Distribution industry top brass optimistic for 2021

A false dawn or a path to the sunny uplands of an industry revival and boom? Industry executives think the latter. Record months and booming business is being reported across the board. This surge in business is already producing lengthening lead times for some products, and allocation may not be too far away, according to Electronic Specifier's Mick Elliott.

Steve Rawlins, CEO at Anglia is in no doubt about prospects.

“There’s been a dramatic change over the past three months, customers are buying again,” he said.

Rawlins ascribes some of this to customers who let inventory run down and now need to replenish to keep production lines moving.

“We’re seeing spot buying in big lumps, £10k to £20k orders,” reported Rawlins.

He is certain this uptick will continue. “Anglia is looking at 15%, maybe 20% growth next year.”

Mark Burr-Lonnon, Senior Vice President, Global Service, EMEA & Asia at Mouser Electronics also reported a recent business surge.

“October was a record month for us in Asia, EMEA and the Americas. We’ve seen a huge increase in demand.”

This year has seen demand accelerate and slow at different times.

“In Q1 Asia was tough, in Europe and north America business was good, that was followed by a global slowdown,” said Burr-Lonnon. “Then business in Asia, post lockdown, started to go crazy, and now Europe and north America are coming back.”

“It’s not just the dollars,” he continued, “the number of customers is up ten percent, the number of buyers is up six percent and overall out business is up eight percent on last year. As we are seen as the distributor that takes new products to the market, those numbers make our suppliers happy too.”

It has been a choppy year as Ian Wallace, EMEA Business Development Director at Digi-Key explains.

“We began 2020 below 2019 levels, before seeing a positive trend through first ten weeks of Q1. Then the lockdowns began, disrupting business and resulting in a decline. That was followed by a growth surge as we all responded to the crisis. We then saw a new base resulting in ten to 12 weeks of flatness and this was followed most recently by 18 to 20 weeks of consistent gains over 2019.”

Wallace continued: “Looking at October, we can see a strong performance by the EMEA team, up 26.4% on October 2019, Asia-Pacific probably recovered best over the whole year, they were 19.1% up, and the Americas 1.2% growth getting them back into the positive. So overall Digi-Key business was 10.5% up on October last year with one less business day.”

Looking ahead Wallace sounds cautiously optimistic for Q4. Digi-Key sales per day are pointing in the right direction.

“Obviously there is another COVID-19 wave upon us with many key EMEA countries in new lockdowns,” noted Wallace. “I am hopeful customers and suppliers have all adapted and will find ways to keep this momentum going.”

Turning to the vertical markets Wallace cited aerospace and automotive as suffering badly.

On the upside he instanced the medical market where innovative ways of people being treated have been developed and key equipment is being designed and manufactured in short timescales.

“Other vertical markets where we are noting positive signs include IoT, 5G, IT infrastructure, communications, robotics, AI and factory and home automation,” added Wallace.

Mouser’s Mark Burr-Lonnon is also optimistic. “We are all waiting to see the impact of 5G when it goes into production. It will require a massive volume of components,” he remarked. “IoT is all driven by the technology, we have already seen demand for sensors go crazy. Automotive has got to bounce back, there is just so much electronics in cars.”

Business in the distributors’ industrial sector heartland has survived the COVID-19 carnage. “That whole sector has been growing nicely, we’ve seen 5% growth there this year,” added Burr-Lonnon. “There isn’t an industry sector where customers don’t buy from Mouser.”

In a recent call with financial analysts, newly installed Avnet CEO Phil Gallagher, observed: “Our business out of Asia region benefited from industry tailwinds across a variety of verticals, most notably, automotive.

“We're pleased to see an improvement in demand in industrial and are further encouraged by the positive sentiment we're hearing from electronic manufacturing services customers, as they look out into early 2021. While we're encouraged by our operational improvements and financial results, uncertainty still remains regarding the pandemic and how it will impact the global economy broadly, the supply chain specifically in the coming quarters.”

