Cash for innovation: how much could you claim?

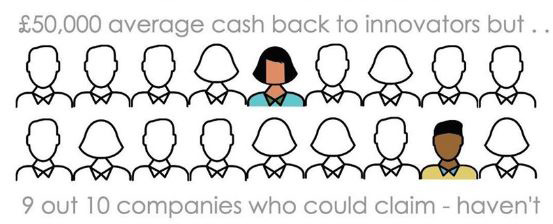

The government’s R&D tax relief legislation entitles UK companies to claim back money invested in research, development and innovation. However, most companies that are eligible are still missing out, as they are simply unaware that it exists. Electronic Specifier speaks to Sue Nelson, CEO of Breakthrough Funding and Kent Business Woman of the Year, to find out more.

Anyone who has received a PPI call in the past will know only too well the scepticism felt when the person on the other end of the line tells you that you’re entitled to thousands of pounds that you didn’t know about.

However, this is the reality for the multitude of UK businesses that are unaware of the government’s R&D tax relief scheme - which has been in place since the year 2000. Kent-based Breakthrough Funding puts companies in the picture with regards to R&D tax relief and works with them to get that money back from the government. Since forming nearly two years ago, Breakthrough has managed to reclaim around £6.8m for UK SMEs – which are its speciality.

Managing Director Sue Nelson explained: “We tend to deal with what we call ‘boutique R&D’, i.e. small companies. These are types of organisations that typically have one owner that’s still running the company, who quite often won’t have a full time finance director, or a big-wig accountant - so as a consequence, they are missing this piece of legislation.

“R&D tax relief is a big deal for small businesses. In fact, they’re undoubtedly the single biggest funding mechanism for those investing in innovative projects. Unfortunately ‘R&D tax credits’ or ‘R&D tax relief’ are not only uninspiring names, they’re also a really poor description of the scheme. This means that thousands of small companies are missing out even though the government wants to give this cash away. So we describe it more simply as ‘Cash for Innovation’.

“We’re so used to the taxman taking money that it’s hard to imagine there are pots of it waiting for companies to claim back. But that’s the truth of it as the government wants to boost the technology sector and the economy in general.”

The truth around R&D tax credits is a message that the government is currently, failing to get across, and out of the four million SMEs currently in the UK, only 16,000 received tax funding last year, meaning that around 95% of UK SMEs have no idea the scheme exists and that they are entitled to claim.

Criteria

According to the HMRC website, a company can claim for tax relief if an R&D project seeks to achieve an advance in overall knowledge or capability in the field of science or technology, through the resolution of scientific or technological uncertainty - and not simply an advance in its own state of knowledge or capability.

Nelson continued: “It doesn’t matter if you’re in profit or loss, you just need to be based in the UK and be a limited company (so the scheme would not apply to charities or sole traders). You’d need to have less than 500 employees and have less than a €100m turnover. The key criteria is that you’ve got to be doing something new and different.”

To qualify as R&D, any activity must meet the definitions set out by the Department for Business, Innovation and Skills. These guidelines state that the activity must contribute directly to seeking the advance in science or technology or must be a qualifying indirect activity. If your company and the project both meet the necessary conditions, you can claim tax relief on revenue expenditure in the areas outlined.

As an example, it is highly unlikely that an electronics design will be perfect first time. In the real world, certain elements won’t work and there will be changes required to the original specification. The manufacturer will constantly have to innovate to make their design work – work that they may not be getting paid for. It’s this problem solving activity that is eligible for R&D tax credits.

Lack of take-up

Nelson believes that part of the reason why so many UK SMEs are still in the dark over R&D tax relief is that when it was first introduced, it was a very narrow piece of legislation that didn’t necessarily apply to everyone.

She added: “Around 95% of SMEs simply aren’t aware of their eligibility, and the main reason is that while they may have heard something about ‘Cash for Innovation’, when they ask their accountant if they’re eligible they will answer “no”, because often they would have been trained a very long time ago when the legislation was narrow. So, a lot of companies are getting the wrong information from their finance personnel (as a result we work with a lot of accountancy practices as many don’t have specialists in this form of legislation and we also have a 3CPD point training programme for accountants). In addition the HMRC are not great at advertising the funding.”

The process

Once a company has established that they may be eligible for R&D tax credits, Breakthrough will visit the company and document the technical projects they are involved with and submit several examples to the HMRC. Nelson added: “Once we’ve shown how the company meets the legislation, we then work with them to ascertain what costs they can place against what they’re doing, so we usually work with their finance controller and look at their accounts etc. and value all of the money they’ve spent in their factory or industrial unit.

“We work with the accountant to produce the application which they send off with our technical report attached and, at the moment, the HMRC are paying within 28 days - so it’s a very quick turnaround. Essentially the client doesn’t have to write anything and it usually only takes about an hour of the company’s time. Not only that, once we’ve helped a company in the first instance, it’s something they can apply for themselves every year.”

The message

So the R&D tax credit scheme is without doubt hiding its light under a bushel, and the UK’s SMEs are suffering financially as a result. Breakthrough are working hard to spread the word, part of which is the company’s TechTalk Show, a radio programme attracting an average of over 25,000 listeners, where innovators have a platform to discuss their projects and promote what they are doing.

“When we approach a company to ask them if they’d like to come on a radio show and talk about their new product, they always say yes,” added Nelson. “So they’ll talk for an hour with a couple of other guests about what they do, and then while they’re here we tell them about R&D tax credits.”

Building those relationships with companies is key for Breakthrough. As so few companies are even aware of the R&D tax credit scheme, the company has been met with scepticism in the past when they tell companies they are entitled to money that they didn’t know about, and have even been questioned as to whether or not it’s legal.

“Making contact with us via the radio show is a great way of building relationships and therefore, it’s not a very big next step for them to see that we’re legitimate and that we can really help them.” Nelson added. “However, if you phone someone telling them they can get around £40,000 in tax credits within six weeks, that’s quite hard to get people to buy into it. This is a much better way of getting our message out there.

“We get such a kick out of helping these types of company, and every company we help will invest the money back into the business - and that’s what the scheme is all about. They’ll invest in a new piece of kit which makes them more profitable, or they will employ more people. It’s a brilliant virtual cycle.”