Is the situation so critical for LED downconverter OEMs?

A comprehensive review of the LED downconverters market and competitive landscape has been proposed in Yole Développement’s (Yole) recent LED downconverters technology and market report, titled Phosphors & Quantum Dots 2015: LED Downconverters for Lighting & Displays. The report presents the requirements for lighting and displays, configurations and dispensing methods, and trends in phosphor compositions.

While volumes are expected to more than double between 2015 and 2020, LED phosphor prices have declined dramatically, leading to a flat revenue outlook. Low technology barriers of entrance on the most mature compositions have prompted companies to procure turnkey manufacturing equipment and enter the market. With little to no quality control and R&D expenses, some have achieved low cost comparable to that of the tri-phosphors used in fluorescent lamps. In a bid to capture market shares, they triggered an intense price war. But is the situation so critical for LED downconverter OEMs?

Despite a difficult environment, some companies will strive. As illustrated by very wide price ranges, despite commoditisation on the low end, LED phosphors remain a specialty market on the high end. Leading suppliers still commend significant price premiums and will strive to create value to maintain margins. This can be achieved through improved performance and consistency, customisation, and innovative products. Solid IP shielding their customers from the risk of a patent lawsuit is also a strong element of differentiation. The LED phosphor market remains technology and IP driven. While China-based suppliers are winning the price war, they now need to fight the patent war.

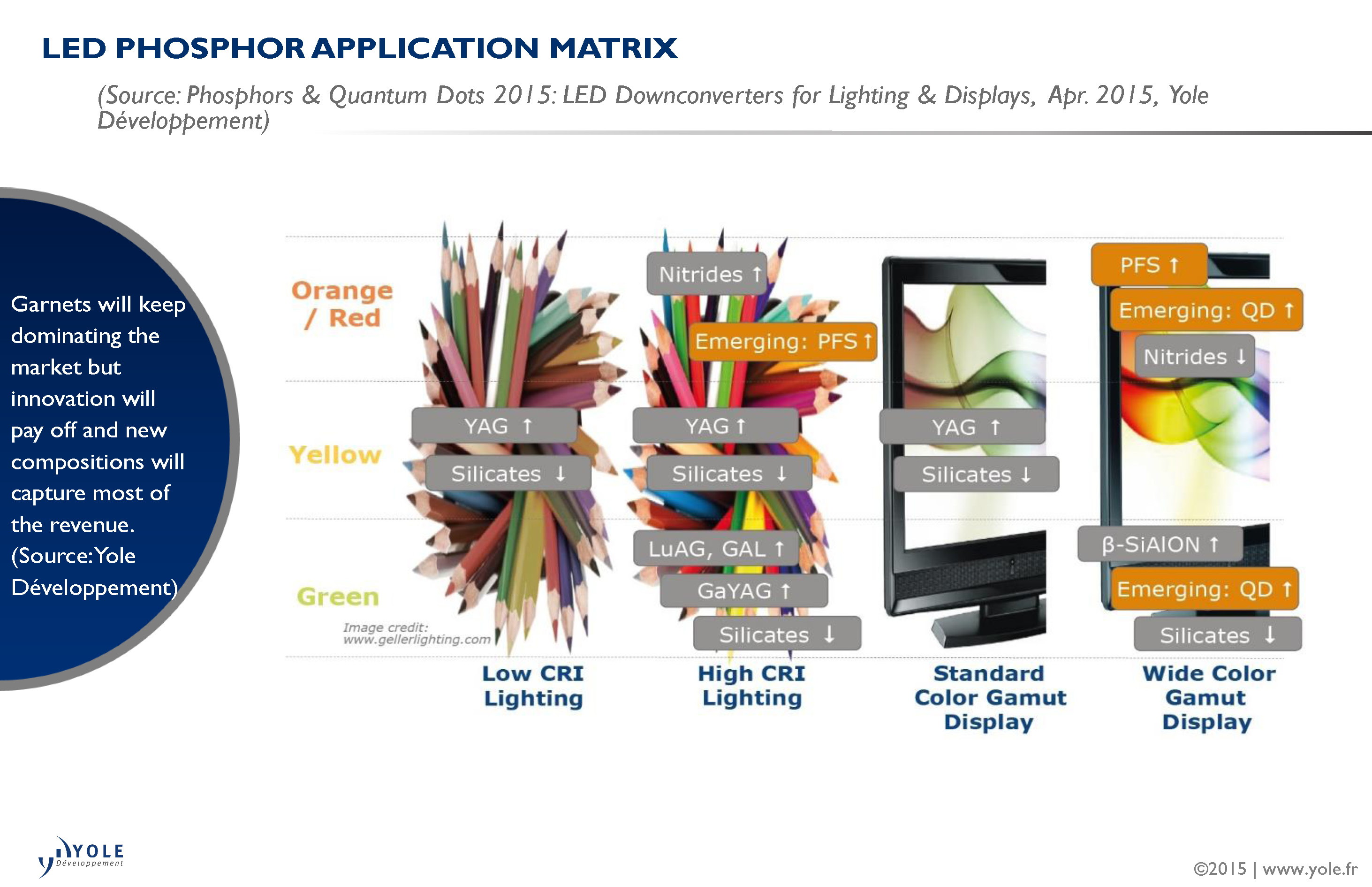

Indeed, YAG remains the best broadband yellow phosphor for generating white light. But its use is restricted by strong IP owned by Nichia. Silicates are the best substitute, although still lagging slightly in term of cost and performance. With critical IP to start expiring from 1997 and prices now significantly lower than any alternative, Yole expects YAG to become the ubiquitous yellow phosphor by the end of the decade while silicate essentially disappear. For green phosphors, LuAG, silicates and the emerging, cost-efficient GaYAG are the best broadband emitters for high CRI lighting. For high colour gamut displays, β-SiAlON is favoured due to its high stability and narrow band emission.

Over the last three years, nitrides prices have decreased significantly and the composition family has risen to become the dominant red phosphors for high CRI lighting and wide colour gamut displays. Suppliers have proliferated despite IP restrictions. However, a new material, Mn4+ doped Potassium Fluorosilicate (PFS) developed by GE and already manufactured by Denka, Nichia and GE, could challenge the nitride dominance in display applications through its extremely narrow band. Many other phosphor manufacturers such as Intematix are developing PFS and Yole’s team expects the competition to intensify. However, GE holds strong patents and it remains to be seen how much leverage this will provide the conglomerate in controlling this emerging segment.

“With major YAG IP expiring from 2017, leading Chinese LED makers will have easier access to overseas markets, and domestic Phosphor suppliers such as Yuji, Grirem, YT Shield, Illuma or Sunfor will expand their markets, further increasing YAG commoditisation,” explains Dr Eric Virey, Senior Analyst, LEDs, Yole. “Phosphor makers are therefore shifting their efforts toward higher added value materials such as nitrides, which, while prices have also decreased significantly during the period, have maintained better margins”.