GaN-on-Si technologies: Let the games begin

It is now common knowledge throughout the semiconductor industry: MACOM is pursuing legal action against Infineon Technologies. The story is complex yet so predictable: Yole Développement and its sister company KnowMade, both heavily involved in technology, marketing and IP analysis for the semiconductor industry, released a patent landscape analysis report two years ago dedicated to GaN-on-Si technologies.

The GaN-on-Silicon Substrate Patent Investigation report highlights the on-going structuration of the market and the maturity of related patents. Behind such huge market potential, both partners had predicted possible litigation in the coming years due to an increasing number of players and limited number of key patents. With both acquisitions taking place within a 2-year period - International Rectifier by Infineon and Nitronex by MACOM - the game has become more complex and today the industry wants to know: What happens now?

Two years ago, Yole and KnowMade analysts expected GaN-on-Si to be widely adopted by power electronics and RF applications because of its lower cost and CMOS compatibility. The status of today’s market confirms this conclusion:

“At Yole we are following GaN-on-Si technology and its existing and emerging applications daily,” commented Dr. Hong Lin, Technology & Market Analyst, Yole. “The global market for GaN RF applications reached $298.5m in 2015, with a significant CAGR for the coming years. At the same time, numerous developments are showing the potential of GaN-on-Si technology in RF products. And we believe that the GaN RF industry could be reshaped, with a strong impact at the supply chain level, if GaN-on-Si technology is in fact adopted. On the power-electronic applications side, GaN-on-Si has currently attained only a few million dollars; but we have also identified huge business opportunities and impressive activities in the GaN-on-Si patent landscape. With such strong growth, we expect the market to reach a few hundred million dollars at mid-term.”

That is likely why the battle predicted in the KnowMade and Yole report is taking place today. Industrial companies are playing the game to penetrate the market and reinforce their market positions. The dispute between MACOM and Infineon is just one example; many may soon follow suit.

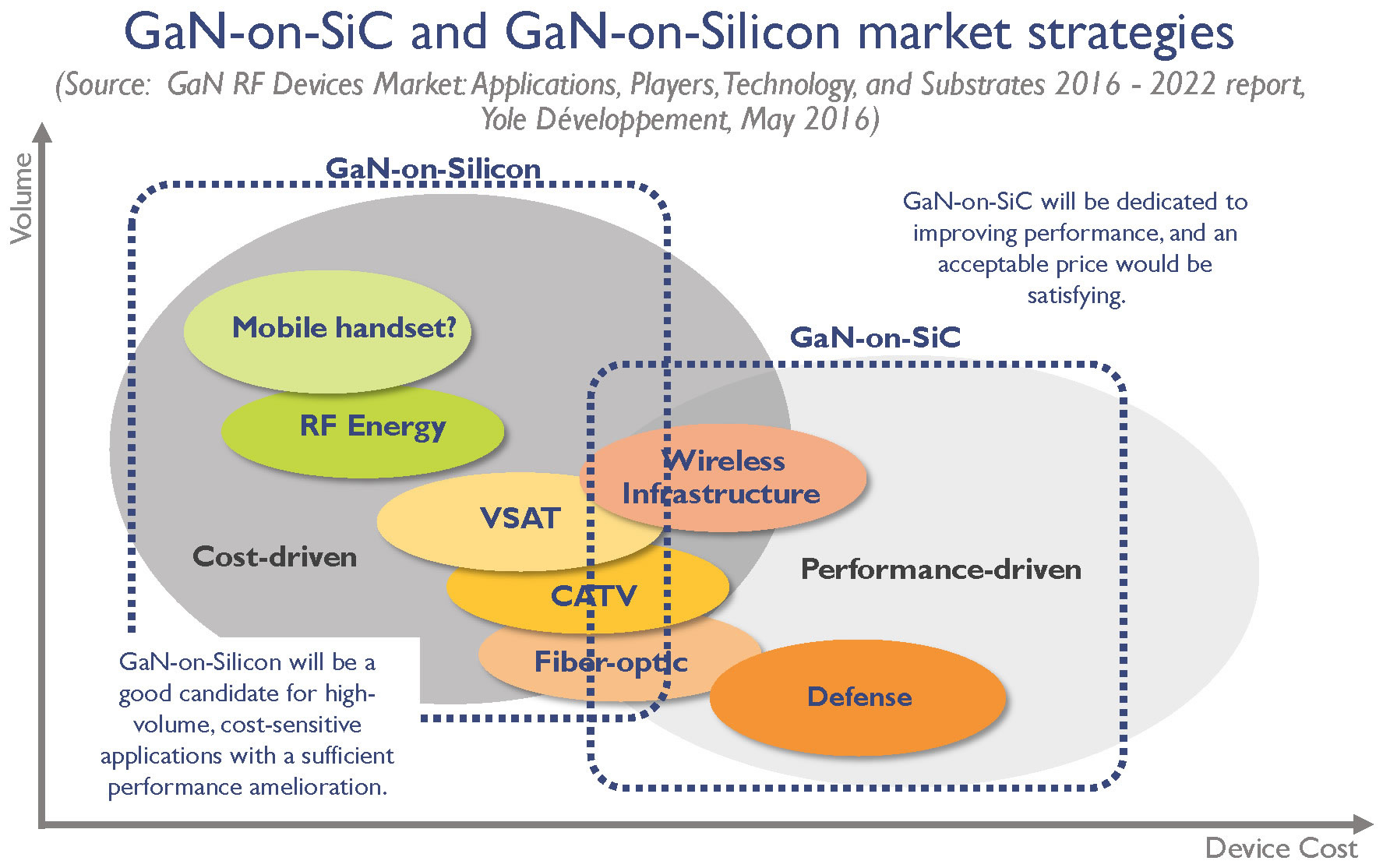

GaN-on-SiC and Gan-on-Si market strategies

MACOM acquired Nitronex in February 2014. This transaction provided MACOM with innovative GaN-on-Si technology process and materials for RF and other applications. At the end of March, the company announced an IP licensing programme; IR and other companies were part of the game. Today, Nitronex patents are widely used within the power electronics and RF sectors. Within this context, MACOM could very well initiate many other legal actions.

“When MACOM acquired Nitronex in June 2014, the company took control of the use of overall GaN-on-Si technology and potentially blocked targeted markets,” asserted Nicolas Baron, CEO, KnowMade. “Its strategy might extend beyond just the RF sector: The company probably expects to maintain an open path to the power electronics market with Nitronex GaN-on-Si patents. Today, with the legal procedure announced on 26th April, MACOM wants to put an end to unacceptable activities from Infineon.”

With the acquisition of IR, Infineon has a leading market position in the power-electronics sector. According to MACOM, the German company would gain some developments in the RF markets and, as a consequence, reduce MACOM’s rights in the sector. “This legal action is clearly a strong message from MACOM to the GaN-on-Si community today,” confirmed Yole and KnowMade analysts.

The synergy between GaN-on-Si markets, RF and power electronics are undeniable today. Pierric Gueguen, Business Unit Manager, Yole, explained: “GaN-on-Si technology has resulted in numerous assets for many applications, including RF and power electronics and GaN-on-Si players have latched onto this potential. It is entirely natural for a bridge to form between the RF and power electronics markets. Under this scenario, RF companies are expanding their activities into the power electronics market. On the other side, power electronics companies are developing their product lines and offering RF solutions. This strategy is a good way to secure their business and ensure increasing revenues.” Dream or reality? Only the future will tell.