Server market revenues to grow 3% in 2014, says IC Insights

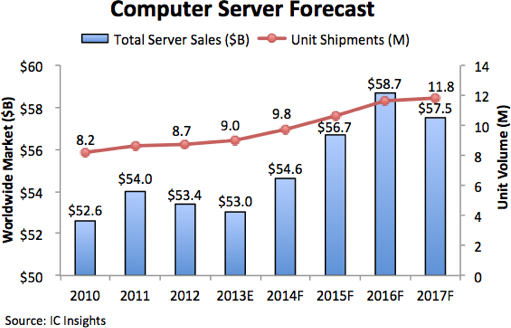

IC Insights has recently released the 2014 edition of 'IC Market Drivers - A Study of Emerging and Major End-Use Applications Fueling Demand for Integrated Circuits'. According to the report, price erosion and the weak global economy have lowered server sales volumes in the past two years, but this computer market is expected to see a modest rebound in 2014 with worldwide revenues rising about 3% to $54.6bn (USD), followed by stronger growth in 2015 and 2016.

Servers accounted for an estimated 13% of total computer systems revenues in 2013, forecasted to reach record-high sales in the next three years before the next economic slowdown pulls the market down again in 2017 (Figure 1). Server sales are forecast to rise by a compound annual growth rate of just 1.5% between 2012 and 2017. The report also indicates that server unit shipment growth will be stronger in the next several years, driven predominantly by purchases of new less-expensive microservers.

Figure 1

High-density microservers contain many CPUs on microprocessors. they also emphasise power efficiency for massive amounts of lightweight-computing tasks, such as delivering thousands of web pages to users of smartphones and other mobile systems. Additionally, new microserver systems are being aimed at a wider range of data centre applications and new cloud-computing services. This computer segment has become a major battleground between Intel and several other processor suppliers developing new 64-bit MPUs with ARM CPU cores for server systems. This microserver market is forecast to achieve sales growth of 139% in 2014 to $580m (USD) from an estimated $243m (USD) in 2013. IC Insights have forecast microserver sales to rise by a CAGR of nearly 72%.

The total server IC market is projected to increase 3% in 2014 to $14.4bn (USD) after back-to-back annual sales declines of 2% in 2013 and 2012. Overall, the report expects the server IC market to rise by a CAGR of just 1.0% in the 2012-2017 period to $15.0bn (USD) in the final year of the forecast, but stronger revenue growth will occur in multi-core MPUs for microservers and NAND flash memories for solid-state drives, which can significantly boost the performance of servers by enabling more input/output operations per second than standard hard-disk drives.