Analysing the evolving graphene application landscape

Graphene industry is entering a new phase, a phase of growth. The industry has accumulated significant experience over the past ten to twelve years to bring about this phase. In this article, IDTechEx Research offer opinions about the recent past and future outlook of the graphene industry based on the report ‘Graphene, 2D Materials and Carbon Nanotubes: Markets, Technologies and Opportunities 2019-2029’.

The industry spent years to arrive at a set of applications in which graphene immediately makes commercial sense. In the early years, the industry was in a divergent exploratory phase in which players pursued numerous opportunities across diverse and often unrelated markets. We are now at a more convergent and focused phase during which a realistic application pipeline is established.

The industry also at first overestimated the value proposition of graphene to different sectors. It is however now more realistic about segment-specific prospects although some recalibration of expectations as well as segment-specific value propositions is still ongoing. The building of this commercial application know-how is an important and indispensable part of the learning curve of the industry and represents a source of competitive advantage.

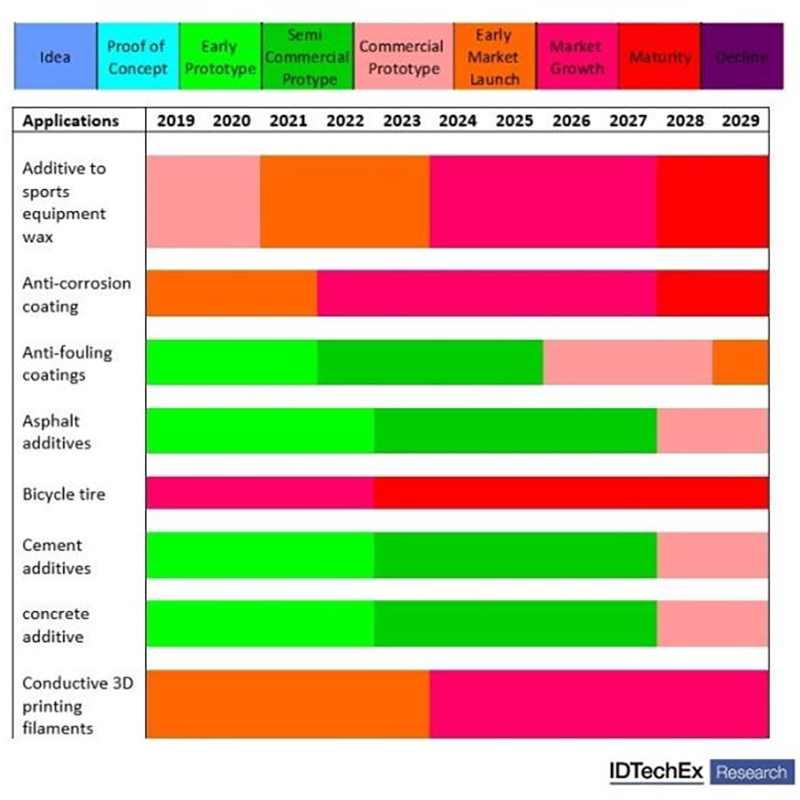

The table below shows an indicative application roadmap. Here, each colour corresponds to a probable readiness or maturity level of graphene in each application at different years. Graphene has a diverse set of properties. Therefore, the list of target applications is long. This list is by no means comprehensive but is, IDTechEx hope, representative of the state of the affairs.

Each application enjoys a different readiness level and is likely to follow its own timeline to market maturity. Graphene will offer a different value proposition in each sector and will need to position itself differently. This diversity has been a source of confusion but ultimately represents a source of industry-wide resilience as it would be highly improbable for graphene to fail in all these applications.

Note that the table below provides a qualitative view of our current assessment and does not offer market size and forecasts.

The table shows that multiple applications are already in the market. Interestingly, the successful applications are not always the most glamorous. They are also not the ones the industry focused on at first. The rest of this article provides a brief highlight on some select applications.

Energy storage

Lithium ion batteries are a growing field. The advent of electric vehicles is creating demand for large-sized and low-cost batteries. To serve this need, large factories, e.g., giga factories, are sprouting around the world. The need to constantly push performance and cost and also the early phase of factory instalments mean that products are still open to new technologies including new materials and formulations.

Overall, these market dynamics translate into opportunities for carbon-based materials. Graphene is one such material. It has shown that it can reduce electrode resistance without decreasing active material content. This property translates into better performance at high discharge rates, a characteristic which is highly sought-after in the EV industry.

Indeed, graphene is already a success in this industry especially in China, creating a tens-of-tonnes-per-year demand. Graphene will remain part of the toolbox of additives that electrode material producers can deploy. Therefore, graphene will likely continue to be employed although formulations will change and evolve. This will affect the type and loading of graphene deployed.

