Commercial and consumer applications drive infra-red imaging

Existing commercial application and new consumer applications will drive infra-red imaging market growth, according to a new report published by Yole Développement. Under this report, entitled Uncooled Infrared Imaging Technology & Market Trends, 2014 edition, experts analyse the latest industry news, identify new market entrants and give a clear understanding of the impact on the market structure.

Experts also list mergers & acquisitions in this area, over the last 4 years and highlight the applications, especially the ultra-low resolution microbolometers segment. This analysis also includes market forecasts from 2013 to 2019, technology trends and ongoing developments.

After its first significant downturn in 2012, the uncooled thermal camera market continued to decline in 2013, with -5% CAGR. “The uncooled thermal camera market is plumbed by the ever shrinking military market, with -15% revenues in 2013 which is the historical and most profitable business for uncooled infrared”, explains Yann de Charentenay, Senior Analyst, MEMS & Sensors, Yole Développement.

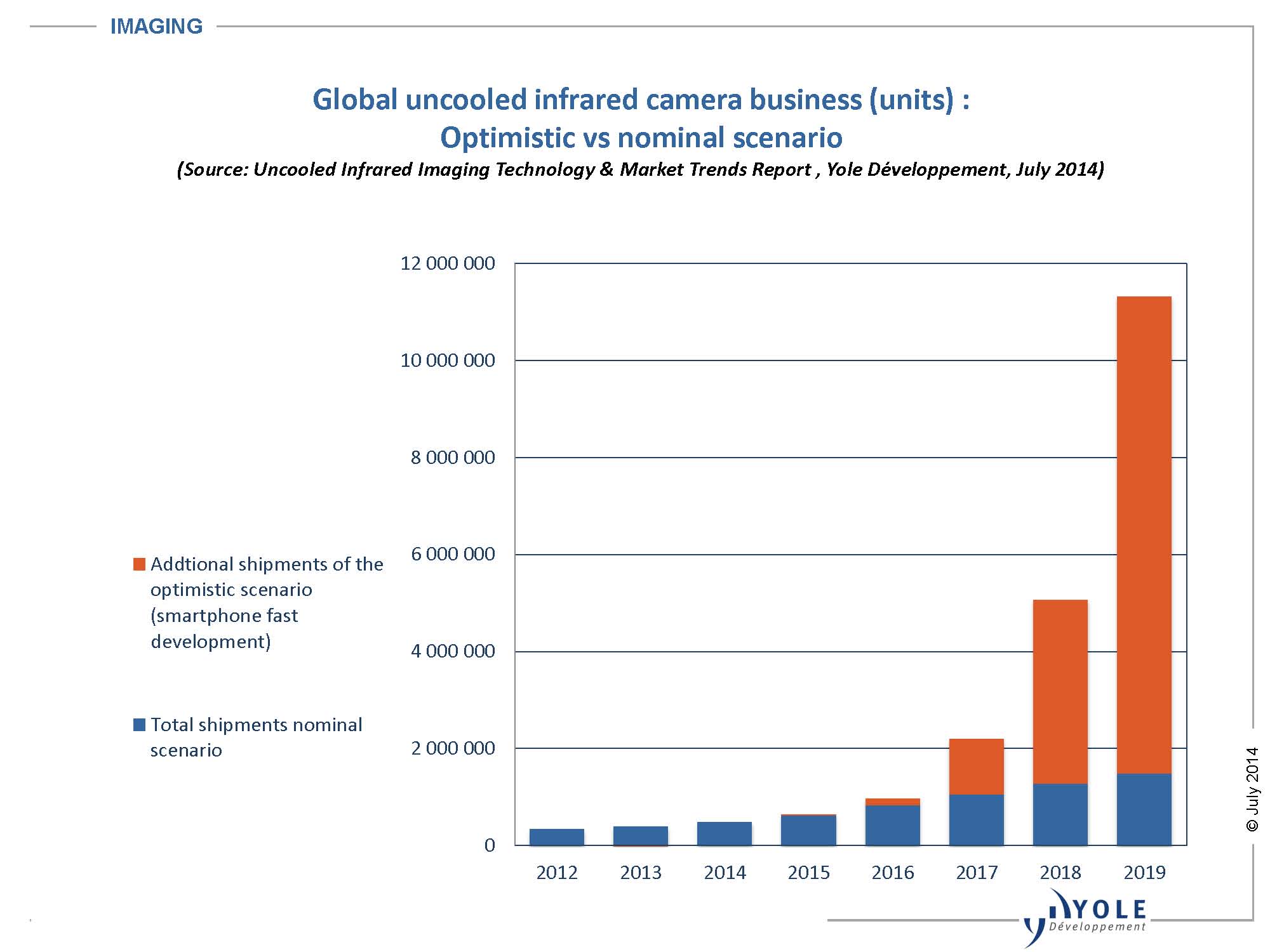

Nevertheless, 2013 overall sales in total shipments have surged again (+15%) because of the dynamic commercial market where sales have grown by +24%. For the next several years, thermal camera shipments will continue to grow rapidly, at +25% CAGR in volume between 2014 and 2019 to reach more than 1.4m.

Shipments will be driven by the existing commercial markets which are expanding quickly:

- Thermography: the market will be driven by ultra-low-end cameras with very attractive pricing, below $1000. Such price widens the audience of thermal technology. Leaders FLIR and Fluke have added many new models in 2013 and 2014 and will continue to lead the price war due to their vertical business model.

- Automotive: according to Yole Développement, Autoliv, the market leader, will continue to introduce its Night vision 3rd generation on new car models. New EuroNCAP tests could boost the market by promoting, in 2018, night time pedestrian collision mitigation solutions potentially using a thermal solution, but only if the cost is sufficiently low.

- Surveillance: new visible CCTV players have entered the market recently (Panasonic, Mobotix) and will participate in thermal technology democratisation. Price erosion will continue (-12%/year) and will enlarge the scope of commercial applications like traffic, parking, and power stations.

- Consumer applications have moved to a new phase of growth in 2013-2014 and will be the high growth applications over the next few years, especially in terms of shipments (+61% CAGR).

- Personal vision systems (goggles, sight for security, and hunting, outdoor observation): first successfully pioneered by FLIR and will continue to grow due to many new entrants arriving from the outdoor visible business.

- Smartphones: first smartphone modules (FLIR One, Opgal Android) have been introduced at the ground breaking price of $349 by FLIR in 2014. A high number of pre-release reservations for the FLIR One already proves the commercial success of this smartphone platform: indeed Yole Développement estimates more than 30,000 units.

An additional scenario envisions an aggressive rapid ramp up of the smartphone application based on a huge price erosion and the integration of the IR core inside the phone. “Indeed, smartphone business is an almost 1bn units market in 2013, and any new sensor adopted induces high volumes produced,” details Yann de Charentenay. “Those high volumes will only be possible if a huge cost reduction is obtained by the IR imaging industry," he adds.