Arrow President Michael Long told analysts that global components sales returned to year-over-year growth, driven by record third quarter sales in Asia. “We’ve just started to see the demand stabilise and recover in the Americas and Europe. Demand in Asia has been robust across all the key verticals. And the third quarter is typically the strongest quarter for that region. All regions benefited from a strong turnaround in transportation-related demand compared to the second quarter.

“Regional inventories had been destocked prior to the onset of the pandemic. Starting from those lean levels, global components sales increased sequentially in each region for the first time since third quarter of 2017.”

This growth may not come without some bumps.

“Suppliers will also continue to face challenges,” said Wallace, and there will be extended lead times on certain products for sure. Some products with extended lead times to watch closely include MOSFETs, some MCU products, MEMs and high end analogue. From a passive perspective lead times are fairly stable, and in general inventory is available within reason. There are several signs of MLCCs and resistors tightening up either this quarter or in early 2021. Another one to keep an eye on is polymer tantalums.

“That said Digi-Key is aggressively increasing the breadth and depth of our inventory to support customers.”

It is a point Anglia’s Steve Rawlins picked up on. “We’ve increased inventory and bought heavily on ceramic capacitors.”

He agrees with the shortages instanced by Wallace and adds SiC diodes and IGBT devices to the mix, alongside what he describes as the usual suspects – tantalum and electrolytic and chip capacitors.

“We may start hearing the allocation word soon,” he concluded.

Mouser’s Burr-Lonnon is a little more relaxed. New products make up 23% of Mouser’s total inventory.

“We will continue that focus,” confirmed Burr-Lonnon. “Our policy is to stock wide not deep, we bring in new products from all our suppliers. He does have concerns for 2021, given the likely demands for components from 5G handset and infrastructure suppliers. “That could well lead to allocation.”

Another positive signal for the industry is the amount of design activity.

“It has definitely picked up,” said Steve Rawlins, particularly in health and safety products across a range of applications including distance monitoring, access control, electronic doors, even electronic toilets. Another good sign is that we are recruiting again.”

He has also registered a shortening of the design cycle.

“We always quote 18 months before a design come to fruition. That time is narrowing down, driven by commercial pressures,” noted Rawlins. It is driven in part by companies realising they haven’t released a new product for months.”

“Decisions are being made more rapidly and companies getting to prototyping much faster,” he added.

Phil Gallagher, newly installed CEO at Avnet is enthusiastic about design activity.

“I'll tell you, it's really exciting,” he commented in a recent call with analysts. “We had all the regional technical managers on the phone today, we have a monthly review with them, with our regional presidents and our teams. And the activity is just extremely high. I think what's happening is there's that much more accessibility, I think the idea of the silver lining in this is that much more accessibility to our customers and the engineers at the customers and so much more can be done digitally. And I think it speaks to a lot of what we've done with putting digital design online. We talked a lot about our avail tool, which our suppliers have embraced.”

