the US of 8%, 4% in Japan, 12% in China and 4% in Asia-Pac.

Faster growth forecast for 2019/20

A major driver of electronic components industry growth in 2019/20 and beyond will undoubtedly be related to the deployment and availability of fifth generation (5G) networks. The forecast super-cycle in customer demand for new 5G mobile phones in 2019/20 is going to put additional strain on capacity within the electronic components supply network as components manufacturers and their authorised distributors struggle to keep up with demand in Asia.

More broadly, the global electronic components industry is set to benefit from the plethora of next-generation applications that are already being spawned by 5G, including autonomous vehicles, smart factories, sensors in smart cities and systems for the backhauling of aggregated data.

In Europe and the US the design, manufacture and deployment of the 5G infrastructure together with increased demand from smart-car applications is going to drive growth much faster than historic rates.

Fletcher's best advice is for all parties is to continue, and where possible enhance, their engagement in positive discussions both up and down their electronic components supply network and work together to identify solutions that amicably meet their mutual objectives in an increasingly turbulent market.

Adam Fletcher is Chairman of the Electronic Components Supply Network (ecsn) a business association established in 1970 supporting all organisations with an interest in electronic components throughout their entire lifecycle and the International Distribution of Electronics Association (IDEA) an association of electronic components associations whose objective is to share best industry practice.