Advances in enabling tech to reset automotive industry by 2023

The global automobile industry, currently worth $3.5 trillion in annual revenues, could face four concurrent disruptive threats, according to GlobalData. These four include: the connected car, autonomous driving technology, electric vehicle technology and transport-as-a-service. Over the next five years, the auto industry is due for a radical reset as these unfolding industry mega-trends dislocate its legacy supply and value chains and reallocate its profit pool.

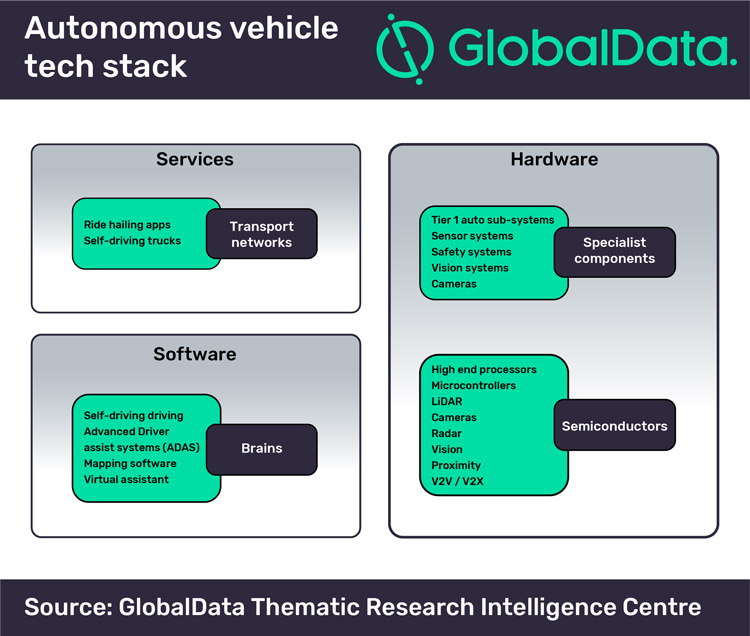

The company’s Thematic Research team’s latest report, ‘Autonomous Vehicles – Global Thematic Research’, reveals that automobile manufacturers can no longer carry on with business as usual as each threat is potentially existential to the legacy carmakers operating in a low growth, low margin sector characterised by over capacity. Cyrus Mewawalla, Head of Thematic Research at GlobalData, commented: ‘‘The sector is seeing its supply lines reset by cumulative advances in enabling technologies typically deployed by the Tier 1 automobile sub system suppliers and a range of AI-first start-ups. As automobiles morph into sentient robots powered by on-board, networked processors fed by data from multiple sensors and smartened up by AI algorithms, a layered value chain will emerge, based on ‘brains’, sensors, auto-grade silicon and Tier 1 auto component suppliers.’’

Brains:

Over 30 companies are currently developing the ‘brains’ for self-drive cars using sensor-fed machine learning algorithms. The acknowledged leader is Google’s Waymo. But Tesla’s AutoPilot claims parity with Waymo while Uber, Baidu, Aptiv/NuTonomy, Nvidia DRIVE, Intel/Mobileye and GM Cruise are all in serious contention. A clutch of AI start-ups is developing avant-garde technology, including the US’s Aurora and China’s Horizon Robotics. Mewawalla, continued: ‘A clutch of AI start-ups is developing avant-garde technology, including the US’s Aurora and China’s Horizon Robotics.’

Sensors:

Sensors provide the key data inputs to the car’s ‘brains’. They range from heat and motion sensors to 3D cameras and from LiDARs and ultrasound radars to vertical cavity lasers.

Mewawalla, added: ‘’The dominant players [in sensors] are Sony, Samsung, NXP, Infineon, STMicro, Velodyne, Lumentum and Finisar with Texas Instruments, Cypress and Xilinx as major contributors. On the LiDAR side, leading player Velodyne is facing rising competition from Quanergy and Lumentar.’’

Auto-grade silicon:

All the various components and activities have to be constantly checked, processed and assessed by multi-core supercomputing processors and networks of microcontrollers. Nvidia and Intel, with AMD as a second source, are the clear leaders in the former, while NXP, STMicro and Infineon dominate the microcontroller space and currently have the advantage of being long standing, tried and tested suppliers of ‘auto grade’ components to the car makers and their Tier-1 sub-system suppliers.

Tier-1 auto suppliers:

The big auto parts suppliers own much of the intellectual property in key semi-autonomous driving technology, electronic and safety systems. The Tier-1 auto supplier leaders are Bosch, Continental AG and Aptiv. Denso, Autoliv and Magna are in strong contention. GlobalData has developed a thematic methodology for valuing technology, media and telecom companies based on their relative strength in the big investment themes that are impacting their industry. Whilst most investment research is underpinned by backwards looking company valuation models and most industry research is analysed in sector silos, GlobalData’s thematic methodology identifies which companies are best placed to succeed in a future filled with multiple disruptive threats.

To do this, GlobalData tracks the performance of the top 600 technology, media and telecom stocks against the 50 most important themes driving their earnings, generating 30,000 thematic scores. The algorithms in GlobalData’s ‘thematic engine’ help to clearly identify the winners and losers within the global TMT sector.