Power transistor sales expected to grow by 6% in 2015

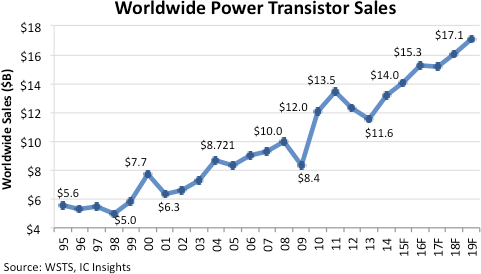

Power transistor sales are forecast to grow 6% in 2015 and set a new record high of $14.0bn following a strong recovery in 2014, which drove up dollar volumes by 14% after two consecutive years of decline, according to IC Insights’ 2015 O S-D Report—A Market Analysis and Forecast for Optoelectronics, Sensors/Actuators, and Discretes. In the last six years, power transistor sales have swung wildly, overshooting and undershooting end-use demand as equipment makers struggled to balance inventories in the midst of economic uncertainty since the 2008-2009 recession.

IC Insights believes the power transistor business is finally stabilising and returning to more normal growth patterns in the 2014-2019 forecast period of the 2015 O-S-D Report. Driven by steady increases in automotive, consumer electronics, portable systems, industrial and wireless communications markets, power transistor sales are expected to rise by a CAGR of 5.3% between 2014 and 2019, when worldwide revenues are forecast to reach $17.1bn. Worldwide power transistor sales grew by a CAGR of 6.2% between 1994 and 2014.

For more than three decades, power transistors have been the growth engine in the commodity-filled discrete semiconductor market, which grew 11% in 2014 to a record-high $23.0bn after falling 7% in 2012 and dropping 5% in 2013. The new O-S-D Report shows power transistors accounted for 58% of total discretes sales in 2014 versus 51% in 2004 and 36% in 1994. A number of power transistor technologies are needed to control, convert and condition currents and voltages in an ever-expanding range of electronics, including battery-operated portable products, new energy-saving equipment, EVs and HEVs, ‘smart’ electric-grid applications, and renewable power systems.

Despite the spread of system applications, power transistors have struggled to maintain steady sales growth since the 2009 semiconductor downturn, when revenues fell by 16%. Power transistor sales sharply rebounded in the 2010 recovery year with a record-high 44% increase followed by 12% growth in 2011 to reach the current annual peak of $13.5bn. Power transistors then posted the first back-to-back annual sales declines in more than 30 years (-8% in 2012 and -6% in 2013) due to inventory corrections, price erosion and delays in purchases by cautious equipment makers responding to economic uncertainty. Power transistors ended the two-year losing streak in 2014 with sales and unit shipments both growing by 14%.

The 2015 O-S-D Report’s forecast shows power transistor sales returning to a more normal 6% increase in 2015 with power FET revenues growing 6% to $7.4bn, IGBT modules climbing 8% to $3.1bn, IGBT transistors rising 6% to $1.1bn, and bipolar junction transistors being up 4% to $893m this year.

In a one-of-a-kind study, IC Insights continues to expand its coverage of the semiconductor industry with detailed analysis of trends and growth rates in the optoelectronics, sensors/actuators and discretes market segments in its 360-page O-S-D Report—A Market Analysis and Forecast for the Optoelectronics, Sensors/Actuators, and Discretes.

Now in its 10th annual edition, the 2015 O-S-D Report contains a detailed forecast of sales, unit shipments and selling prices for more than 30 individual product types and categories through 2019. Also included is a review of technology trends for each of the segments. The 2015 O-S-D Report, with more than 240 charts and figures, is priced at $3,290 for an individual-user license and $6,390 for a multi-user corporate license.