5 of the top-20 companies show double digit growth

IC Insights' November Update to the 2015 McClean Report will include the latest IC market forecasts by product type through 2019, a detailed forecast for semiconductor industry capital spending by company for 2016 and a ranking of the top-25 semiconductor suppliers’ forecast for 2015 (the forecasted top-20 2015 semiconductor suppliers are covered in this research bulletin).

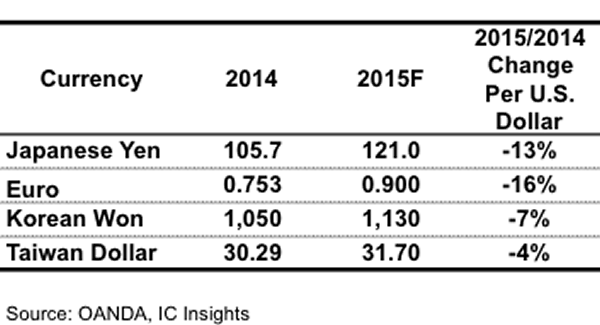

Since all of IC Insights’ figures are presented in U.S. dollars, a strengthening U.S. currency deflates foreign sales and market results while a weakening U.S. dollar serves to inflate the sales and market figures. Thus, the rare occurrence of significant strengthening of the U.S. dollar versus the four major currencies shown in Figure 1 is expected to deflate the combined 2015 semiconductor sales growth rate of the top 20 suppliers by four percentage points. Moreover, the strong U.S. dollar is forecast to lower the total worldwide semiconductor market growth rate by three percentage points to -1% this year.

Figure 1 - 2014-2015F currency exchange rates per USD

This currency “deflation” effect presents itself in the form of lower semiconductor Average Selling Prices (ASPs), which are forecast to register a 3% decline this year. The continuing strength of the U.S. dollar throughout 2015 is one of the reasons IC Insights lowered its IC market forecast for this year from +1% to its current -1% expectation.

The forecasted top-20 worldwide semiconductor (IC and O-S-D [Optoelectronic, Sensor and Discrete]) sales ranking for 2015 is depicted in Figure 2. As shown, it is expected to take just over $4.4bn in sales just to make it into the 2015 top-20 ranking and seven of the top-20 companies are forecast to have 2015 sales of at least $12.0bn. The ranking includes eight suppliers headquartered in the U.S., three in Japan, three in Taiwan, three in Europe, two in South Korea, and one in Singapore. The top-20 supplier list includes three pure-play foundries (TSMC, GlobalFoundries and UMC) and five fabless companies. If the three pure-play foundries were excluded from the ranking, Japan-based Sharp would be ranked 18th, U.S.-based AMD 19th and China-based fabless supplier HiSilicon 20th.

![]()

Figure 2 - 2015F top-20 semiconductor sales leaders ($m, including foundries)

IC Insights includes foundries in the top-20 semiconductor supplier ranking since it has always viewed the ranking as a top supplier list, not a marketshare ranking, and realises that in some cases the semiconductor sales are double counted. With many of our clients being vendors to the semiconductor industry (supplying equipment, chemicals, gases, etc.), excluding large IC manufacturers like the foundries would leave significant 'holes' in the list of top semiconductor suppliers. As shown in the listing, the foundries and fabless companies are clearly identified. In the April Update to The McClean Report, marketshare rankings of IC suppliers by product type were presented and foundries were excluded from these listings.

Not all foundry sales should be excluded when creating marketshare data. For example, although Samsung is expected to have a large amount of foundry sales in 2015, some of its foundry sales were to Apple and other electronic system suppliers. Since the electronic system suppliers do not resell these devices, counting these foundry sales as Samsung IC sales does not introduce double counting. Overall, the top-20 list in Figure 2 is provided as a guideline to identify which companies are the leading semiconductor suppliers, whether they are IDMs, fabless companies or foundries.

Highlights of the forecasted top-20 semiconductor supplier ranking for 2015 include:

- In total, the top-20 semiconductor companies’ sales are forecast to be flat in 2015, one point higher than the growth rate expected for the total worldwide semiconductor industry;

- Using the 2014 exchange rates per U.S. dollar, the combined top-20 semiconductor suppliers are forecast to show a 4% increase (note: the semiconductor sales figures for Avago, ST, and NXP were not adjusted since they report their sales in U.S. dollars);

- Although the top-20 semiconductor companies are forecast register 0% growth in 2015, there is expected to be a 52-point spread between Avago, the fastest growing company on the list (23%), and Renesas, the worst performing supplier (-22% in U.S. dollars, -11% in yen) in the ranking;

- In 2014, Intel’s semiconductor sales were 36% greater than Samsung’s. In 2015, the delta is forecast to drop by a whopping 15 percentage points to only 21%. Moreover, Samsung’s 'currency adjusted' semiconductor sales for 2015 are forecast to be only 11% less than Intel’s.

- One new entrant is forecast to break into the top-20 ranking in 2015 - Taiwan-based pure-play foundry UMC, which is expected to replace U.S.-based AMD. AMD is forecast to have a particularly rough 2015 with its sales expected drop 28% this year to about $4.0bn.

- Infineon is forecast to register the highest 'currency adjusted' 2015 semiconductor industry growth at 39%. Even if International Rectifier’s (Infineon’s purchase of IR was completed in January of this year) estimated $1.1bn in 2015 sales were excluded from Infineon’s results this year, the company would still be forecast to show a 20% increase in sales expressed in euros.

- One of the real 'star performers' on the list is Sony. As shown, even with the tremendous weakness of the yen versus U.S. dollar, the company is forecast to register an 11% increase in semiconductor sales when expressed in U.S. dollars and a 27% surge in sales in its local currency, the Japanese yen. Sony is having tremendous success in sales of image sensors and is expected to more than triple its semiconductor capital spending this year to put in additional capacity for image sensor production.

- The pending mergers of Avago & Broadcom and NXP & Freescale will have a significant impact on future top-20 rankings. The combination of Avago and Broadcom’s sales in 2015 ($15.4bn) is forecast to be enough to move the company into the 6th spot while the combined 2015 sales of NXP and Freescale ($10.2bn) are forecast to be enough to move the new entity into the 8th position. IC Insights believes that additional acquisitions and mergers over the next few years are likely to continue to shake up the future top-20 semiconductor company rankings.