Microchip announces financial results for fiscal year 2015

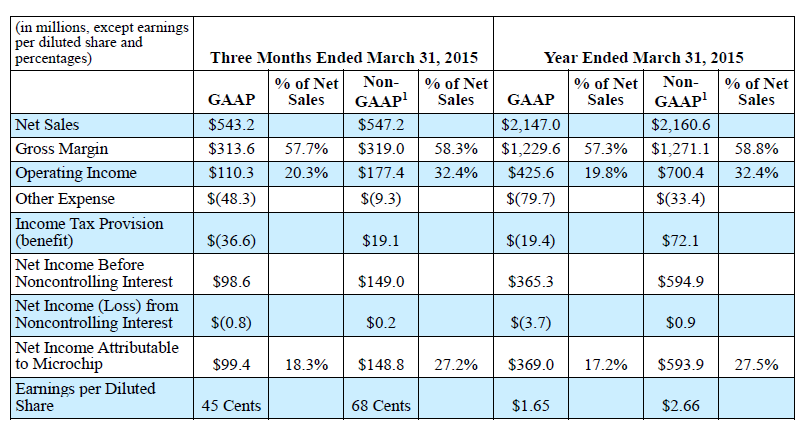

Microchip Technology has reported results for the three months and fiscal year ended 31st March 2015 as summarised in the following table:

GAAP net sales for the fourth quarter of fiscal 2015 were $543.2m, up 10.1% from GAAP net sales of $493.4m in the prior year's fourth fiscal quarter. GAAP net income for the fourth quarter of fiscal 2015 was $99.4m, or 45 cents per diluted share, down 10.8% from GAAP net income of $111.5m, or 50 cents per diluted share, in the prior year's fourth fiscal quarter.

Non-GAAP net sales for the fourth quarter of fiscal 2015 were $547.2m, up 10.9% from non-GAAP net sales of $493.4m in the prior year's fourth fiscal quarter. Non-GAAP net income for the fourth quarter of fiscal 2015 was $148.8m, or 68 cents per diluted share, up 5.3% from non-GAAP net income of $141.3m, or 64 cents per diluted share, in the prior year's fourth fiscal quarter. For the fourth quarters of fiscal 2015 and fiscal 2014, non-GAAP results exclude the effect of share-based compensation, expenses related to our acquisition activities, revenue recognition changes related to ISSC's distribution relationships, a loss on the retirement of convertible debentures, gains from equity securities, non-cash interest expense on our convertible debentures and non-recurring tax events. A reconciliation of our non-GAAP and GAAP results is included in this press release.

GAAP net sales for the fiscal year were $2.147bn, an increase of 11.2% from net sales of $1.931bn in the prior fiscal year. On a GAAP basis, consolidated net income for the fiscal year was $369.0m, or $1.65 per diluted share, a decrease of 6.6% from net income of $395.3m, or $1.82 per diluted share in the prior fiscal year.

Non-GAAP net sales for the fiscal year were $2.161bn, an increase of 11.9% from net sales of $1.931bn in the prior fiscal year. On a non-GAAP basis, net income for the fiscal year was $593.9m, or $2.66 per diluted share, an increase of 11.9% from net income of $531.0m, or $2.45 per diluted share, in the prior fiscal year.

Microchip announced that its Board of Directors declared a quarterly cash dividend on its common stock of 35.75 cents per share. The quarterly dividend is payable on 4th June 2015 to stockholders of record on 21st May 2015.

"We are very pleased with our execution in the March quarter," said Steve Sanghi, President and CEO, Microchip Technology. "We achieved record net sales and our non-GAAP earnings per share in the March quarter were 68 cents per diluted share, at the high end of our guidance which was upwardly revised on 11th February 2015 to reflect our refinancing activities."

Sanghi added: "Fiscal year 2015 was another record year as we achieved non-GAAP net sales of $2.161bn, up 11.9% from fiscal year 2014. In fiscal year 2015 our MCU and analog product lines both set new revenue records. The March quarter was our 98th consecutive quarter of profitability, a track record that our employees and stockholders should be extremely proud of."

"Our MCU revenue was up 8.4% in the March quarter from the year ago quarter," said Ganesh Moorthy, COO, Microchip Technology. "For fiscal year 2015, our MCU business was up 11.4% over fiscal year 2014, setting a revenue record at over $1.4bn. Additionally, for fiscal year 2015, each of our three MCU segments, 8-bit, 16-bit and 32-bit set revenue records and gained significant market share as reported in the 2014 Gartner Dataquest rankings, with our 8-bit business also regaining the number one position in revenue."

Moorthy added: "For fiscal year 2015, our analog business was also up strongly at 17.6% over fiscal year 2015, setting a revenue record and for the first time crossing the half billion dollar mark."

Eric Bjornholt, CFO, Microchip Technology, said: "Our cash generation in the March quarter excluding the purchase of additional shares of ISSC, our dividend payment, and changes in borrowing levels was $155.5m. As of 31st March 2015, our consolidated cash and total investment position was approximately $2.34bn. The dividend that we announced today marks the 45th occasion that we have increased our dividend payment, and cumulative dividends paid are now $2.52bn."

Sanghi added: "We have evaluated the current global economic environment, our backlog position and customer designs that are coming to production and expect our revenue to be between $547m and $564m in the June quarter."