Samsung extends its no 1 ranking and sales lead over Intel to 22%

IC Insights released its August Update to the 2018 McClean Report earlier this month. This update included a discussion of the top 25 semiconductor suppliers in 1H18 (the top-15 1H18 semiconductor suppliers are covered in this research bulletin) and Part 1 of an extensive analysis of the IC foundry market and its suppliers.

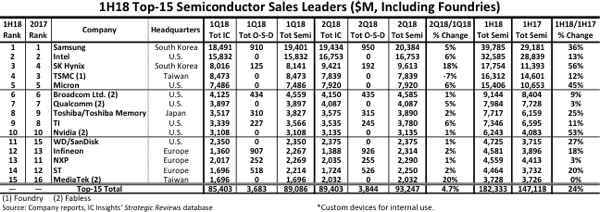

The top-15 worldwide semiconductor (IC and O-S-D - optoelectronic, sensor, and discrete) sales ranking for 1H18 is shown in Figure 1. It includes seven suppliers headquartered in the US, three in Europe, two each in South Korea and Taiwan, and one in Japan.

After announcing in early April 2018 that it had successfully moved its headquarters location from Singapore to the US IC Insights now classifies Broadcom as a US company.

As shown, all but four of the top 15 companies had double-digit year-over-year growth in 1H18. Moreover, seven companies had more than 20% growth, including the five big memory suppliers (Samsung, SK Hynix, Micron, Toshiba/Toshiba Memory, and Western Digital/SanDisk) as well as Nvidia and ST.

The top 15 ranking includes one pure-play foundry (TSMC) and four fabless companies. If TSMC were excluded from the top 15 ranking, US-based Apple would have been ranked in the 15th position. Apple is an anomaly in the top company ranking with regards to major semiconductor suppliers.

The company designs and uses its processors only in its own products - there are no sales of the company’s MPUs to other system makers. IC Insights estimates that Apple’s custom ARM-based SoC processors and other custom devices had a 'sales value' of $3.5bn in 1H18.

IC Insights includes foundries in the top 15 semiconductor supplier ranking since it has always viewed the ranking as a top supplier list, not a marketshare ranking, and realizes that in some cases the semiconductor sales are double counted.

With many clients being vendors to the semiconductor industry (supplying equipment, chemicals, gases, etc.), excluding large IC manufacturers like the foundries would leave significant 'holes' in the list of top semiconductor suppliers. Foundries and fabless companies are identified in the Figure.

In the April Update to The McClean Report, marketshare rankings of IC suppliers by product type were presented and foundries were excluded from these listings. Overall, the top 15 list shown in Figure 1 is provided as a guideline to identify which companies are the leading semiconductor suppliers, whether they are IDMs, fabless companies, or foundries.

In May 2018, Toshiba completed the $18.0bn sale of its memory IC business to the Bain Capital-led consortium. Toshiba then repurchased a 40.2% share of the business. The Bain consortium goes by the name of BCPE Pangea and the group owns 49.9% of Toshiba Memory (TMC). Hoya owns the remaining 9.9% of TMC’s shares.

The new owners have plans for an IPO within three years. Bain has said it plans to support the business in pursing M&A targets, including potentially large deals. As a result of the sale of Toshiba’s memory business, the 2Q18 sales results shown in Figure 1 include the combined sales of the remaining semiconductor products at Toshiba (e.g., Discrete devices and System LSIs) and the new Toshiba Memory’s NAND flash sales.

The estimated breakdown of these sales in 2Q18 is shown below:

- Toshiba System LSI: $468m

- Toshiba Discrete: $315m

- Toshiba Memory: $3,107m

- Total Toshiba/Toshiba Memory 2Q18 Sales: $3,890m

In total, the top 15 semiconductor companies’ sales surged by 24% in 1H18 compared to 1H17, four points higher than the total worldwide semiconductor industry 1H18/1H17 increase of 20%. Amazingly, the Big 3 memory suppliers - Samsung, SK Hynix, and Micron, each registered greater than 35% year-over-year growth in 1H18.

Fourteen of the top-15 companies had sales of at least $4.0bn in 1H18, three companies more than in 1H17. As shown, it took just over $3.7bn in sales just to make it into the 1H18 top 15 semiconductor supplier list. Intel was the number one ranked semiconductor supplier in 1Q17 but lost its lead spot to Samsung in 2Q17 as well as in the full-year 2017 ranking, a position it had held since 1993.

With the continuation of the strong surge in the DRAM and NAND flash markets over the past year, Samsung went from having only 1% more total semiconductor sales than Intel in 1H17 to having 22% more semiconductor sales than Intel in 1H18.

It is interesting to note that memory devices are forecast to represent 84% of Samsung’s semiconductor sales in 2018, up three points from 81% in 2017 and up 13 points from 71% just two years earlier in 2016.

Moreover, the company’s non-memory sales in 2018 are expected to be only $13.5bn, up 8% from 2017’s non-memory sales level of $12.5bn. In contrast, Samsung’s memory sales are forecast to be up 31% this year and reach $70.0bn.