IC industry capacity led by Samsung, TSMC, and Micron

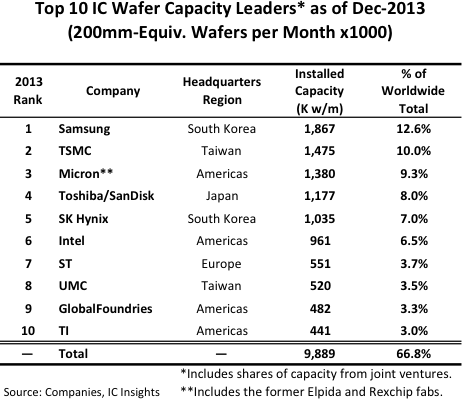

The 2014 edition of IC Insights’ McClean report provides a ranking of the industry’s 10 largest IC manufacturers in terms of installed capacity. This top 10 list features four companies from North America, two companies from South Korea, two from Taiwan, and one each from Europe and Japan.

Samsung has topped the list with, as of December 2013, nearly 1.9m 200mm-equivalent wafers per month representing 12.6% of the world’s total capacity. Most is used for the fabrication of DRAM and flash memory devices. TSMC, the largest pure-play foundry in the world, were ranked second with almost 1.5m wafers per month capacity, or 10.0% of total worldwide capacity.

Micron have been ranked third, following the amendment of their Inotera partnership with Nanya such that Micron now takes 95% of Inotera’s wafer output (it was evenly split before). Also the closing of Micron's deal to acquire Elpida Memory and the Rexchip business in Taiwan (which Elpida operated in partnership with Powerchip) added the Elpida and Rexchip fabs to Micron repertoire. With these additions, Micron became the third-largest wafer capacity holder in the world in 2013 with nearly 1.4m 200mm-equivalent wafers per month (9.3% of total worldwide capacity).

Toshiba was the fourth-largest capacity holder at the end of 2013 with a little under 1.2m in monthly wafer capacity. Representing 8.0% of total worldwide capacity, this included a substantial amount of flash memory capacity for joint-investor/partner SanDisk. Following Toshiba was another memory supplier, SK Hynix, with just over 1m wafers each month, or 7.0% of total worldwide capacity. Intel have been ranked sixth with 6.5% of total worldwide capacity at 961,000 200mm-equivalent wafers per month. In 2011, Intel was ranked third, but has since reduced its ownership position in IM Flash and its wafer output share from its joint venture with Micron.

The ramainder of the top ten is completed with STMicroelectronics, UMC, GlobalFoundries and TI. These four companies each hold between 3.0-3.7% of total worldwide capacity, equating to 441,000-551,000 wafers per month.

TSMC, GlobalFoundries, and UMC are the three largest pure-play foundries, having held about 80% of the worldwide pure-play foundry market since 2010. Additionally, these three foundries had a combined capacity of about 2.5m wafers per month as of December 2013, representing almost 17% of the total fab capacity in the world.

The combined capacity of the top five accounted for 47% of total worldwide capacity in Dec-2013, while the top 10 represent 67% of the world’s capacity. The top 15 accounted for 76% and the top 25, 85%, of worldwide installed IC capacity. The shares of these groups have increased significantly since 2009, each gaining 7-13 percentage points over four years.