Electronic distribution forecast 2018

As Mark Burr Lonnon, Senior Vice President at Mouser observed as 2017 drew to a close, “If you aren’t making money now, you never will.” It was the land of milk and honey for the distribution industry and moving into 2018 the momentum is still there, albeit with one or two caveats.

Europe has been at the forefront of this growth and industry body DMASS reported that the European semiconductor distribution market posted all time record sales of €8.5bn, a rise of 14.6% on the previous year. Q4 2017 contributed €2.01bn - a winter quarter record on the back of an 11.6% increase.

“A combination of several factors led to this all-time record year for DMASS members: high demand in all industries, long lead-times and price increases, new and exciting technologies, deeper penetration of existing applications with more semi-technology,” commented Georg Steinberger, chairman of DMASS.

He did strike a note of caution. “We see, however, a slight slowdown in the growth rate and a high order backlog, which in combination could mean a certain risk for 2018. The first quarter 2018 will show in which direction the year will go.”

From a regional perspective, Q4 turned out very positive for Nordic, Benelux, Iberia, Italy, Eastern Europe, Turkey and Israel, with Germany sitting right on the average. For the full fiscal year, it was the south and the east that drove the growth in semiconductor distribution.

In Q4, of the major regions/countries, Germany grew by 11.7% to €597m Euro, Italy rose 13.8% to €170m, France’s 9.8% rise achieved €143m and overtook the UK which grew 5.3% to €142m. Nordic ended 20.8% up at €184m and Eastern Europe jumped 12.4% at €316m.

Added Steinberger: “The long-term tendency of a production and thus market shift from the West to the East continues. Also Germany’s share of the European DTAM, which has been up to 34% in the past, came down to ~30% now.”

Furthermore Steinberger commented: “Regarding a further outlook, the important factor is component production, and if a relaxation can be expected. Concerning the customers the demand seems to remain high, less driven by availability (and hence the risk of double orders) but by innovation and good economy in all industries.”

afdec, the UK and Ireland distributors association has adopted a conservative tone for 2018 forecasting growth in the range of 6.5%-to-10.5% in 2018, achieving a mid-point of 8.5% against 17% growth in 2017. Afdec/ecsn analyst Aubrey Dunford also notes that the distributors’ share of the overall Total Available Market (TAM) in the UK will have risen to 40%.

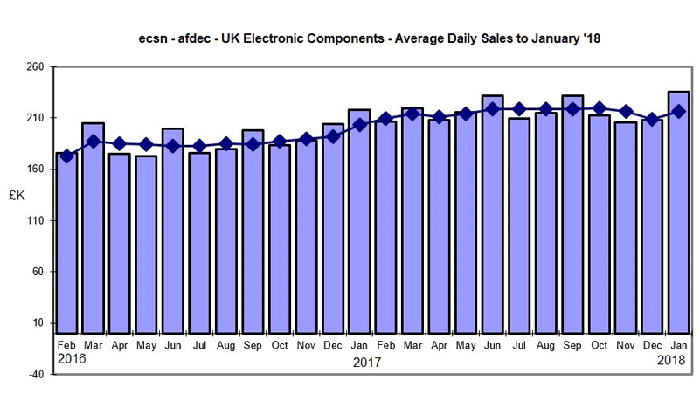

The upper range of afdec’s forecast may be a better bet as January figures show the UK and Ireland distribution market flying.

Monthly Billings in January 2018 increased by 21% when compared to the previous month and increased by 14.5% when compared to January 2017. According to ecsn chairman Adam Fletcher, January 2018 saw a reversal of the disappointing semiconductor sales that UK and Ireland Authorised Distributors experienced in December 2017.

“Compared to the same period in 2017, semiconductors sales increased by 16% in January, and sales of passives also showed a 16% increase,” Fletcher said. “Electro-mechs increased by 31% while component assemblies increased by 11%. However, our catch-all ‘Other Products’ reporting group showed a small (5%) decline compared to the same month 2017.”

Fletcher added: “The Book-to-Bill ratio declined by 13 points to 0.98:1 in January 2018, but afdec/ecsn members welcomed an increase in overall Bookings of 8% compared to December 2017, together with a 6% increase over January 2017: The polynomial trend line suggests a positive B2B ratio as we progress further into the first half of 2018. The Sales by Month ‘three month moving average’ for all electronic components suggests that continued growth into the first half of this year is likely, which is broadly in-line with longer term historical trends.”

In the wider world, optimism abounds with the caveat of distributors actually being able to lay their hands on parts in short supply.

Michael Long, Arrow Electronics’ Chairman, President and Chief Executive Officer acknowledges there are longer lead times for some products adding: “I would say that overall, we've had a pretty successful supply chain this year of giving customers what they need. And there has been very few line down situations at the customer base where the product hasn't found its way there. So, if I start with that, I expect this to persist through the first half of the year easily.”

“The current book-to-bill indications are that it's going to stay the same,” he continued. “I do not expect a lot of online capacity to come on because, frankly, I don't know where it's going to come from. That's the big thing. You don't just flip a switch in a year to get capacity because everybody is buying their capacity from the foundries. So, if they don't have it, then there's none to be had. And, if there is anything to come online, I certainly haven't really heard about it.

“I'm going to probably go out on a limb here and say this market is going to continue through the first half of the year easily and we'll see what comes out of it in the second half. But right now the manufacturers are bullish. They're bullish everywhere in the world. We’re seeing pretty unprecedented growth in Europe.”

Long is buoyed by Arrow’s success in design activity.

Steve Rawlings, Chief Executive Officer at UK-based Anglia also strikes an upbeat note. “Business is good,” he remarks, helped by both currency conversion and supply and demand economics as some products are in short supply.

Looking ahead, Rawlings sees no signs of customers double ordering, though as he observes, “It’s tough to track if a customer decides to lay his bets.” Rawlings’ strategy is to be as flexible as possible especially with key customers. “If they need to change their order schedule, we’ll do our best to help,” he said.

On some parts he has put down a red line. “On short supply components we will only support regular customers” he explained. He acknowledges the supply situation is tight especially in lower value components like chip capacitors, diodes and other IC products. His view is that manufacturers are focussing any manufacturing investment in higher value products at present. He instances two chip capacitor makers that are not at present taking orders from distributors.

Rawlings is confident for the next two quarters at least. The order book is up 60% on last year and Anglia is winning designs in IoT, medical and wireless applications.

This spread of applications is welcome news to Rawlings. “In the past we’ve seen the market driven by a game-changing product, but that impetus can go as quickly as it arrives,” he commented. “Having business spread across a number of market sectors is more comfortable.”

In fact the only factor holding up Anglia’s design business is finding the field applications engineers (FAE) who operate at the sharp end.

“Any internal sales engineers who fancy a change of scenery, give me a call,” is Rawlings' request. He’d like to add at least six more to Anglia’s FAE team, especially those with expertise on RF and power – “unfortunately they are in short supply," he observes

Rawlings is predicting a 15% sales increase for Anglia this year taking the distributor to £72m in sales and closer to its £100m sales target set for five years out in 2017.

Ismosys Managing Director Nigel Watts predicts a strong market next year with plenty of opportunities for continued growth.

“Design starts are plentiful in high growth markets and demand continues to be strong”, Watts said. He also cites potential supply issues with some passive and memory components could be an anchor on the supply chain, and offshore volume production might skew the UK and Ireland TAM.