Comms & computers drive IC sales across all regions

Communication and computer systems are forecast to be two of the three largest system applications for IC sales in every global region (Americas, Europe, Japan and Asia-Pacific) this year, according to data presented in the upcoming update to the 2016 edition of IC Insights’ IC Market Drivers, A Study of Emerging and Major End-Use Applications Fueling Demand for Integrated Circuits.

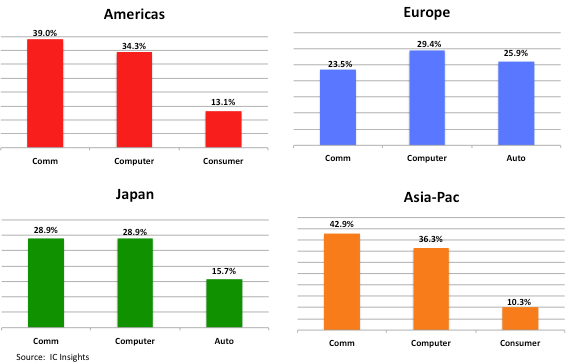

Communications applications are expected to capture nearly 43% of IC sales in Asia-Pacific and 39% of the revenue in the Americas region this year. Communications and computer applications are forecast to tie as the largest end-use markets in Japan while in Europe, communications apps are forecast to trail computer applications with 23.5% of ICs sales (Figure 1).

Figure 1 - Regional IC consumption by system type (2016 forecast)

Consumer systems are forecast to be the third-largest end-use category for ICs in the Americas and Asia-Pacific regions in 2016. Automotive is expected to be the second-largest system application for ICs in Europe, which has been a bastion for automotive electronics system development. Each of Europe’s three largest IC manufacturers - Infineon, ST and NXP - is annually ranked among the top suppliers of automotive ICs. In addition, the automotive segment is forecast to edge ahead of the consumer segment in Japan in 2016 to become the third-largest end-use market for ICs in that country.

Collectively, communications, computers and consumer systems are projected to account for 86.4% of IC sales in the Americas this year (an increase of half a percentage point from 2015) and 89.5% in Asia-Pacific (a decrease of half a percentage point from 2015). This year, communications, computer and automotive applications are forecast to represent 73.5% of IC sales in Japan and 78.8% of IC sales in Europe, the same percentage as in 2015.

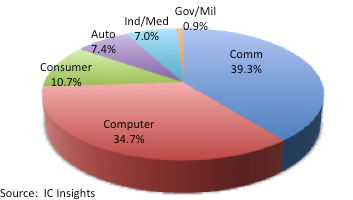

For more than three decades, computer applications were the largest market for IC sales but that changed in 2013 when the global communications IC market took over the top spot due to steady strong growth in smartphones and weakening demand for desktop and notebook personal computers. Figure 2 shows that globally, communications systems are now forecast to represent 39.3% of the $291.3bn IC market in 2016 compared to 34.7% for computers and 10.7% for consumer, which has gradually been losing marketshare for several years. IC sales to the automotive market are forecast to represent only about 7.4% of the total IC sales this year but from 2015-2019, this segment is projected to rise by a CAGR of 8.0%, fastest among all the end-use applications.

Figure 2 - 2016 total IC usage by system type ($291.3bn, forecast)