Is DC grid a viable solution for data centres?

Increasing internet traffic and video streaming will encourage large data centre investments in the coming years with around $143bn invested for new data centre projects worldwide. Large online companies such as Amazon, Facebook and Google are leading the investment in next-gen 'green' data centres. There is a trend towards building larger data centres, consolidating and increasing the density of server concentration for the sites which require more efficient buildings.

Yole Développement has released a comprehensive analysis of the trends, market and opportunities of development for next-gen data centres, including new architectures and technologies, titled New Technologies & Architectures for Efficient Data Centers.

Yole’s team presents market forecasts between 2010 and 2020 with regional splits. Yole’s analysts also identify the key players and their market share for servers, UPSes and cooling systems. This report also provides an overview of each technology’s technical evolution including silicon photonics, NVM, wide band gap materials and more.

“At Yole, we clearly identify a trend to develop larger data centres with an increased server concentration,” confirms Mattin Grao Txapartegi, Technology & Market Analyst, Yole. This trend has a direct impact on the blade server market: indeed, the blade server market for data centres will display a CAGR of +10.8% from 2015 to 2020, while the entire server market will increase by 2.3%. Global server market share for data centres will increase from slightly lower than 20% in 2014 to almost 35% by 2020.

“Our regional split shows that North America, particularly the US, has the biggest share of the server market, at 34% or $3.5bn,” adds Txapartegi. “Europe, however, leads the UPS equipment and cooling systems markets for data centres. In fact, Europe’s large UPS (up to 100kW) market was estimated at $931m in 2014.”

Container data centre market

Traditionally rigid AC architectures are evolving towards flexible and modular solutions. Is a DC grid a solution for data centres? Established data centres are not able to enlarge their IT equipment, since the power architecture and the centralised cooling system were designed for rated power. Such designs cannot be modified and, more importantly, they present many inefficiencies when servers work in 'low load' mode. Modularity brings a fresh approach to data centre design, enabling the incorporation of additional servers when needed. The power and cooling systems are better optimised, since equipment modules and distribution sub-networks can be activated/deactivated for improved efficiency. Moreover, virtualisation and server resource management systems eliminate unnecessary power waste.

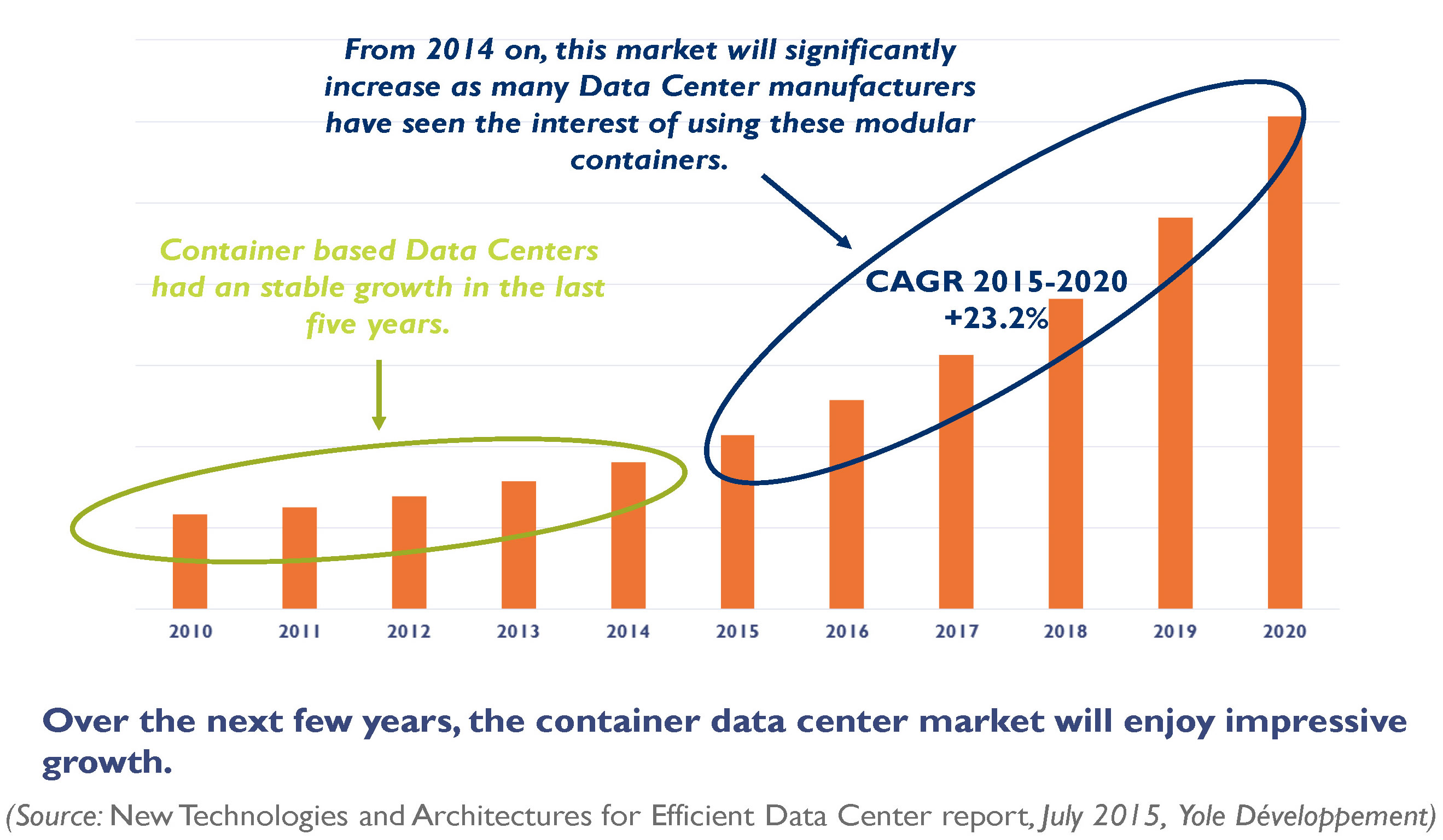

Yole has also identified a smaller, high-potential parallel market consisting of 'container data centres'. These containers are rugged, portable, energy-efficient plug & play solutions that have enjoyed rising sales over the last few years. HP leads this new market, which will enjoy a +23.2% CAGR from 2015 to 2020, with Huawei following closely behind.

“Other solutions exist to minimise distribution chain power loss, such as DC grid data centres. Thanks to a simplified architecture and fewer conversion steps, losses can be reduced by 20%. Players like ABB, NTT and Huawei have several DC grid data centre demonstrators that use a 380VDC distribution voltage. The main barrier for this new architecture is the lack of appropriate DC components, especially 400VDC safety breakers.”

Yole’s report contains a detailed analysis of who is doing what and how DC architecture helps reduce energy consumption.