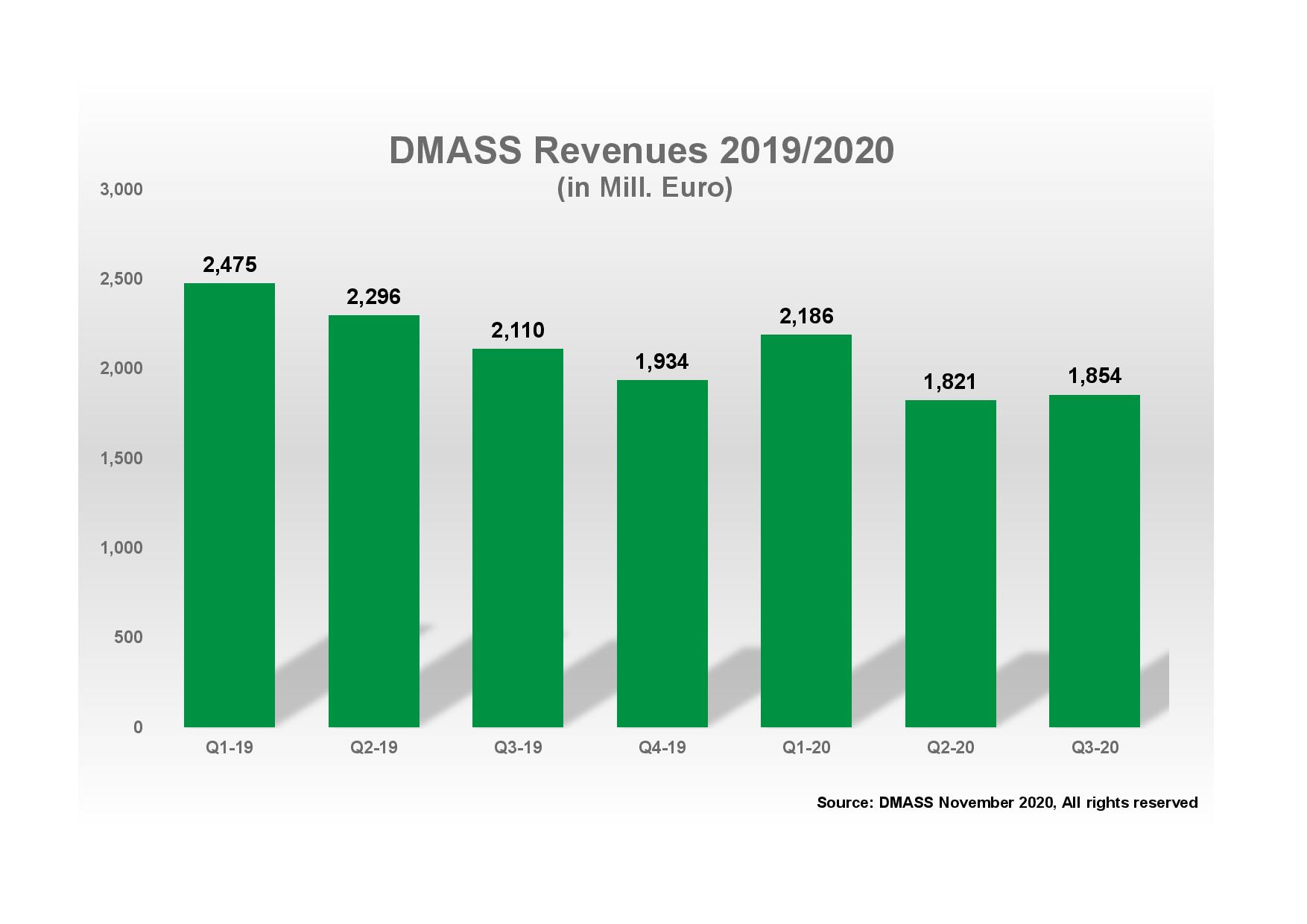

A lull in the spread of COVID-19 and lockdown-related pressure slowed the European Semiconductor Distribution industry’s decline in the third quarter of 2020.

According to DMASS, sales in the European Semiconductor Distribution Market fell by 12.1% to 1.85 Billion Euro, compared to a decrease of 20.7% in Q2.

Georg Steinberger, chairman of DMASS, commented: “With the second wave of the COVID-19 pandemic now rolling over Europe and many countries going for anything between full and soft lockdown, it is hard to interpret what the Q3 numbers really meant, but it will be even harder to predict what will happen in Q4 and in 2021. From our perspective it really seemed that -12.1% decline is actually not that bad, given that compared to Q2 revenues actually grew. We saw slight improvement across the board and a positive booking situation. Now we hope that the current wave will not affect the high-tech industry in the same way as did the first wave in Spring 2020.”

There’s no doubt it has been a year to put all industry executives on their mettle. Amidst the concern over the impact of COVID-19, some have thrived.

“Discussions and decisions become more critical when to invest in inventory, how much, particularly on passives. Semiconductors too, especially tied in to the reduced semiconductor capacity,” said Anglia’s Rawlins.

His view? “Next year will be a bumper year for the industry.”