Mergers & acquisitions continue through uncertain business climate

IC Insights has examined the huge surge of Merger & Acquisition (M&A) activity in the IC industry during the first six months of 2015. In just the first half of 2015, announced semiconductor acquisition agreements had a combined total value of $72.6bn, which was nearly six times the annual average for M&A deals struck during the five previous years (2010-2014).

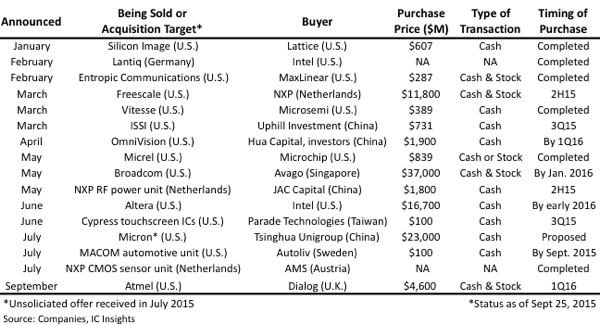

With Dialog Semiconductor’s announced plan to acquire Atmel, the total M&A value has now reached nearly $77.0bn. Figure 1 summarises major M&A deals so far this year.

Figure 1 - major merger & acquisition deals announced or planned so far in 2015

The list does not include other, smaller (less than $100m) acquisitions such as Rohm Semiconductor’s $70m acquisition of Powervation, an Ireland-based supplier of digital power ICs in July 2015 or Qualcomm’s plan to purchase Ikanos for $47m, which is expected to close by the end of 2015. Additionally, several large M&A agreements announced last year have closed in 2015. These include the following:

- RF Micro Devices and TriQuint Semiconductor officially completed their Qorvo merger at the start of 2015.

- Qualcomm completed its acquisition of CSR in August 2015. CSR's operations became a subsidiary of Qualcomm and were renamed Qualcomm Technologies International. The transition was valued at $2.4bn.

- Cypress completed its acquisition and merger with Spansion in March 2015. The all-stock transaction had a value of $5bn.

- Infineon completed its $3.0bn acquisition of power-semiconductor pioneer and rival International Rectifier in January 2015.

- IBM completed the sale of its Microelectronics business, including its 300mm and 200mm wafer fabs, to GlobalFoundries in July 2015.

IC Insights has previously noted that the unprecedented M&A activity is indicative of IC suppliers experiencing slower sales in their existing market segments and the need to broaden their businesses to stay in favour with investors. Rising costs of product development and advanced technologies are also driving the need to become bigger and grow sales at higher rates in the second half of this decade. The emergence of and huge market potential for the IoT is causing major IC suppliers to reset their strategies and quickly fill in missing pieces in their product portfolios. China’s ambitious goal to become self-sufficient in semiconductors and reduce imports of ICs from foreign suppliers has also launched a number of acquisitions by Chinese companies and investment groups.

IC Insights believes that the increasing number of mergers and acquisitions, leading to fewer major IC manufacturers and suppliers, is one of major changes in the supply base that illustrate the maturing of the industry. In addition to the monstrous M&A wave currently taking place, trends such as the lack of any new entry points for startup IC manufacturers, the strong movement to the fab-lite business model, and the declining capital expenditure as a percent of sales ratio, all promise to dramatically reshape the semiconductor industry landscape over the next five years.