IC wafer fabs closed or repurposed from 2009-2017

Since the global economic recession of 2008-2009, the IC industry has been on a mission to pare down older capacity (i.e., ≤200mm wafers) in order to produce devices more cost effectively on larger wafers.

The spree of merger and acquisition activity and the migration to producing IC devices using sub-20nm process technology has also led suppliers to eliminate inefficient wafer fabs.

From 2009-2017, semiconductor manufacturers around the world have closed or repurposed 92 wafer fabs, according to data compiled, updated, and now available in IC Insights’ Global Wafer Capacity 2018-2022 report.

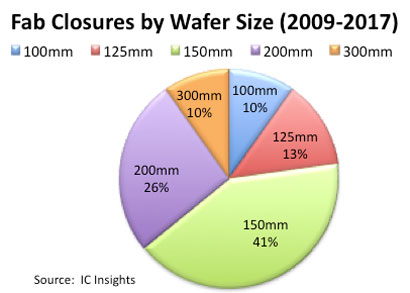

Figure 1 shows that since 2009, 41% of fab closures have been 150mm fabs and 26% have been 200mm wafer fabs. 300mm wafer fabs have accounted for only 10% of total fab closures since 2009. Qimonda was the first company to close a 300mm wafer fab after it went out of business in early 2009.

More recently, ProMOS closed two 300mm memory fabs in 2013 and Renesas sold its 300mm logic fab to Sony in 2014. Sony repurposed that fab to make image sensors. In 2017, Samsung closed its 300mm Line 11 memory fab in Yongin, South Korea, also repurposing it to manufacture image sensors.

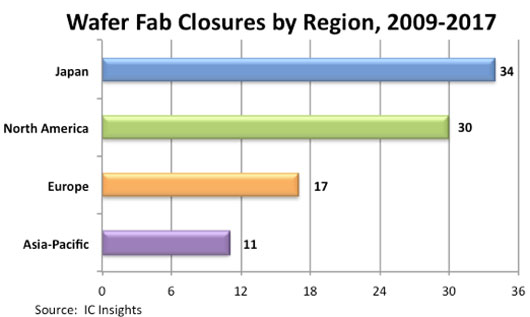

Semiconductor suppliers in Japan have closed a total of 34 wafer fabs since 2009, more than any other country/region. In the 2009-2017 timeframe, 30 fabs were closed in North America and 17 shuttered in Europe, and only 11 wafer fabs were closed throughout the Asia-Pacific region (Figure 2).

Worldwide fab closures surged in 2009 and 2010 partly as a result of the severe economic recession at the end of the previous decade. A total of 25 fabs were closed in 2009, followed by 22 being shut down in 2010. Ten fabs closed in 2012 and 2013. Two fabs were closed in 2015, the fewest number of closures per year during the 2009-2017 time span. In 2017, 3 wafer fabs were removed from service. IC Insights has identified three wafer fabs (two 150mm fabs, one 200mm fab) that are targeted for closure this year and next.

Given the flurry of merger and acquisition activity seen in the semiconductor industry recently, the skyrocketing cost of new wafer fabs and manufacturing equipment, and as more IC companies transition to a fab-lite or fabless business model, IC Insights expects more fab closures in the coming years - a prediction that will likely please IC foundry suppliers.

Report details: Global Wafer Capacity 2018-2022

IC Insights’ Global Wafer Capacity 2018-2022 - Detailed Analysis and Forecast of the IC Industry’s Wafer Fab Capacity report assesses the IC industry’s capacity by wafer size, minimum process geometry, technology type, geographic region, and by device type through 2022. The report includes detailed profiles of the companies with the greatest fab capacity and gives comprehensive specifications on existing wafer fab facilities.