Graphene is also used, or can be used, in other energy storage devices such as lead acid batteries, Si anode, Li sulphur, and supercapacitors. The value proposition and the readiness level of graphene in each energy storage device and the readiness level of the device market itself are different in each case. The market dynamics and prospects are therefore different in each case. In general, the development results are promising but end user markets are still not ready. As such these represent future and not today sales.

Functional coatings

Graphene-enabled functional coatings are a growing success story (the energy storage applications are arguably also a coating applications). In particular, graphene-containing anti-corrosion coatings offer a compelling performance and price value proposition.

In one case, small additives of graphene can extend performance whilst drastically reducing the required Zn content. This use case has a large market as metal corrosion is a costly and widespread global challenge.

It might be noteworthy that CVD graphene is also being explored as a protective layer against metal corrosion. Here, the film would also act as a barrier. The challenge however is to scale up the process and to reduce the number of grain batteries which compromise barrier properties. This is an early stage work.

Graphene conductive inks are also finding their way although this has been, and continue to be, more of a technology push. Graphene conductive inks had an awkward market position. They had a performance level only slightly better than carbon but far below metal particle filled inks. The price was much higher than carbon but way below most metal fillers.

It therefore took some time to identify and propose sensible applications. Today, graphene inks are being proposed, and sometimes used, as (a) RFID antenna materials (the desired attribute is the chemical inertness); (b) heater films for textiles, underfloor, wall and other heaters (the desired attribute is higher conductivity than carbon).

Thermal management

Graphene has also found success as a thermal management material. The prominent case is as a thermal spreader in mobile phones. The value proposition here is strong. Graphene or rGO platelets when faced down offer y-x thermal conductivity superior to copper at a lower weight. In general, the need for high-performance and light-weight thermal spreaders will grow. Already it is reported to be a 200tone order.

Graphene can also be added to epoxies to form thermal interface materials (TIM). TIMs are used to provide a thermal linked when two heterogenous surfaces are joined. Here, special alignment techniques will be needed to achieve high z-direction conductivity.

If alignment is successful, graphene will likely to be positioned as a high-performance TIM, beating the likes of alumina and boron nitride fillers and competing against the high-price high-performance protruded carbon fibre pastes. Vertically aligned carbon nanotubes might offer superior thermal conductivity (assuming good contact) but their price position will be difficult to justify in many cases.

Graphene can also be coated on, or added to, light-weight plastic heat sinks to improve their performance, e.g., for use in high power LEDs for street lighting. Yet another success of graphene in thermal management can be with textiles.

It is shown that graphene coated fabrics are very effective at spreading and thus dissipating heat. This is being actively explored and developed by multiple textile firms and brands,

Plastic additives

This is potentially a huge opportunity. It is not easy to explore. It is extremely diverse in every term, e.g., material set, performance requirements, volume demand, price tolerate, rival solutions, etc. Nonetheless, within this complex space, several leading target markets have emerged. Here, IDTechEx briefly outline a few.

Sports equipment were a first. In a déjà vu moment, we witnessed tennis request and similar. Next, came a high-performance bicycle tire for riding. Then we saw helmets, skis, fishing rods, gold balls, and so on. In all cases, small traces of graphene were deployed.

In some cases, the performance benefit was not evident although the name of graphene proved a good marketing tool. In some case, it was even disputed whether graphene or thin graphite was used.

Now we are seeing more interesting applications. We see graphene added to wear liners used in cement production or mining equipment. Graphene, it is claimed, improves tensile strength and adhesion resilience in high-performance polyurethanes.

Graphene-TPU is reportedly now commercialised for over ten under-the-hood components in car. The benefit is in improving heat endurance, noise properties, and mechanical strength. Graphene-in-TPU is being explored for automotive dashboard soft skins, graphene-in-PET for fuel line systems, graphene-in-rubber for tires, and so on.

Pipes are also emerging as a serious high-volume target market. In particular, it is reported that graphene can enable corrugated pipes to be constructed from recycled plastics without compromise in quality. This and similar applications, if successful, can change the volume demand landscape.

The incumbent materials in this market are often other forms of carbon including graphite or carbon black fillers. They sell at low prices and the industry knows how to use them. This makes it difficult for graphene.

To compete against the incumbent, suppliers have pursued various strategies. Some are still positioning graphene as a high-performance high-price alternative. They seek to justify the high price (even 75-100$/Kg is often a high cost) by dramatically improving performance at tiny loadings.

Others are seeking to position graphene as a material with comparable cost but will incremental or secondary benefit propositions. These firms must cost prices dramatically though scale-up operations to succeed in commercialising essentially the next-gen of carbon black or similar.