IC Insights predicts less volatility for power transistors

According to IC Insights, greater demand for energy efficiency in systems, cars, portable electronics and new connections to the IoT will steadily drive power transistor sales to new record-high levels in the next three years.

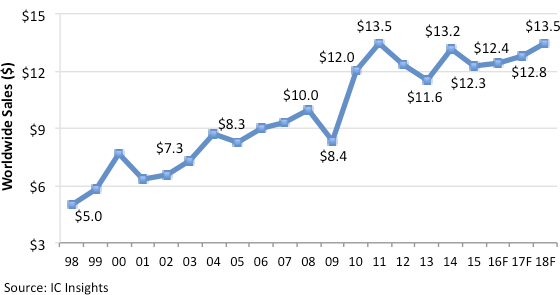

Power transistors - the $12bn growth engine in the $21bn discrete semiconductor market - have faced a choppy uphill climb since surging in the 2010 recovery from the 2008-2009 economic recession. Worldwide revenues for power transistors continue to increase by a CAGR of about 4%, but sales in the largest discretes product category have fallen in three out of the last five years because of ongoing economic uncertainty and quick cancellation of purchase orders by systems makers whenever they see signs of demand weakening for end-use electronic products, says IC Insights’ 2016 O-S-D Report—A Market Analysis and Forecast for Optoelectronics, Sensors/Actuators, and Discretes.

After dropping 7% in 2015 to $12.3bn, power transistor sales are expected to stabilize and begin a modest recovery in 2016, growing by a little over 1% to $12.4bn, according to the latest edition of IC Insights’ annual O-S-D Report, which contains a detailed five-year forecast of sales, unit shipments and ASPs for more than 30 individual product types and device categories in optoelectronics, sensors/actuators and discretes. The 360-page report shows power transistor sales slowly regaining strength in the next few years, rising 3% in 2017 to $12.8bn followed by 5% growth in 2018 to about $13.5bn, which will match the current annual peak set in 2011.

Figure 1 - power transistor sales zigzag higher

Between 2015 and 2020, power transistor sales are projected to grow by a CAGR of 3.9% to $14.8bn in the final year of the 2016 O-S-D Report’s forecast. The annual growth rate in the second half of this decade essentially matches the CAGR of 4.0% recorded in the last 10 years (2005-2015), but IC Insights anticipates much less volatility in the power transistor market because worldwide demand will continue to climb for greater energy efficiency in data centre computers, industrial systems, home appliances, battery-operated portable electronics, automobiles and the explosion of connections to the IoT. Worldwide shipments of power transistors are now forecast to rise by a CAGR of 6.5%, reaching 71.1bn units in 2020 compared to about 52.0bn in 2015.

Among the power transistor product categories, sales growth is expected to be the strongest in high voltage FETs and IGBT modules during the second half of this decade. The 2016 O-S-D Report shows sales of high-voltage (over 200V) FETs growing by a CAGR of 4.7% to $2.4bn in 2020 while IGBT modules are expected to increase by an annual rate of 4.0% to $3.2bn in five years. Other projected 2015-2020 CAGR growth rates for power transistor product categories are: 3.7% for low-voltage FETs (under 200V) to $5.6bn; 3.8% for discrete IGBT transistors to $1.1bn; and 3.1% for bipolar junction transistors to $886m in 2020.