Intel to reclaim number one semiconductor supplier ranking

IC Insights’ ‘November Update to the 2019 McClean Report’, released later this month, will include a discussion of the forecasted top-25 semiconductor suppliers in 2019 (the top-15 2019 semiconductor suppliers are covered in this research bulletin).

The Update also includes a detailed five-year forecast of the IC market by product type (including dollar volume, unit shipments, and average selling price) and a forecast of the major semiconductor industry capital spenders for 2019 and 2020.

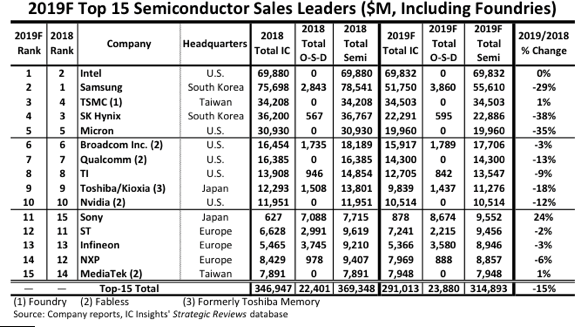

The expected top-15 worldwide semiconductor (IC and O-S-D—optoelectronic, sensor, and discrete) sales ranking for 2019 is shown in Figure 1. It includes six suppliers headquartered in the US, three in Europe, two each in South Korea, Japan, and Taiwan.

Figure 1

In total, the top-15 semiconductor companies’ sales are forecast to drop by 15% in 2019 compared to 2018, two points lower than the expected total worldwide semiconductor industry decline of 13%. The three largest memory suppliers, Samsung, SK Hynix, and Micron, are each forecast to register ≥29% year-over-year declines in 2018 with SK Hynix expected to log the biggest decline among the top-15 companies with a 38% plunge in sales this year.

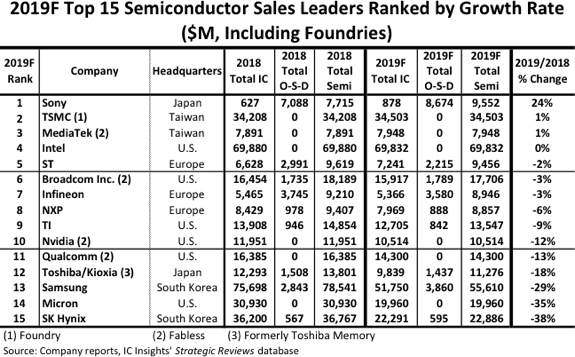

All of the top-15 companies are expected to have sales of at least $7.0 billion in this year, the same number of companies as in 2018. As shown in Figure 2, only three of the top-15 companies are forecast to register year-over-year growth in 2019—Sony, TSMC, and MediaTek. Moreover, six companies are expected to have double-digit sales declines this year, including four of the big memory suppliers (Samsung, SK Hynix, Micron, and Toshiba/Kioxia) as well as Nvidia and Qualcomm.

Figure 2

The largest move upward in the ranking is forecast to come from Sony, which is expected to move up four spots to the 11th position on the strength of extremely strong image sensor sales. In contrast, NXP is expected to fall two places to 14th with a sales decline of 6% this year.

Intel was the number one ranked semiconductor supplier in 1Q17 but lost its lead spot to Samsung in 2Q17. It also fell from the top spot in the full-year 2017 ranking, a position it had held since 1993. With the strong surge in the DRAM and NAND flash markets in 2018, Samsung went from having seven percent more total semiconductor sales than Intel in 2017 to having 12% more semiconductor sales than Intel in 2018.

However, with a forecasted 34% drop in the memory market this year, Intel is once again expected to rank as the largest semiconductor supplier and have sales that are 26% larger than Samsung in 2019.

The 2019 top-15 ranking includes one pure-play foundry (TSMC) and four fabless companies. If TSMC is excluded from the top-15 ranking, China-based HiSilicon (Huawei) would move into the 15th position with forecasted 2019 sales of $7.5 billion, up 24% from 2018.

IC Insights includes foundries in the top-15 semiconductor supplier ranking since it has always viewed the ranking as a top supplier list, not a marketshare ranking, and realises that in some cases the semiconductor sales are double counted. With many of our clients being vendors to the semiconductor industry (supplying equipment, chemicals, gases), excluding large IC manufacturers like the foundries would leave significant holes in the list of top semiconductor suppliers.

Foundries and fabless companies are identified in the Figures. In the April Update to The McClean Report, marketshare rankings of IC suppliers by product type were presented and foundries were excluded from these listings.

Overall, the top-15 list is provided as a guideline to identify which companies are the leading semiconductor suppliers, whether they are IDMs, fabless companies, or foundries.