Semiconductor growth at 11% despite 2022 headwinds

Quarterly update shows higher gains in microprocessors and power discretes this year, but lower sales increases in optoelectronics while the global economy faces greater risks.

Despite rampant inflation, soaring energy costs, ongoing glitches in supply chains, recent COVID-19 virus lockdowns in China, and Russia’s war with Ukraine, IC Insights continues to anticipate an 11% increase in total semiconductor sales this year — the same growth rate that was forecast in January. However, what's different in IC Insights’ new updated forecast is how the semiconductor market achieves the low double-digit percentage growth and reaches record-high sales of $680.7bn in 2022.

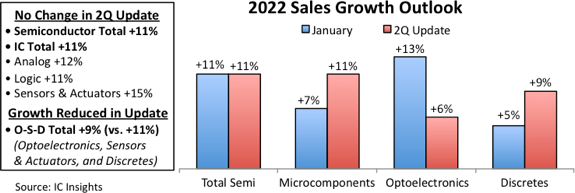

IC Insights’ 2Q22 Update of its McClean Report raises and lowers sales growth forecasts in a number of major semiconductor product categories this year. These changes offset each other and keep the overall increase of the semiconductor market at 11% in 2022, despite stiffening economic headwinds that are challenging global growth this year, says the new 110-page update report.

The 2Q22 Update raises the sales forecast for microcomponent ICs to 11% in 2022 from seven percent early this year. This increase is being driven by stronger microprocessor sales in the embedded MPU category (now up 12% versus nine percent, previously) and in cellular application processors (rising 22%, which is significantly higher than 10% in the January forecast).

The overall projection of total IC sales growth in 2022 is unchanged and expected to rise 11% this year to a record-high $567.1bn. The 2Q22 Update keeps the 2022 growth forecast unchanged in analog ICs (up 12%) and logic integrated circuits (up 11%). IC Insights’ 2Q22 Update lowers this year’s forecast for total sales volume in the non-IC semiconductor market categories — optoelectronics, sensors and actuators, and discrete semiconductors (O-S-D), which account for about 17% of total semiconductor revenue worldwide.

Total O-S-D sales are now expected to rise nine percent to $113.6bn versus the previous projection of 11% growth in 2022. The new forecast cuts optoelectronics sales growth this year to just six percent because of weak gains in CMOS image sensors and lamp devices (mostly light-emitting diodes—LEDs). However, the weakness in optoelectronics is partly being offset by stronger increases in discrete semiconductors, primarily because of higher increases in sales of power transistors (now expected to be up 11% in 2022) and diodes (projected to grow 10%) due to tight supplies worldwide and rising average selling prices (ASPs). IC Insights’ strong 15% growth forecast for sensor/actuator semiconductors remains unchanged in the 2Q22 Update.

Report details

The 2022 McClean ReportThe McClean Report — A Complete Analysis and Forecast of the Semiconductor Industry, is now available. A subscription to The McClean Report service includes the January Semiconductor Industry Flash Report, which provides clients with IC Insights’ initial overview and forecast of the semiconductor industry for this year through 2026.

In addition, the second of four Quarterly Updates to the report was released in May, with additional Quarterly Updates to be released in August and November of this year. An individual user license to the 2022 edition of The McClean Report is available for $5,390 and a multi-user worldwide corporate license is available for $8,590.

The Internet access password and the information accessible to download will be available through November 2022.