2H16 spending surge expected from Samsung, TSMC & Intel

In addition to the monthly Updates, IC Insights’ subscription to The McClean Report includes three “subscriber only” webcasts. The first of these webcasts was presented on 3rd August, 2016, and discussed semiconductor industry capital spending trends, the worldwide economic outlook, the semiconductor industry forecast through 2020, as well as China’s failures and successes on its path to increasing its presence in the IC industry.

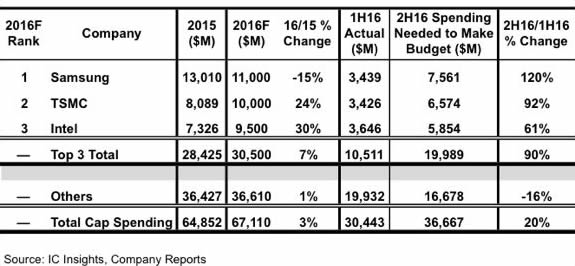

In total, IC Insights forecasts that semiconductor industry capital spending will increase by only 3% this year after declining by 2% in 2015. However, driven by the top three spenders - Samsung, TSMC and Intel - capital spending in 2016 is expected to be heavily skewed toward the second half of this year. Figure 1 shows that the combined 2016 outlays for the top three semiconductor industry spenders are forecast to be 90% higher in the second half of this year as compared to the first half.

Figure 1 - 2016 capital spending forecast (1H16 vs 2H16)

Combined, the “Big 3” spenders are forecast to represent 45% of the total semiconductor industry outlays this year. An overview of each company’s actual 1H16 spending and their 2H16 spending outlook is shown below.

Samsung: The company spent only about $3.4bn in capital expenditures in 1H16, just 31% of its forecasted $11.0bn full-year 2016 budget.

TSMC: Its outlays in the first half of 2016 were only $3.4bn, leaving $6.6bn to be spent in the second half of this year in order to reach its full-year $10.0bn budget. This would represent a 2H16/1H16 spending increase of 92%.

Intel: Spent just $3.6bn in 1H16. The company needs to spend $5.9bn in the second half of this year to reach its current $9.5bn spending budget, which would be a 2H16/1H16 increase of 61%.

In contrast to the “Big 3” spenders, capital outlays by the rest of the semiconductor suppliers are forecast to shrink by 16% in the second half of this year as compared to the first half. In total, 2H16 semiconductor industry capital spending is expected to be up 20% over 1H16 outlays, setting up a busy period for the semiconductor equipment suppliers through the end of this year.

Further trends and analysis relating to semiconductor capital spending through 2020 are covered in the 250-plus-page Mid-Year Update to the 2016 edition of The McClean Report.