Intel to keep its number one semiconductor supplier rank

IC Insights’ November Update to the 2020 McClean Report, released later this month, will include a discussion of the forecasted top-25 semiconductor suppliers in 2020. This research bulletin covers the expected top-15 2020 semiconductor suppliers.

The November Update also includes a detailed five-year forecast through 2024 of the IC market by product type (including dollar volume, unit shipments, and average selling price) and a forecast of the major semiconductor industry capital spenders for 2020. A five-year outlook for total semiconductor industry capital spending is also provided.

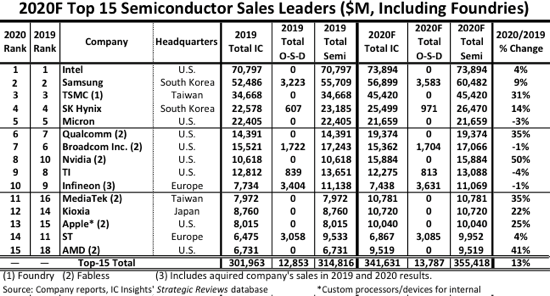

The top-15 companies semiconductor sales are broken out into IC and O-S-D (optoelectronic, sensor, and discrete) device categories for 2019 and 2020. The forecasted 2020 top-15 semiconductor supplier ranking includes eight suppliers headquartered in the US, two each in South Korea, Taiwan, and Europe, and one in Japan.

The semiconductor industry has been one of the most resilient markets during this corona-virus plagued year. Although causing a deep global recession in 2020, the Covid-19 pandemic spurred an acceleration of the worldwide digital transformation resulting in remarkably robust semiconductor market growth.

In total, the top-15 semiconductor companies’ sales are forecast to jump by 13% in 2020 compared to 2019, slightly more than twice the expected total worldwide semiconductor industry increase of six percent. In contrast, in 2019, the top-15 semiconductor suppliers registered a collective 15% decline in sales. All of the top-15 companies are forecast to have semiconductor sales of at least $9.5bn in 2020.

There are expected to be two new entrants into the top-15 semiconductor sales ranking for this year—MediaTek and AMD, with these companies forecast to register strong sales increases of 35% and 41%, respectively. As shown, MediaTek is expected to jump up five spots to 11th place while AMD is forecast to move up three positions to 15th this year.

Apple is an anomaly in the top-15 ranking with regards to major semiconductor suppliers. The company designs and uses its processors and other custom ICs only in its own products—there are no sales of the company’s IC devices to other system makers. IC Insights believes that Apple’s custom ICs will have an equivalent ‘sales value’ of $10,040 million in 2020, which would place them in the 13th position in the top-15 ranking.

In order to make the year-over-year growth rate comparison more reflective of actual growth, the semiconductor sales figures for Infineon include Cypress’ sales for 2019 and 2020. Although Infineon acquired Cypress on April 16th, 2020, IC Insights added Cypress’ 2019 IC sales of $2,205 million to Infineon’s 2019 semiconductor sales of $8,933 for a total of $11,138m.

Moreover, $514m was added to Infineon’s 1Q20 sales to account for Cypress’ 1Q20 revenue with another $87m added to Infineon’s 2Q20 sales to reflect Cypress’ semiconductor sales in the first half of April before the acquisition was finalised on April 16th, 2020. With these adjustments, Infineon’s 2020/2019 semiconductor sales are forecast to decline by one percent.

The top-15 ranking includes pure-play foundry TSMC, which is forecast to register a strong 31% 2020/2019 jump in revenue. Much of TSMC’s increase is due to a surge in sales of its 5nm and 7nm application processors to Apple and HiSilicon for their respective smartphones. If TSMC was excluded from the list, Sony, with $9,243m in expected 2020 semiconductor sales, would be ranked 15th.

IC Insights includes foundries in the top-15 semiconductor supplier ranking since it has always viewed the ranking as a top supplier list, not a market share ranking, and realises that in some cases the semiconductor sales are double counted. With many of our clients being vendors to the semiconductor industry (supplying equipment, chemicals, gases, etc.), excluding large IC manufacturers like the foundries would leave significant ‘holes’ in the list of top semiconductor suppliers.

As shown in the listing, the foundries and fabless companies are identified. In the April Update to The McClean Report, marketshare rankings of IC suppliers by product type were presented and foundries were excluded from these listings.

Overall, the top-15 list shown in gigure 1 is provided as a guideline to identify which companies are the leading semiconductor suppliers, whether they are IDMs, fabless companies, or foundries.