Demand for electronics failing to boost automotive IC market

With discussion increasingly focused on autonomous vehicles and vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication, demand is rising for electronic systems to support new, intelligent cars. Meanwhile, older, existing technology on high end vehicles continues to migrate down to mid-range and low end cars and technology-based aftermarket products are gaining momentum.

Given all the new electronic systems that have been added to automobiles in recent years, one might reason that this segment accounts for a large share of the total global electronic system sales. That’s simply not the case. On a worldwide basis, automotive electronics represented only 8.9% of the $1.42tn total 2015 worldwide electronic systems market, a slight increase from 8.6% in 2014. Automotive’s share of global electronic system production has increased only incrementally and is forecast to show only slight gains through 2019, when automotive electronics are forecast to account for 9.4% of global electronic systems sales. Despite the many new electronics systems that are being added in new vehicles, IC Insights believe pricing pressures on automotive ICs and electronic systems will prevent the automotive end use application from accounting for much more than its current share of total electronic systems sales through 2019.

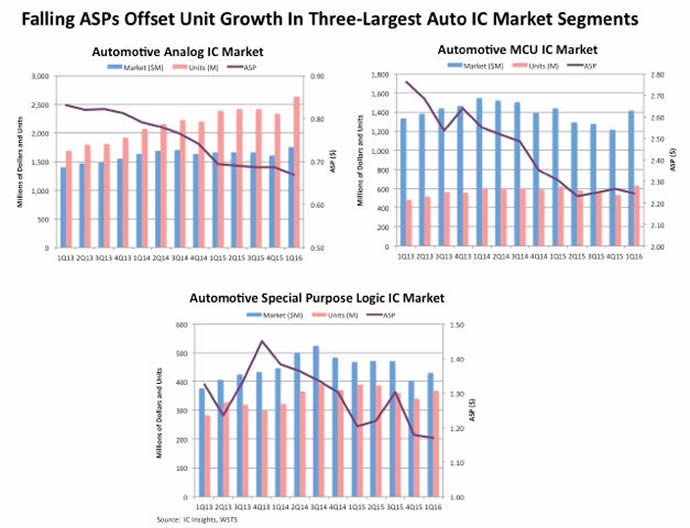

Figure 1 (above) shows the quarterly market trends for the three largest automotive IC markets - Analogue, MCU and special purpose logic. As shown, falling average selling prices in these three segments have largely offset unit growth over the past few years. In 2015, falling ASPs led to a three percent decline in the automotive IC market to $20.5bn. Based on IC Insights’ forecast, the automotive IC market will return to growth in 2016, increasing 4.9% to $21.5bn, as currency exchange rates stabilise and additional electronic systems (such as back-up cameras) become mandatory equipment on new cars sold in the US. The automotive IC market is now forecast to reach $28.0bn in 2019, which represents average annual growth of 5.8% from $21.1bn in 2014. Based on IC Insights’ forecast, the 2019 automotive IC market will be 2.6x the size it was in 2009 when the market was only $10.6bn - its low point during the great recession.

Analogue ICs and MCUs together accounted for 74% of the estimated $20.5bn automotive IC market in 2015. Demand for automotive MCUs continues to expand as more vehicles are designed with embedded computer systems to address safety and efficiency issues demanded from legislators and consumers. As cars get smarter and more connected, demand is growing for memory and storage to support a wide array of applications, particularly those that require quick boot up times as soon as the driver turns the ignition key. DRAM and flash memory, which receive considerable attention in computing, consumer and communication applications, are currently much less visible in the automotive IC market but memory ICs are expected to account for 12% of the 2019 automotive IC market, an increase from 7.8% in 2015.